The Four Potential Scenarios for Housing Markets: UBS

The removal of the APRA serviceability floor and the federal election has improved sentiment, but Australia’s housing market is “not yet out of the woods”.

In an update published Friday, UBS analysts have outlined four potential scenarios for the banks and housing markets — ranging from a “bounce back” to “downturn”.

With the reserve bank expected to take rates to 1 per cent and the removal of APRA’s serviceability floor, housing stimulus policies are well under way — indicating that regulators will do whatever it takes to avoid a hard landing.

However, the UBS house view is cautious: “While the risk of a hard landing in the housing market is less likely, we question whether the ‘treatment is worse than the disease’ if further stimulus from the RBA, APRA and governments is required.”

The analysts, Jonathan Mott, Minh Pham and Karyn Cao, said that a recovery in housing lending flow of more than 20 per cent (back to record levels) would add 2.2 per cent to housing credit growth.

Related: Housing downturn is nearing end, 3pc left to fall

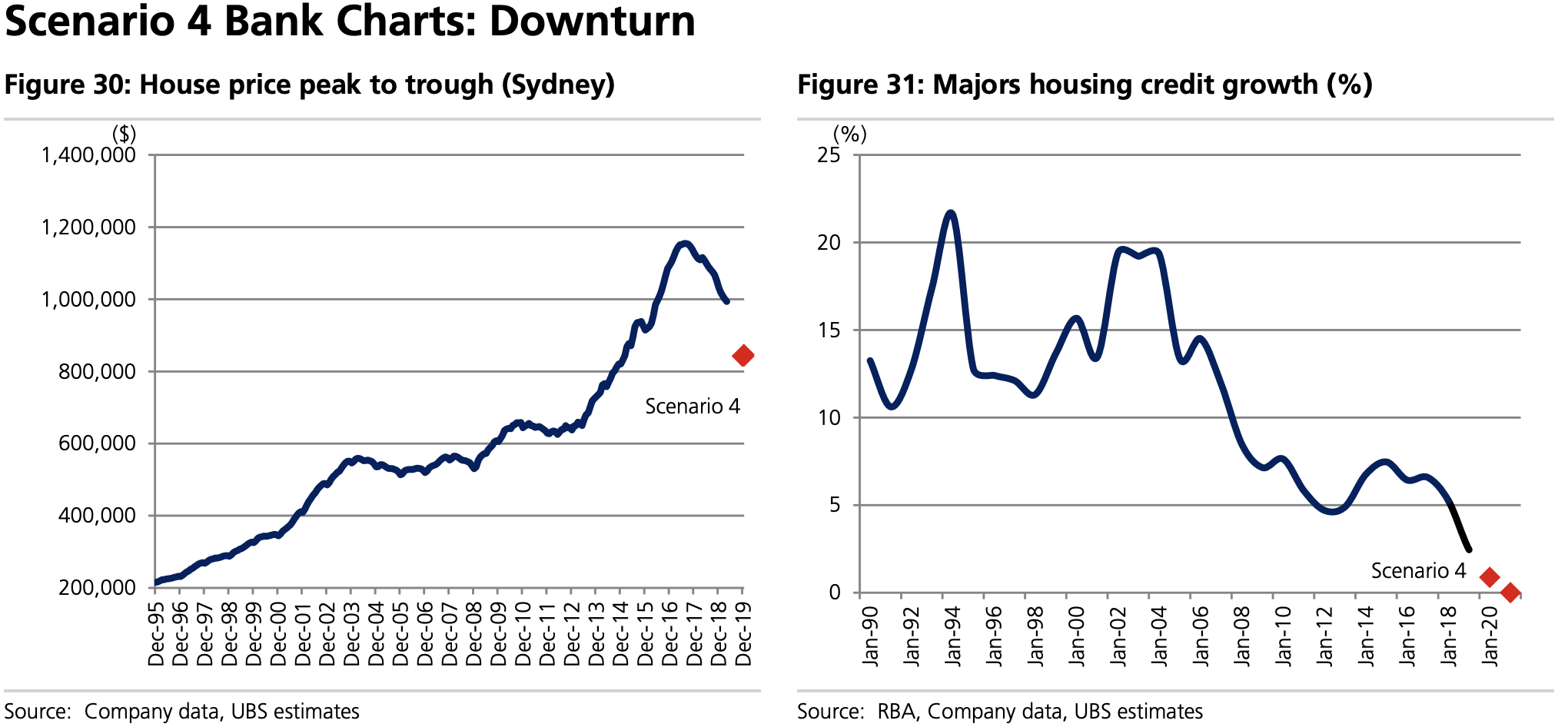

Scenario one: ‘bounce back’

The “bounce-back” scenario assumes that the flow of new housing lending bounces 20 per cent, with Sydney house prices improving up to 10 per cent.

