Property Industry Expects Interest Rate Rise

Property industry confidence levels are near record highs but there are rumblings that interest rates could to increase soon.

The ANZ/Property Council industry survey for the March quarter found confidence levels has improved drastically since the pandemic started, led by the residential sector.

The survey canvassed the views of more than 830 respondents—including, owners, developers, agents, managers, consultants and government—across all major industry sectors and regions.

The results revealed respondents also believe there will be an interest rate increase during the next 12 months.

This comes as the Reserve Bank of Australia closely watches the housing market as “cyclically low-interest rates and rising asset prices create a risk of excessive borrowing”.

According to the RBA financial stability review, this could lead to financial instability particularly if lending standards are weakened, which could expose lenders to large losses.

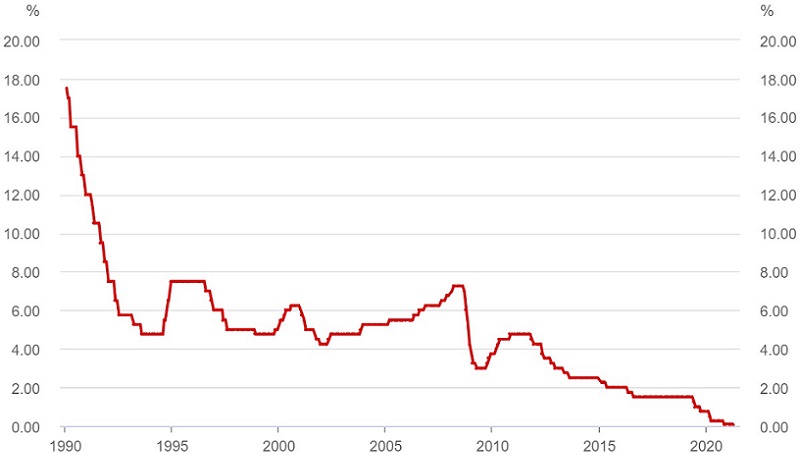

Interest rate changes

^Source: RBA

For the meantime, the Reserve Bank decided to hold the official cash rate at 0.1 per cent for the fifth time in a row.

Despite expecting an interest rate rise, survey respondents were confident about work expectations, national growth and house prices in the next year.

Property Council of Australia chief executive Ken Morrison said the expectations for house prices were at the highest level in the survey’s 10-year history.

“When the property industry is confident it is exceptional news for the entire national economy because it employs so many people—more than 1.4-million Australians,” Morrison said.

“While the economy still faces significant challenges, the property industry is clearly buoyed by the speed of our turnaround and the strong demand they are seeing, particularly in the residential and industrial sectors.”

ANZ senior economist Felicity Emmett said that for now the combination of record low mortgage interest rates and targeted stimulus was clearly supporting the housing sector.

“Property sentiment has improved again, reflecting stellar economic performance, a large pipeline of work for the coming year and a strong outlook for property prices,” Emmett said

The survey also revealed an easing of concerns about the office sector as more CBD workers return to their work places.