Shopping Centre Vacancies Decline as Landlords ‘Work Hard’ to Keep Retailers

The spectre of online shopping and softening conditions hasn’t impacted shopping centre occupancy rates, which remained relatively unchanged over the second half of 2017.

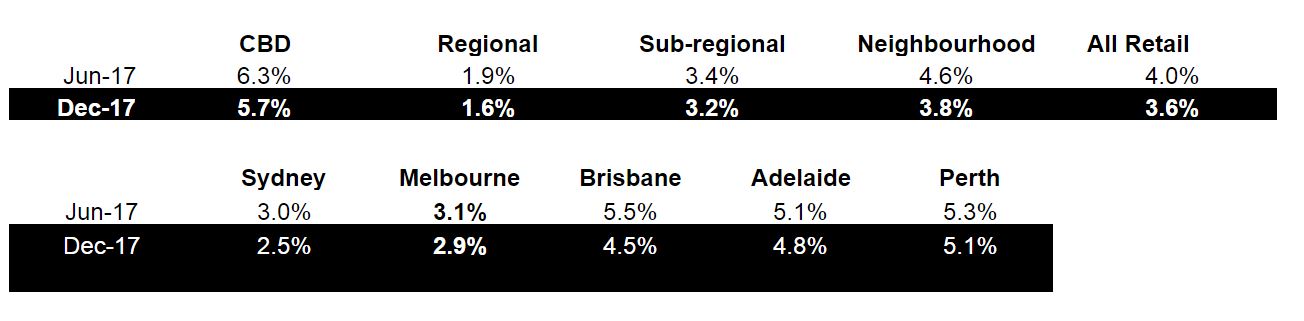

According to the latest research from JLL, the average retail vacancy rate fell from 4.0 per cent in June 2017 to 3.6 per cent in December 2017, representing vacancy tightening across all major capitals and their CBD, regional and neighbourhood markets.

The national vacancy rate declined from 6.3 per cent to 5.7 per cent.

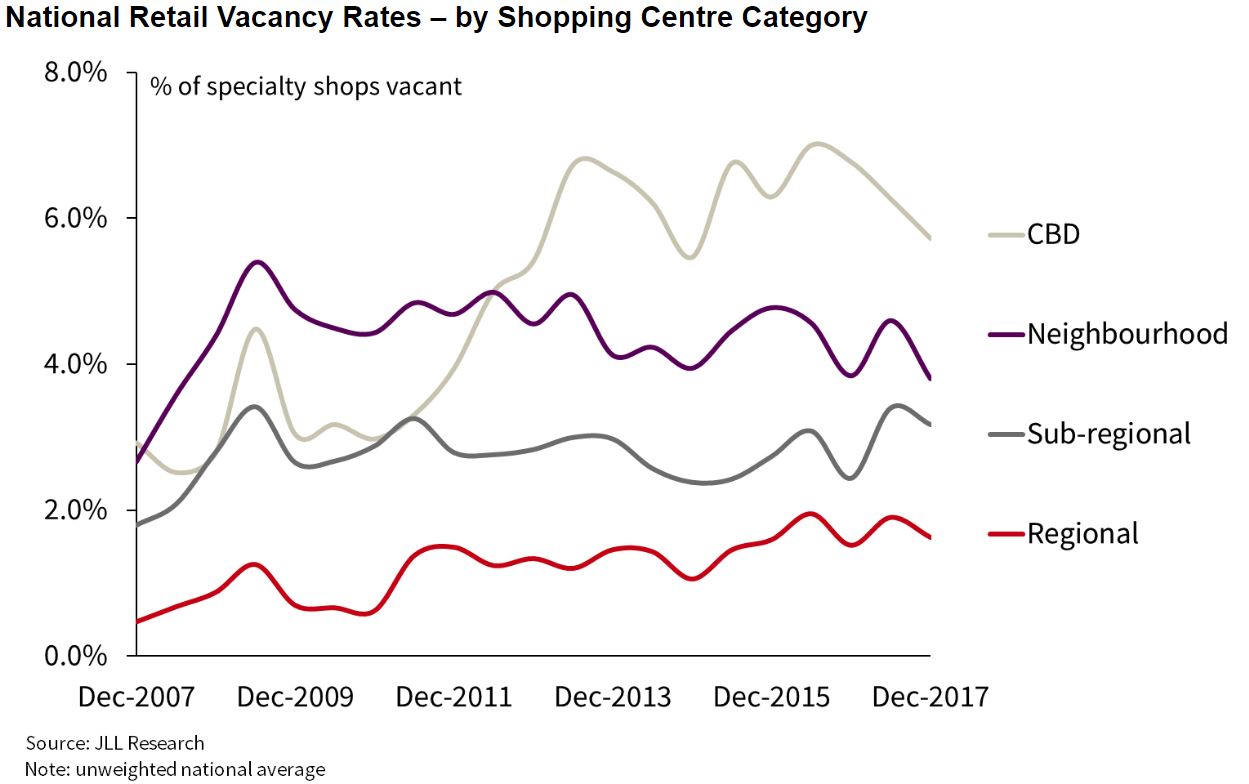

Neighbourhood and sub-regional centre vacancy rates were relatively stable since 2009, with only minor fluctuations. The national CBD vacancy rate was considerably higher than a decade ago, driven by high vacancy rates in the Perth and Adelaide CBDs which sat around 10 per cent, compared with the 3-3.5 per cent average of Sydney and Melbourne.

Related reading: Record Yields for NSW Neighbourhood Shopping Centres

The regional shopping centre vacancy rate has been trending up slightly over a long-term view, but remains within the 1-2 per cent range, significantly lower than the other major shopping centre sub-sectors.

Growth in pop-up retailers has helped keep the vacancy rate lower, particularly around the Christmas trading period.

“Landlords are acutely aware of the changes in the retail industry and the impact that it is having on retailer decision-making,” JLL head of retail Tony Doherty said.

“Centre owners are taking a proactive approach to retailer engagement strategies to ensure occupancy rates are maintained.

Related reading: GPT Sells $500m Wollongong Shopping Centre

Doherty said that store closures associated with retailers that went into voluntary administration were lower in 2017 than they were in 2016, putting less pressure on vacancy numbers.

“Nevertheless, owners and managers of shopping centres are having to work hard to attract and retain retailers and are actively trying grow their exposure to innovative retailers which will remain relevant in the fast-changing new retail environment.”