“This is our most upbeat scenario and would need everything to go right,” the analysts said.

“It would lead to a reacceleration in the household debt to disposable income ratio and the risk of ‘kicking the can’.”

For this scenario to play out, monetary and fiscal stimulus would likely be removed — implying that the pick-up in the housing market may not be sustainable.

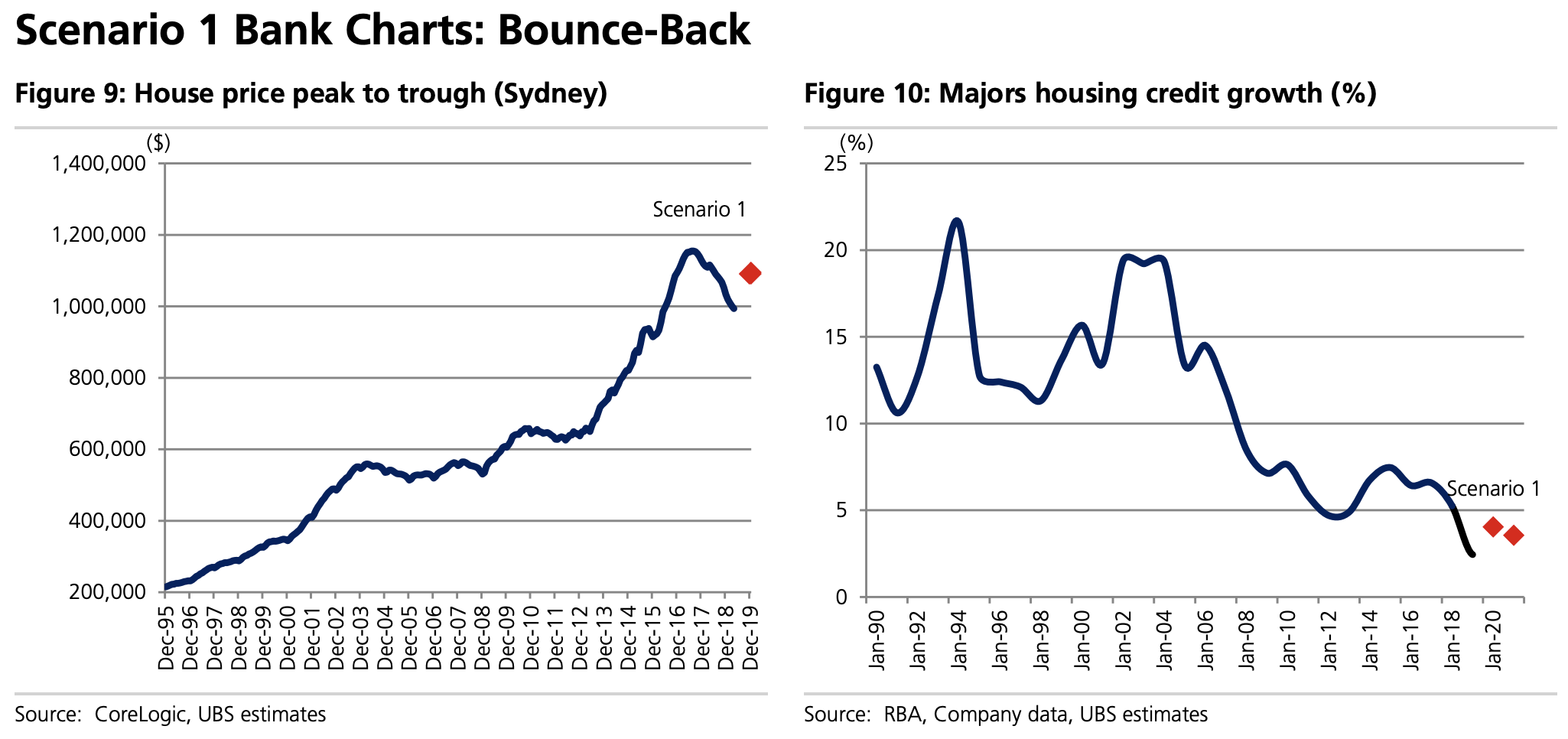

Scenario two: modest recovery

In this scenario the federal election and regulatory changes have put a floor under the housing market, leading to a modest increase in housing activity and a 10 per cent increase in residential lending.

