Resources

Newsletter

Stay up to date and with the latest news, projects, deals and features.

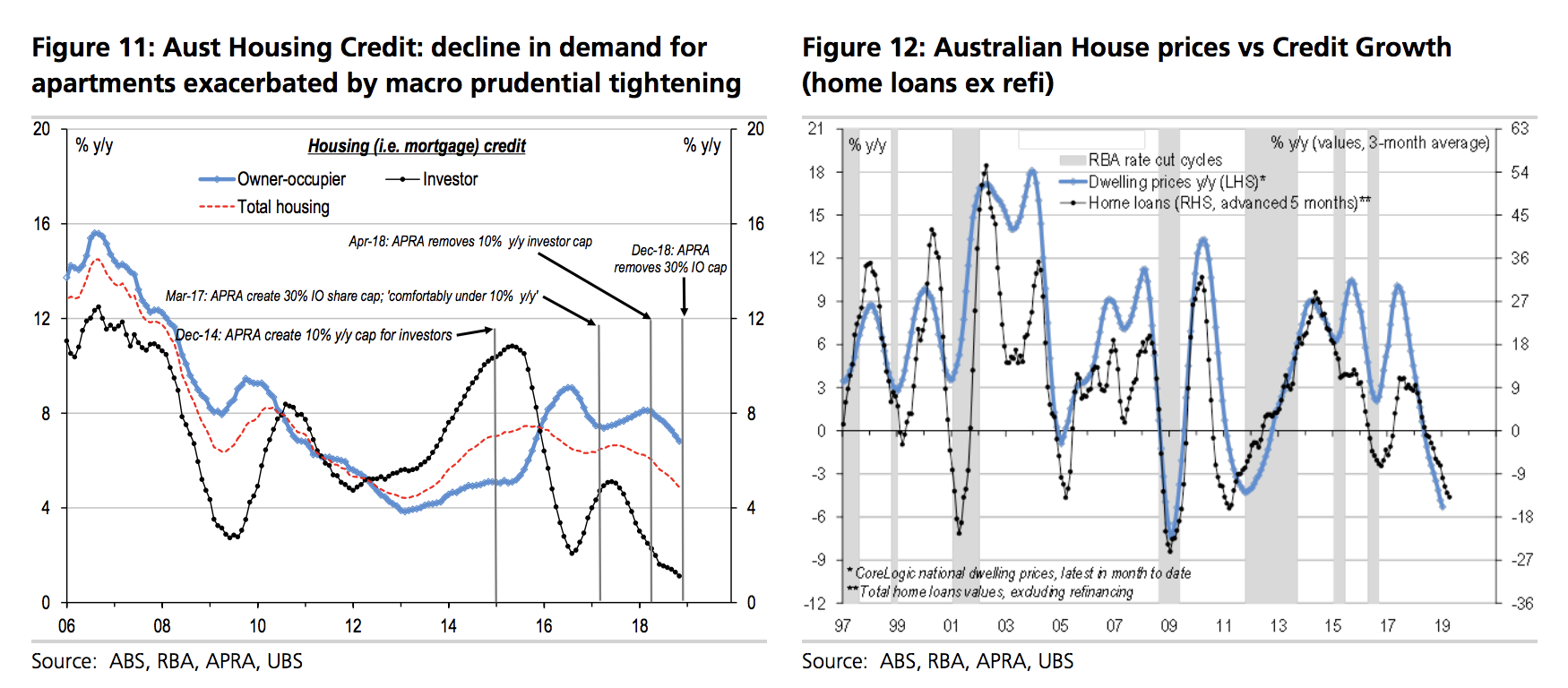

SubscribeWhile there are multiple factors that will continue to weigh on the property market, UBS has identified Australian house prices versus credit growth and settlement risk as its key issues.

With declining property prices and the banks' increased scrutiny on lending, UBS economist Carlos Cacho says valuations prior to settlement could drop by 10-to-20 per cent below the original off-the-plan purchase prices.

“What we’re seeing now is apartments are increasingly out of money,” Cacho said.

“If you speak to any private developer they will tell you there has been significant settlement issues at the moment.”

Related: Deteriorating Outlook Hits Developers in Residential, Retail Sectors

Earlier this year UBS said Mirvac's most at risk projects are in Sydney, such as Marrickville and Sydney Olympic Park which “appear already out of money with the Sydney apartment price index down 5 per cent since launch”.

St Leonards could also become an issue if apartment prices were to fall a further 5-10 per cent.

“If you look at the launches for Sydney Olympic Park and even St Leonards, we’re getting to the point where, if you’re already typically down 10 per cent when buying off the plan, in valuation we’re getting worried it could be (down) more like 20 per cent if you roll forward 20 months time when these apartments are due to settle,” Cacho said.

In January UBS said apartment prices were down 7 per cent in Sydney and 2 per cent in Melbourne, while lending to new housing was down 22 per cent from its peak.

Historically bank valuations were probably not as important when the banks were not looking at your finances as closely, Cacho said.

“What’s happened to buyers now, when they come to settlement the bank valuation might come in 10-or-20 per cent below the contract price, and then the bank is also assessing buyers with more stringent expenses.”

As of the September quarter, there were 100,000 units under construction in Sydney and Melbourne alone, according to UBS.

“So it’s a significant chunk coming on and we expect completion this year,” Cacho said.

But by estimates of underlying demand, UBS doesn't expect the construction pipeline to flood the market with stock.

“While we’re overbuilding now for underlying demand we’re actually just making up for a prior period of under building, and so we don't think there will be a fundamental oversupply that’s going to hang around for a long period of time,” Cacho said.

“The risk is more in the near term for settlement.”