New Listings Lift Number of Homes on Market

The number of homes on the market rose significantly across Australia last month, driven by more new listings.

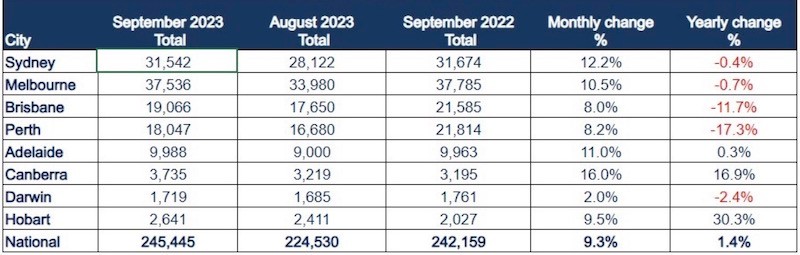

According to SQM Research, total listings rose 9.3 per cent for a total of 245,445 properties, compared to 224,530 properties recorded in August.

This surge could be attributed to a substantial rise in new listings across all capital cities, according to SQM.

Sydney recorded a 12.2 per cent increase in total listings for September, driven by a 12.7 per cent increase in new listings, while Melbourne’s total listings were up 10.5 per cent off the back of a 10 per cent increase in new listings.

Canberra recorded the largest percentage increase for any capital city with a 16 per cent increase in total listings pushed along by a 13.9 per cent increase in new listings.

Over the past 12 months, residential property listings nationwide increased by 1.4 per cent—Hobart stood out by consistently reporting an increase of 30.3 per cent.

New listings surge

Nationally, new listings (less than 30 days) rose by 14.3 per cent in September, adding 77,621 new property listings to the market.

Sydney, Melbourne and Canberra outperformed the national average with increases of 12.7 per cent, 10 per cent, and 13.9 per cent, respectively.

As well, Hobart experienced a remarkable surge in new listings, with a 45.7 per cent jump over August.

Meanwhile, new listings in Brisbane and Darwin grew at a softer rate of 3.4 per cent and 27.6 per cent respectively.

Older listings (properties listed for more than 180 days) increased by 7 per cent, marking a 21.5 per cent rise during the past 12 months.

All cities recorded a rise in older stock during the month.

Total listings for September

The report also found that as of September, the number of residential properties being sold under distressed conditions in Australia had risen to 5246.

This was a modest increase of 1.3 per cent compared to the 5180 distressed listings recorded in August 2023.

The uptick was primarily driven by increases in NSW (4 per cent), Victoria (1.5 per cent), Western Australia (3.6 per cent) and a substantial 11.1 per cent increase in the ACT.

Queensland and South Australia have recorded a decrease.

Asking prices nudge up

Asking prices for capital cities increased by 0.9 per cent, marking an 8.1 per cent rise compared to September 2022.

There was a significant surge in asking prices for all units, up 2 per cent. Sydney had a notable increase of 1.7 per cent, while Melbourne showed a more cautious rise of 0.6 per cent, indicating some restraint among vendors in the Victorian capital.

Brisbane recorded a substantial uptick in asking prices, rising by 1.5 per cent for the month and registering an overall increase of 9.8 per cent for the past 12 months.

The rise in asking prices generated new record highs at the national level as well as the capital city level.

New highs were set for Sydney, Brisbane, Adelaide and Perth. The highest recorded median asking price was Sydney houses, which reached $1.873 million.

The most affordable capital city asking price was Darwin units at $374,000.