Australia Number Two on Real Estate Transparency Index

The ease of doing business in Australia with its stable and transparent regulatory and legal systems has secured Australia's place near the top of a global transparent real estate market index.

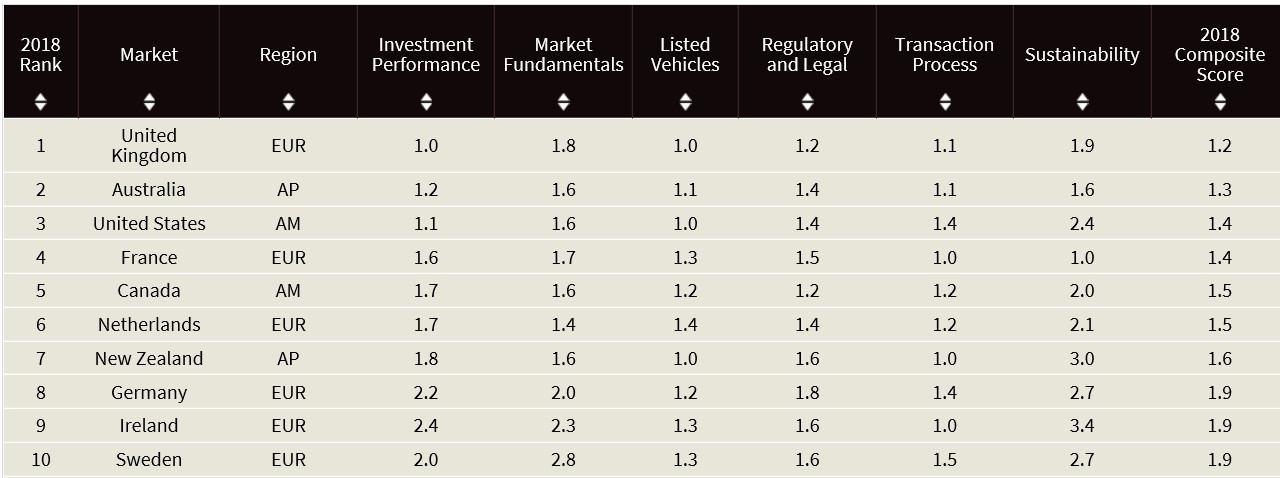

Australia is the most transparent real estate market in Asia Pacific and the second most transparent real estate market in the world, according to JLL's Global Real Estate Transparency Index 2018.

JLL's index, which is compiled every two years, measures transparency by analysing factors including market data availability, governance, property rights and the legal and regulatory environment.

JLL Australia chief executive Stephen Conry says there is a strong relationship between transparency and cross-border investment activity.

“Transparency is one of the key factors for investment into Australia, complementing a diverse economy, strong population growth and positive market fundamentals,” Conry said.

“Australia’s solid investment fundamentals have attracted high levels of offshore capital.

"Foreign investors accounted for 33 per cent of investment into the Australian commercial property market in the first six months of 2018.”

Related: Foreign Investment in Australian Property Tumbled in 2017: FIRB

Chair of Foreign Investment Review Board David Irvine confirmed a significant decline in both the number and value of approved residential real estate investment, while speaking at an International forum in May this year.

“This decline is largely due to the introduction of application fees, which has reduced multiple applications, encouraging investors to only apply for those properties they genuinely intend to purchase,” Irvine said.

In the 2015-16 financial year, residential real estate was the largest asset segment approved, at $72 billion.

Corelogic property market analyst Eliza Owens says this fell to $25 billion the following year, representing a year on year decline of 69 per cent.

Owens says this decline was not as drastic in the commercial real estate segment. Commercial real estate assets approved for acquisition fell from $50 billion in 2015-16, to $44 billion in 2016-17 – representing a decline of 12 per cent.

JLL recorded $56.3 billion worth of acquisitions by offshore investors since 2012.

During this period investors represented 33.2 per cent of transaction volumes across the office, retail and industrial sectors.

JLL global research director Jeremy Kelly says transparency is increasingly important for commercial real estate, where investors are allocating growing amounts of capital.

“The availability and quality of information – from prices to ownership – is crucial when trying to make investment decisions, especially in new markets.”