Sydney and Melbourne Downturn Only at Halfway Point: BIS

A historical look at the history of Australia's numerous housing downturns reveals that markets in Sydney and Melbourne are only halfway through the average downturn cycle with prices expected to fall a further 5 to 10 per cent over the next 12 months.

According to economic forecaster BIS Oxford Economics, markets are likely to continue to decline in 2019, particularly given the constrained availability of credit and ongoing weakness in investor demand.

BIS Oxford Economics study author Angie Zigomanis noted in the context of previous market downturns, real prices in Sydney and Melbourne have been falling at a faster rate than historical benchmarks.

“So far, the period of decline in these two markets has been much shorter than the longest downturn duration and around half of their respective average downturn lengths in both the house and unit markets,” Zigomanis said.

“It is foreseeable that the current downturn in the Sydney and Melbourne markets may have at least another year to run before reaching the cyclical trough.”

There is, however, some upside in Adelaide and Canberra.

In contrast to those of Sydney and Melbourne, Adelaide real prices have grown and that market is not going through a downturn. Its last downturn was between 2010 and 2013.

Related: What Can We Learn from 30 Years of Sydney Property Markets

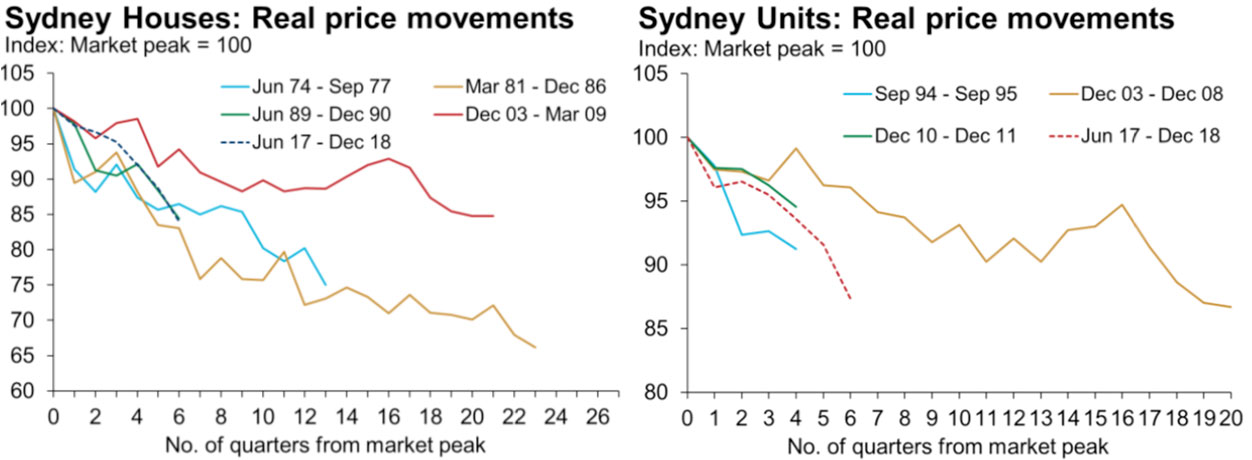

Sydney

A historical look at Sydney's four downturns has found average length of time is 14 quarters with the current downturn, which commenced in June 2017, is currently sitting at its sixth quarter to December 2018.

The city is currently experiencing its sharpest downturn since 1965 with real prices falling 14 per cent within six quarters.

Prices have weakened by approximately 21 per cent on average in total during each historical downturn.

Whether Sydney would re-enact its worst downturn recorded since 1965, the 1980s downturn, which saw 34 per cent price drops over 23 quarters, was yet to be seen.

BIS also noted that inflation in the 1980s was higher, causing more volatile price swings whereas lower inflation now could curb deep movements.

The Sydney apartment cycle mirrors its house price cycle, with real prices down 13 per cent at the halfway mark.

“Significant levels of new unit supply – surpassing previous records – are expected to continue to put downward pressure on prices in the Sydney unit market,” Zigomanis said.

