New RBA Chief Holds Rate as Approvals, Loans Rise

The Reserve Bank of Australia is to leave the cash rate on hold for a fourth straight month, but incoming chief Michele Bullock—chairing her first board meeting—refused to rule out further increases to curb inflation.

In a statement after the board’s October meeting, Bullock said the cash rate would remain at 4.1 per cent—its highest level since April 2012.

The bank’s decision to again leave rates unchanged had been in line with forecasts by economists, despite Australia’s inflation rate rising slightly to 5.2 per cent in August, up from 4.9 per cent the month before.

Echoing her predecessor, Philip Lowe, who vacated the chair last month, Bullock said future rate rises might be needed to combat inflation.

“The higher interest rates are working to establish a more sustainable balance between supply and demand in the economy and will continue to do so,” Bullock said.

“In light of this and the uncertainty surrounding the economic outlook, the board again decided to hold interest rates steady this month. This will provide further time to assess the impact of the increase in interest rates to date and the economic outlook.

“Some further tightening of monetary policy may be required to ensure that inflation returns to target in a reasonable time frame but that will continue to depend upon the data and the evolving assessment of risks,” she said.

Homeowners have been hammered with interest rate rises totalling four percentage points since May last year.

Commenting on the board’s decision, CoreLogic research director Tim Lawless said it was clear inflation remained high on the RBA’s risk radar.

“Higher fuel and energy prices, alongside persistently high services and rental inflation have the potential to trigger another rate hike later this year,” Lawless said.

“Logically, the RBA will be waiting to see September quarter inflation data, released the week ahead of the RBA’s November meeting.

“The November meeting will be closely watched.”

AMP’s chief economist, Shane Oliver, agreed, saying the near-term risk of another rate hike is still high.

“If new governor Bullock is to raise rates again though she is likely to wait to see the September quarterly CPI and updated RBA forecasts which will both be available by the November,” he said.

However, Oliver warned another rate hike would be a mistake.

“The RBA has already done more than enough to slow the economy in order to rebalance demand and supply and bring inflation back to target,” he said.

“Rate hikes impact the economy with a long lag as it takes a while for the hikes to be passed through to borrowers and for them to adjust their spending.”

He said continuing to raise interest rates would only add to the “already very high risk of unnecessarily knocking the economy into recession.”

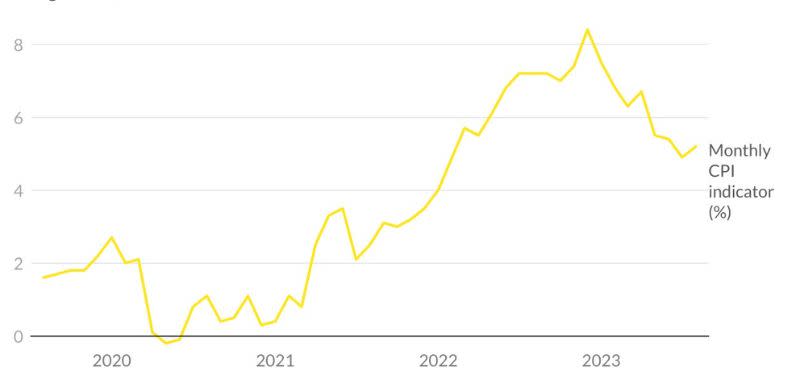

CPI percentage growth nationally

Oliver said former RBA governor Lowe’s substantial rate increases would mean Bullock should get a much easier run on interest rates.

“The risk is that her main challenge will be trying to turn the economy back up again in the event of a hard landing or recession.”

CoreLogic said the RBA was likely to be keeping a close eye on the housing sector, given rental pressures were at the forefront of the inflation numbers.

“The annual change in CoreLogic’s measure of market rents has been slowing since October last year,” Lawless said. “CPI rents tend to lag market rents, implying CPI rental growth could be close to peaking.”

Approvals bounce back

Home approvals rose 7 per cent in August, following a 7.4 per cent fall in July, according to data from the Australian Bureau of Statistics.

ABS head of construction statistics Daniel Rossi, said approvals for private sector houses rose by 5.8 per cent, following three months of stable movement.

“Approvals in the more volatile private sector hones excluding houses series rose by 9.4 per cent, following a 14.6 per cent fall in July,” Ross said.

Total home approvals were mixed overall, with rises in Victoria (22.2 per cent), New South Wales (12.5 per cent), and Western Australia (12.3 per cent).

Meanwhile, falls were recorded in Queensland (26.9 per cent), Tasmania (10.1 per cent), and South Australia (6.9 per cent).

Approvals for private sector houses rose in all states: Western Australia (+13.0 per cent), Victoria (+9.9 per cent), South Australia (+4.7 per cent), Queensland (+3.1 per cent), and New South Wales (+2.4 per cent).

The value of total building approvals rose 0.5 per cent, following a 16.0 per cent fall in July. The value of total residential building rose 2.3 per cent, comprised of a 3.2 per cent rise in new residential building and a 2.4 per cent decrease in alterations and additions.

The value of non-residential building approved fell 1.5 per cent in August, following a 26.9 per cent decline in July.

Loans improve but still below 2022

The ABS said the number of new owner-occupier loan commitments for homes rose 2.5 per cent in August but remained 12.3 per cent lower compared to last year.

ABS head of finance statistics Mish Tan, said that since February 2023, the number of new owner‑occupier loans appeared to have returned to levels seen before the pandemic began, but well below the peak in January, 2021.

The number of refinanced owner-occupier loan commitments between lenders fell 5.4 per cent to 26,539, after reaching an all-time high last month.

“Since November 2022, the number of refinanced loans has been above the number of new owner‑occupier loan commitments. Refinancing has remained at unprecedented levels as households continued to seek better loans amid a high interest rate environment,” Tan said.