Retail Investment Market Reaches New Record In 2017

Transaction activity in Australia's retail investment market is set to reach a new record in 2017 as the high rate of turnover for retail assets continues, according the latest research by JLL.

JLL’s annual Shopping Centre Investment Review and Outlook Report revealed an ongoing trend for the last five years, driven by a number of key strategies employed by owners and investors alike.

JLL Head of Retail Investments in Australasia Simon Rooney said investor demand remains very strong from domestic and offshore capital sources.

"Demand continues to outweigh supply of investment product, resulting in surplus capital which is yet to be deployed and driving competition-led yield compression.

“Australia is expected to attract a high proportion of offshore capital again in 2017, given retail yields in Australia remain high in a global context and market fundamentals are relatively stable.

"Australia’s status as a low-risk investment destination with high levels of market transparency and the opportunity to secure large, institutional grade, core and core-plus assets, continues to drive significant demand from global investors.

“Domestic owners will selectively dispose of or offer passive JV interests in assets to fund developments and bolster portfolios, reduce risk and maintain low gearing,” Mr Rooney said.

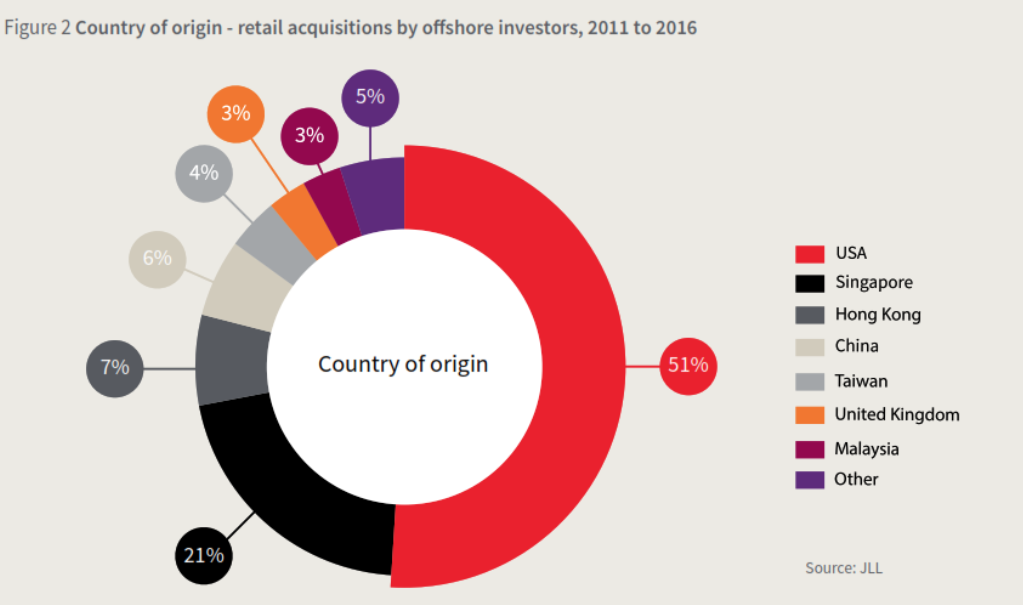

In 2016, transactions to offshore investors reached $2.3 billion, slightly below the $2.5 billion recorded in 2015.

Offshore investment activity accounted for a significant 32% of total acquisitions, compared with the long-term average of 12%.

