Resources

Newsletter

Stay up to date and with the latest news, projects, deals and features.

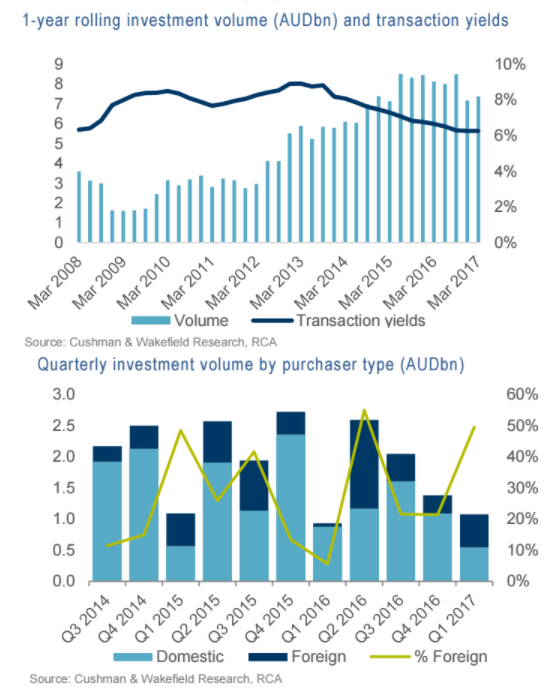

SubscribeForeign investment in retail was particularly strong quarter-on-quarter, rising to $533 million in total volume, according to Cushman & Wakefield research.

Retail investment totalled $1.1 for the first quarter – up 23% on the same period last year, according to the research, with Queensland representing the most "attractive" destination – 43% ($457m) of the national investment volume.

New South Wales and Victoria recorded $262m and $221m, both below respective longer-run averages, as limited available stock was on the market. Foreign investment rebounded to $533m, up from $297m in Q4 2016.

Retail Overview

In December 2016, Moving Annual Turnover (MAT) grew 3.4%, though continued the downward trend from a peak of 5.7% in late 2014. Turnover growth has been limited by weak employment and income growth though consumer sentiment has bounced back to 99.6 reflecting a more positive attitude towards national economic growth.

Investment Overview

Retail investment remained robust in Q1 2017 with a total of $1.1bn, up 23% on the same period last year. Queensland proved the most attractive destination, accounting for 43% ($457m) of the national investment volume. Foreign investment rebounded strongly in Q1 2017 to $533m, up from $297m in Q4 2016.

2017 Outlook

Retail property’s relative value proposition and competition to secure assets - a trend during 2016 - continues into 2017. But the company said it expects more stock to enter the market as "established owners sell non-core assets to recycle capital into existing assets."