“This leads to a modest acceleration in housing credit growth toward 3 per cent and an improvement in business confidence leads to a rise in SME lending,” the analysts said.

“We do not believe this scenario is unrealistic, especially if the global environment improves and business confidence and employment recover.

“However, the fundamental issues around consumer leverage and housing affordability would remain, leaving the banks vulnerable to a future correction.”

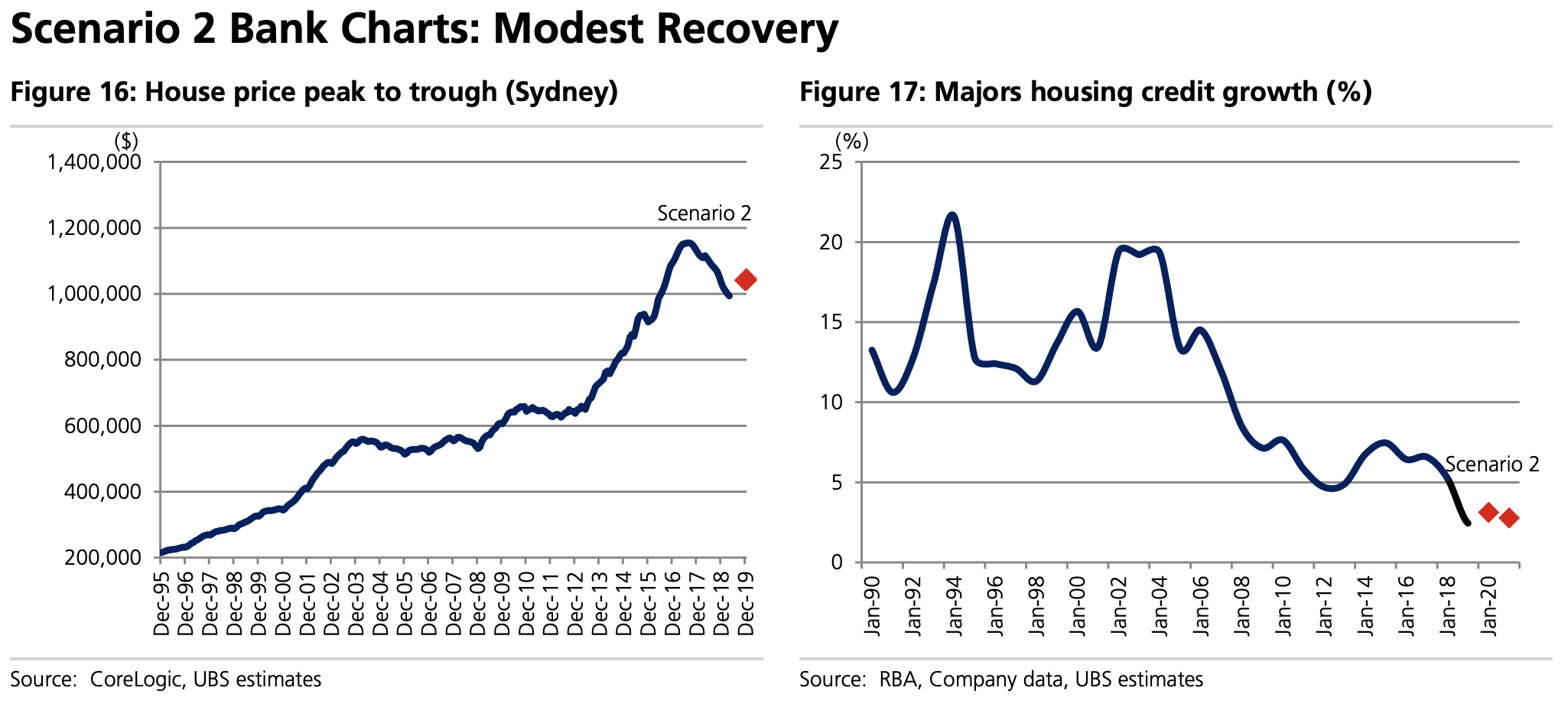

Scenario three: stagnation

The improved sentiment and regulatory adjustments are short lived in this scenario. A challenging global environment means the economy is under stress and reduced credit availability offsets APRA’s removal of the 7 per cent serviceability cap.

“This situation is possible, especially if the global economy weakens and improved housing sentiment proves to be short lived.

“When interest rates fall below 1 per cent it is difficult for the banks to make a spread, or the banks have to choose not to pass rate cuts through to customers, damaging the economy.”

