Rent Caps Spell Disaster for Build-to-Rent Sector: CKC

“This could plague us for the rest of the decade.”

That was the advice from Charter Keck Cramer’s national executive director Richard Temlett as Victoria stares down the barrel of Premier Dan Andrews’ rent caps.

Temlett warned that rent caps would force investors and developers out of the build-to-rent market and severely hamper off-the-plan sales for build-to-sell apartments into the future.

“The industry needs confidence not uncertainty around planning changes or rental capping, this could be a disaster,” Temlett said.

“I’ve heard from build-to-rent investors that they are putting things on hold until they know what’s happening with rental capping.

“There’s an approach that can have a long term fix to the housing crisis, and there’s another approach that will generate votes for the government, but it’s not a proper fix.”

Temlett said the only real fix is to incentivise development of density to boost supply and create downward pressure on pricing.

Last month the Victorian Premier Daniel Andrews signposted that the government was working on a housing policy that entailed freezing rents and capping increases.

It is expected to cap rent rises to once every two years, which would have a tangible commercial impact on the build-to-rent sector, which requires strong pricing to ensure feasibility.

Temlett said rent capping would distort the market and could also create an “elastic response” when the period of rent capping is over and asset owners would look to recoup losses.

“Rental capping will sell build-to-rent out of the market and shrink rental stock,” he said.

“If government is brave and incentivises the market by bringing back local and overseas investors to build-to-rent it will start solving the housing crisis.

“But we will have a persistent crisis if stock is not mobilised.”

Temlett said the tax wedge was one way the government could help to incentivise development to boost housing stock, while also expediting planning and enabling skilled migrants to emigrate to Australia.

“Turning off population growth would be a disaster, it’s a short sighted response to a problem that has been decades in the making,” he said.

Vacancy Rate v Rental Growth

The Victorian government had already introduced a one-year freeze on rent increases for agreements that started on or after June 2019.

The Queensland government also introduced rent freezes in April this year.

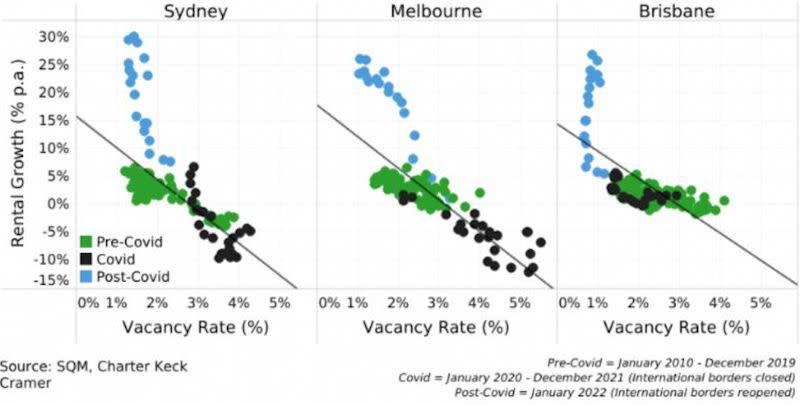

Charter Keck Cramer data shows the correlation between vacancy rates and price growth.

“A simple but effective method to assess the level of both opportunity and risk in a rental sub-market is to compare the vacancy rate against the change in weekly rents over time,” Temlett said.

“A rental market is notionally in “market equilibrium” when the vacancy rate is around 3 per cent. It is at this point that rents typically remain stable.

“A vacancy rate higher than 3 per cent suggests an oversupply of rental dwellings which is reflected in negative rental growth whilst a rate lower than 3 per cent suggests an undersupply of rental dwellings which is reflected in positive growth.

“We are not in a balanced market.”

Charter Keck Cramer’s analysis shows that the rental markets, much like the ‘for sale’ markets, were distorted during the pandemic and particularly whilst international borders were closed.

This was most acutely felt in many apartment sub-markets in Sydney and Melbourne which rely on students and new migrants for rental demand.