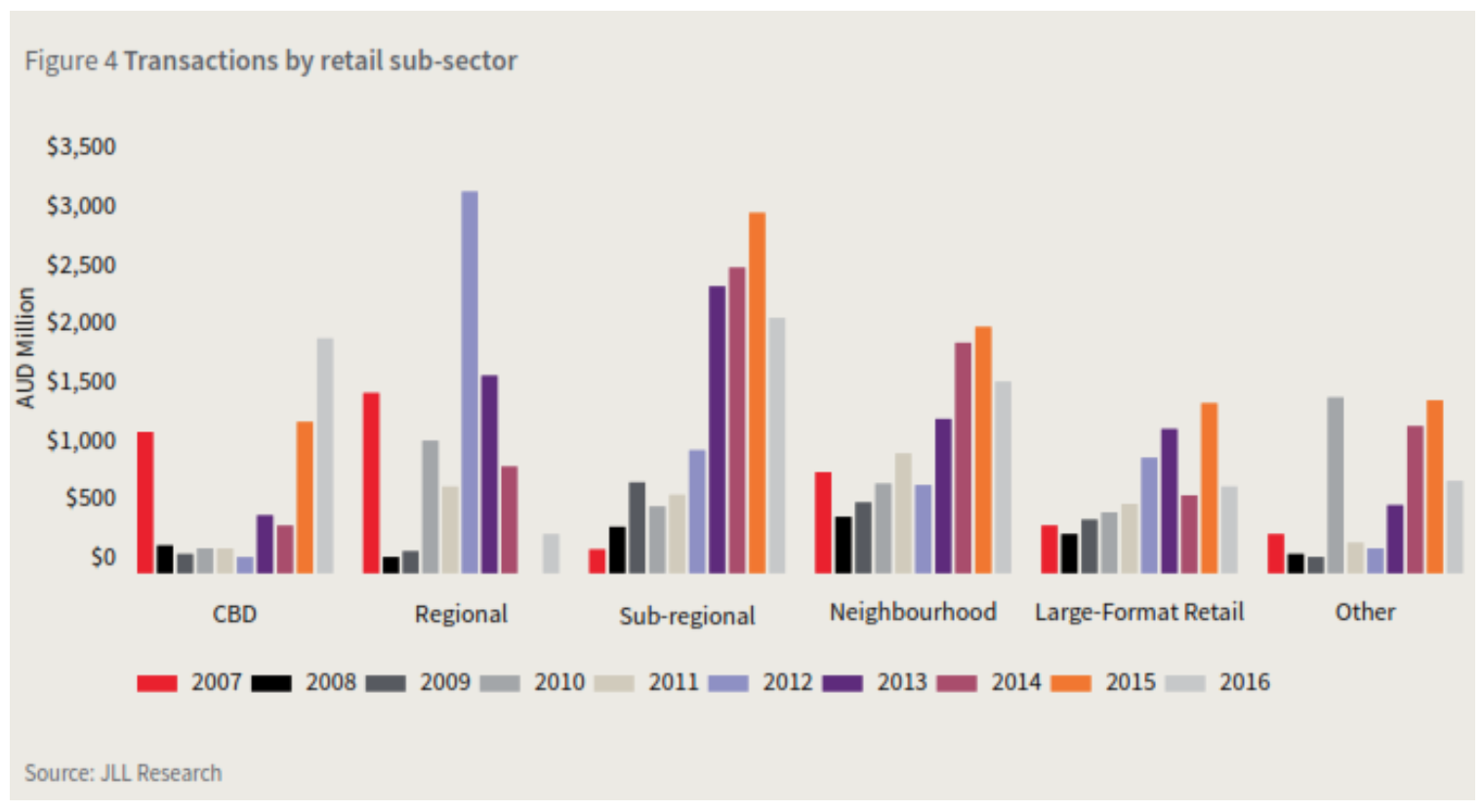

The report said total retail transactions reached $7.3 billion in 2016, down approximately 18% from the record high of $8.9 billion in 2015. CBD and sub-regional shopping centres were the standout performers and the major theme in 2016 – with a record set for CBD shopping centre sales at $1.9 billion. The previous record for CBD transactions was $1.2 billion in 2015.

Sub-regionals accounted for the largest share of activity in 2016 at $2.1 billion (or 28%) and are expected to be the major focus of attention for domestic and offshore investors alike, given their defensive qualities and attractive growth profile.

2017 outlook

JLL said they expected a limited number of regional shopping centres could become available for acquisition over the next 12-24 months in some form, as owners seek strategic partners for major redevelopments and capitalise on favourable market conditions.

“Regional shopping centre redevelopments are highly capital intensive," Mr Rooney said.

"We expect a number of major owners to potentially seek diversification by reducing high exposure to a single asset and trade area and look to unlock capital to fund alternative developments across their portfolio.

“Sub-regional assets have been the most highly traded category for each of the last four years. Investors continue to be attracted to this retail sector given their defensive nature and the relative value proposition that it offers in terms of the attractive yields, inbuilt growth and value-add opportunities, to drive returns through active asset management strategies," he said.

Total transactions for neighbourhood centres totalled $1.6 billion in 2016, 41% above the 10 year average. The large majority of transactions occurred in QLD, with 28 transactions totalling $561 million, while neighbourhood centres remained tightly held in NSW and VIC, with only 10 ($524.7 million) and 12 ($248.4 million) transactions.

Key highlights - Shopping Centre Investment Review and Outlook Report

Transaction volumes

2016 was another highly active year for the Australian retail investment market. 2016 marked the 5 th consecutive year that volumes exceeded $5 billion – a level only reached once before in 2003. 2016 transactions reached $7.3 billion, approximately 18% below the record of $8.9 billion reached in 2015.

Australia continues to attract offshore capital

In the last five years, investors form the USA accounted for the greatest share (51% of acquisitions by offshore buyers). Investors from Asia were also a major contributor (42%). There is renewed interest in the Australian retail sector from European investors and pension funds, as well as ongoing demand from North America and Asian investors.

Domestic players remain active on the buy and sell side

Acquisitions by domestic buyers in 2016 were led by private investors, followed by A-REITs and to a lesser extent, superannuation funds and unlisted funds. For private investors, acquisitions and disposals were relatively even in 2016 at approximately $1.5 billion - $1.6 billion, after being net sellers from 2013 to 2015.

A-REITs

A-REITs were more active in the market (on both the buy and sell side) than they have been over the past 10 years, reflecting the view that owners continue to rebalance portfolios.

Product

CBD and sub-regional shopping centre transactions continued to be the main theme in the retail market. Only one regional centre transacted in 2016 – the first since 2014. Neighbourhood remains an active part of the market and heightened competition for assets has driven further compression of yields.

Yields

CBD, regional and neighbourhood yields are now all sitting at record low levels (on average), on a national basis, and sub-regional and large-format retail yields are within 10 basis points of their historical low.

“Retail fundamentals remain resilient at the headline level," JLL Retail Research Director Andrew Quillfeldt said.

“Owners are deploying capital into their extensive development pipelines and are focused on primarily upgrading and extending existing shopping centres in order to attract and retain tenants, and drive investment returns," he said.

“Although the leasing market has been supported by the entrance of new international brands in certain segments, competition remains high in the retail sector and there is a divergence occurring between the performance of individual retailers.

"Online retailers continue to create further competition for traditional retailers – especially for those that rely on price as a key differentiator.

“Retail turnover growth will be supported over the medium term by a recovery in wages growth and inflation," Mr Quillfeldt said.

"We expect rents to grow at around the rate of inflation through 2017, but are expecting there to be more scope for rents to recover from 2018 given the reset in occupancy cost ratios that has already occurred and the alignment between retail sales growth and fixed rental increases."