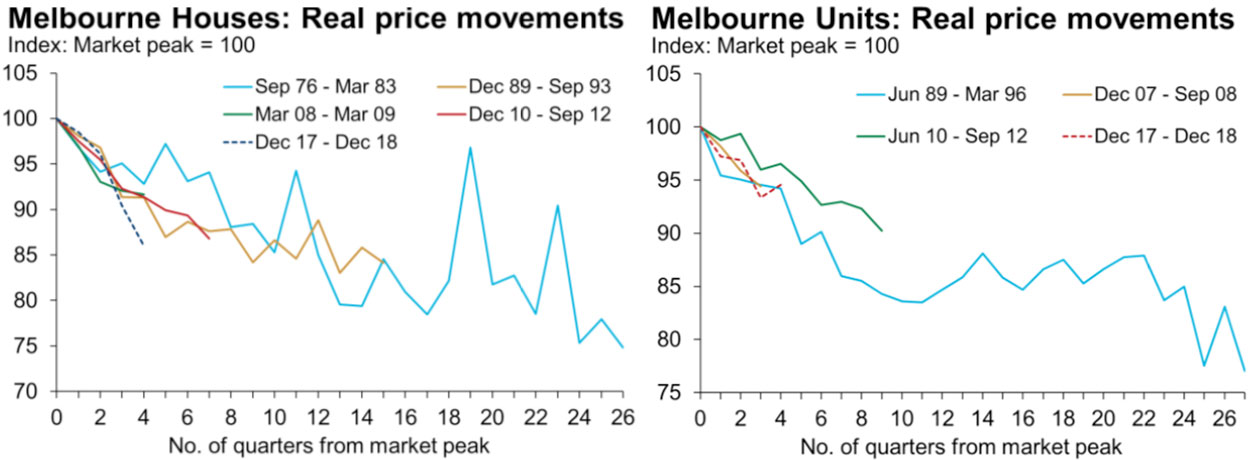

Melbourne

The average duration between peak and trough in Melbourne has historically averaged 11 quarters, while the average real price decline was around 15 per cent.

The present downturn has been significantly sharper at the same stage compared with previous downturns, with records showing prices had declined by between 7 per cent and 9 per cent at corresponding points in time during the other downturn periods.

Melbourne unit prices have experienced four periods of decline in real terms since 1984 with the most significant thus far being the 23 per cent decrease which occurred between June 1989 and March 1996.

The average duration of downturn historically has been 11 quarters, while the average price reduction experienced across the four downturns has been 11 per cent.

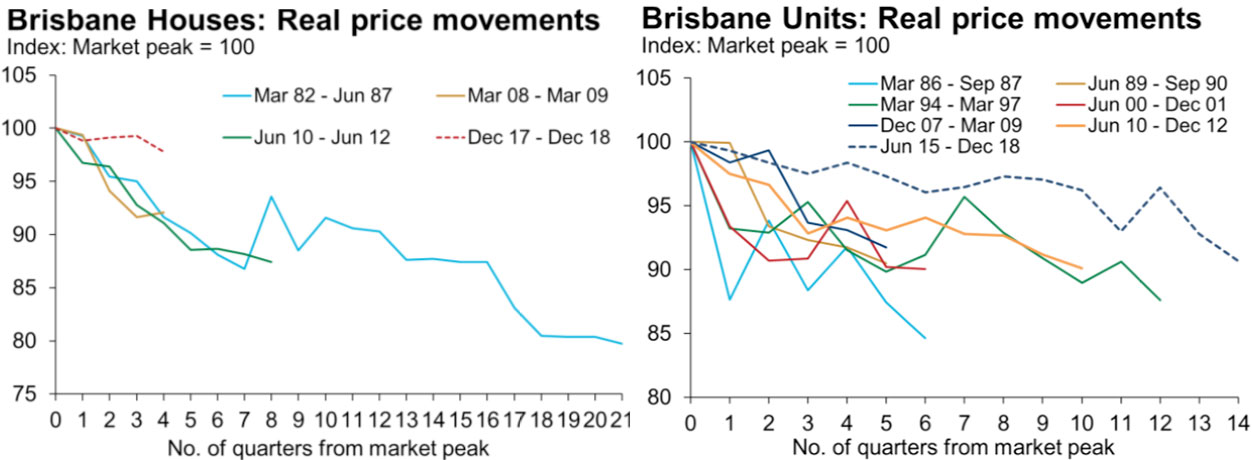

Brisbane

Brisbane, which has experienced four downturns since monitoring began in 1978, averages a length of nine quarters.

While the most significant real price decrease during a downturn was 20 per cent, the average reduction per downturn has been just under 11 per cent.

“Brisbane house prices are expected to remain relatively flat over the next 12 months, although there is a risk house prices could also begin to weaken in nominal terms,” Zigomanis said.

The average duration of Brisbane’s unit market downturns has been eight quarters, however the city is currently experiencing its longest downturn with real prices declining from a June 2015 peak.

Implications for the building industry

Analysts warned that declining prices will also weigh heavily on the building industry.

“Price declines are typically accompanied by a reduction in turnover with upgraders tending to sit out of the market until conditions for them to sell their existing dwelling improve, which in turn reduces demand from those who would upgrade to a new house,” Zigomanis said.

Further declines in median house and unit prices will adversely impact the feasibility of a variety of potential new projects, particularly in circumstances where the price paid for land has been high compared to current market.

“As a result, the next round of development may be delayed pending an uplift in house and unit prices.”