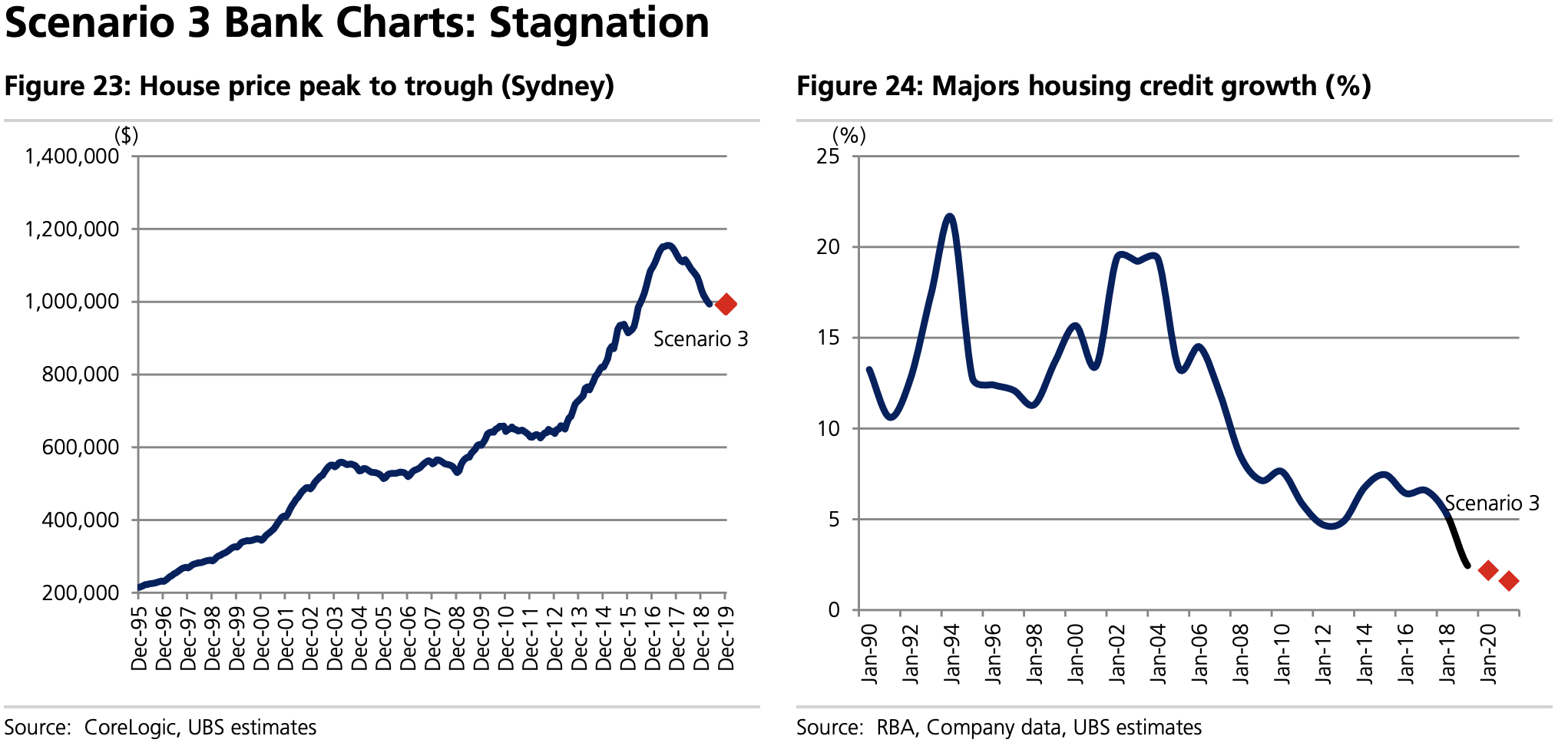

Scenario four: downturn

In this scenario, the outcome of the federal election and changes to regulatory policies supports the housing market but the fundamentals remain “very stretched”.

In a challenging global environment with stagnating unemployment, consumer confidence does not pick up and a hard landing in the economy and housing market may still eventuate.

Borrowers may come under pressure and credit impairment charges could rise up to 80 basis points as the unemployment rate rises and Australia falls into recession.

“The probability of this scenario has reduced,” the analysts said.

“However, if the global environment deteriorates and sentiment turns negative, a hard landing in the housing market and the banks cannot be ruled out.”

“In this extreme scenario, investors would question the value of the banks’ tangible assets with share prices trading at a material discount to book value.”