The Data Driving The Australian Property Market, How Consumers Are Buying.

While the property industry’s understanding of consumers’ buying habits falls a long way short of other industries, such as retail and Fast Moving Consumer Goods (FMCG’s), the advent of e-commerce has driven developers and marketers alike to become increasingly aware of buyers’ online habits and the data that sits behind them.

One of the best indicators of what drives a buyer’s decision-making process is the data that the major property portals such as realestate.com.au gather through their platforms.

The Urban Developer sat down with Nerida Conisbee, Chief Economist of the REA Group, to look into the world of online buyer data and what our industry can learn from it.

National buyer demand fluctuates wildly across the states.

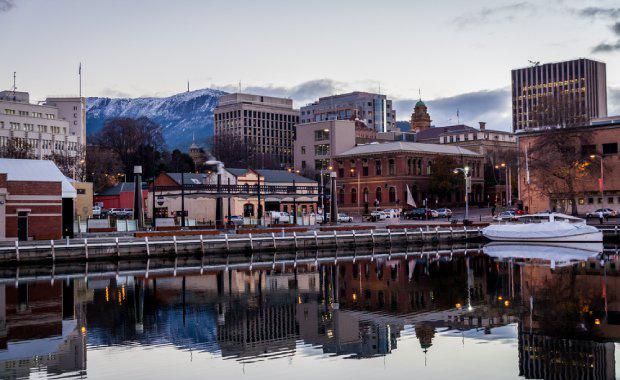

While the powerhouse economies of New South Wales and Victoria continue to see very high activity, Western Australia and the Northern Territory are historically low. Interestingly, Tasmania has seen a spike in activity, based on the number of people looking to buy versus the number of listings on the site.

“What we're seeing happen over the last year is that in New South Wales, Victoria and Tasmania there’s been a surge in the number of people looking to buy and a drop off in listings. So we don't have enough listings on our site to really satisfy that kind of demand.”

In Western Australia and Northern Territory, conditions still seem to be very negative. We've obviously seen very strong price declines in those states but our site also indicates very low listings and levels of people looking to buy. So the data is consistent with what's happening with prices and what's happening across each of the states as well,” said Conisbee.

Demand is highly sensitive to interest rate activity.

The data suggests that buyer activity and demand is strongly correlated to fluctuations in interest rate brought on by either the Reserve Bank of Australia or the major banks.

“During the last year, demand was stable but then, as a result of two interest rate cuts, we saw a surge in demand.Interestingly, last November many of the banks started increasing their rates despite no movement from the RBA and we saw a drop off in demand. Anything to do with rates causes a marked change in behavior on our site.”

New development drives increased activity.

Major projects, and the marketing budgets that support them, often drive a surge in activity. The best example of this is Melbourne which has two-speeds.

“Apartment demand is sitting around the Australian average but housing demand is sitting far higher in Melbourne. It’s a city that’s had a lot of development which on the other hand has helped consumers find properties they want. Supply is so important for markets and our site really shows that.”

Suburbs supported by retail, transport and schools typically see the highest engagement.

The suburbs that are most searched indicate the highest engagement. By analysing these suburbs closer the data can inform what surrounding infrastructure best supports a housing market.

“We've done the analysis for the characteristics of those suburbs and they do tend to have shopping centers with good public transport and good schools.”

Where this data has defied the perceived trend is that it suggests there doesn’t seem to be a high correlation with close proximity to CBD’s. If a suburb can provide these aspects it generally has a high engagement which includes regional areas.

The most common search criteria is…

Most commonly searched are four bedroom, two bathroom, two car homes at the surprisingly low price point of around $700,000. Difficult to find in large capital cities such as Melbourne and Sydney however in most markets isn’t impossible.

“The likes of Adelaide, Hobart and Brisbane offer that sort of housing type, but is very difficult to find in places like Melbourne and Sydney. In Melbourne you can find something in that sort of price range about 20-40km out of the CBD. In Sydney it's virtually impossible to find housing with those characteristics.”

Affordability is significantly shaping buyer behavior.

Tasmania is seeing the highest levels of demand in Australia and affordability is likely to be the key factor.

“It does show there is a price point people want to hit. We're starting to see Tasmania really push up the list, places like Central Coast are also becoming very popular as well as outer Eastern Melbourne.”

Knowing how buyers are utilizing the site is key to determining these behaviours. Data is currently suggesting buyers are gravitating strongly to affordable housing. Affordability is altering which locations are most ideal for property buyers.

Interest from overseas property seekers is growing and the criteria is becoming more diverse.

Property seekers from China are the top overseas searchers on the site however there is still consistent interest from the United States, United Kingdom and New Zealand.

“There is still lots of interest from people based in the US, UK and NZ however we're seeing that buyers based in China are very interested in housing in Australia. Chinese property buyers originally started on apartments in Sydney and Melbourne however are now looking at house and land in more affordable locations. Which has a lot to do with the greater number of people coming to buy in Australia.”

Originally many property buyers were very wealthy Chinese coming to Australia to find somewhere for their children to study, however that has now extended to the middle class.

This is causing a shift in the dynamic of what kinds of house types Chinese property buyers are searching for.

Certain suburbs are becoming ethnic settlement hotspots.

Several suburbs in Australia have become settlement hotspots for particular backgrounds of migrants. For instance, St Ives in New South Wales has a large number of South African residents, for Manly its UK-born residents and Glen Waverley is the number one suburb in the country for property seekers from China.

“I think it’s word of mouth. If you're from the UK and you've come to Australia and settled in Manly, you'll tell your friends and family about what a great place it is. It's consistent across the country that we are noticing these particular settlement patterns.”

Lifestyle is key for renters.

Locations popular with renters are typically inner city and provide for ease of lifestyle. For instance inner Melbourne and inner west and lower Northern Beaches in Sydney. Gold Coast also appears as a very popular area with renters.

“When you consider what they're looking for, it’s primarily lifestyle. Whether it’s a lifestyle that provides beaches, such as the Gold Coast or Northern Beaches in Sydney or a lifestyle that provides cafe's, restaurants or nightlife; which inner Melbourne and inner Western Sydney provide. It's quite consistent but they're the ones we see lots and lots of people looking to rent.”

Lifestyle is a key aspect amongst renters due to the highest demographic coming from younger households between the ages of 20-35. With affordability affecting the ability to buy, this demographic could set to rise. However this is only determinable through Census data.