More Pain to Come: Perth Land Prices Equal 2007 Boom

The average price of a new block of land in Perth is at its highest in 17 years, ringing alarm bells in the industry.

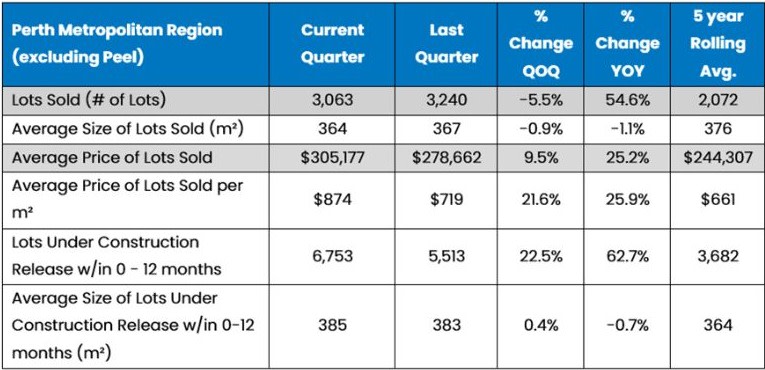

The Urban Development Institute of Australia said that the average price of a new block of land in the Perth Metro area is now $305,177, with an average lot size of 364 square metres.

It said that average price was likely to continue to rise.

According to the UDIA, it is the first time the average price has topped $300,000 since 2007.

The number of sales during the quarter to June, 2024 increased 54 per cent compared with the same quarter last year, but the number of lots on the market has decreased by 71 per cent.

UDIA WA chief executive Tanya Steinbeck said that “given the high sales volumes and lack of housing supply in the forward pipeline, we are starting to see the knock-on impact on the new land market, where prices have managed to stay relatively stable up until recently”.

The established market had experienced “significant price escalation” since 2020, the UDIA said.

According to PropTrack, Perth’s home-price dominance is persisting, with price growth of 8 to 11 per cent projected for 2025, after an 18.9 per cent increase over the financial year to date.

Until recently, the house and land market “has managed to retain a level of price stability”, Steinbeck said.

UDIA WA urban development index June quarter 2024

“That is all starting to change with a 9.5 per cent lift in the average price of land this quarter, and that is a 25 per cent lift year on year,” she said.

“We know that developers are struggling to keep up with demand, and they just don’t have the depth in their forward pipeline to keep construction up to the current levels, or indeed to increase construction levels further, which is what the market really needs.”

Urbis director David Cresp said that increasing land prices heralded more pain to come, especially in the apartment sector, where there has been “very little activity” in recent years.

“While 2024 will see the highest year of apartment completions that we have seen for some time, with 2566 apartments forecast to be completed, the forward supply pipeline is at much lower levels,” Cresp said.

“In the first six months of 2024, only 661 apartments commenced construction in developments of 25 or more apartments.

“This compares to an average year between 2014 and 2022 where almost 2000 apartments were commencing construction each year.”