Toy Billionaire Brings North Shore Office Tower to Market

Billionaire Francis Choi will find out if third time’s a charm in the Sydney office sector as he brings another asset to market.

Choi has listed Northpoint Tower at 100 Miller Street, North Sydney, as the sector shows clear sign an upswing is under way.

Industry sources told The Urban Developer the price expectation for the asset was around $400 million.

The Hong Kong investor in October of last year sold 1 Castlereagh Street for $196.4 million, almost $20 million less than he paid for it five years earlier.

And in February of this year his Exchange Centre also did not meet expectations, selling to PGIM Real Estate and Anton Real Estate Partners for $250 million, a substantial discount on the expected $300 million.

A major difference this time around is the North Sydney property includes a substantial hotel and retail component.

The billionaire founder of Early Light Hong Kong, who made his fortune in toy manufacturing, completed ownership of the 34-storey tower in 2018 when he picked up the remaining 50 per cent share for $300 million.

The property is the subject of an expressions-of-interest campaign being run by Knight Frank agents Dominic Ong and Rob Sewell and closing September 10.

Tenants across the 26,820sq m of office space include Dynatrace Asia, Ferrero Australia, Holcim Australia and EG Group.

The tower’s Vibe Hotel occupies 187 rooms over eight levels while the retail component totals 4728sq m above a six-level basement carpark.

Harbour City leasing on rise

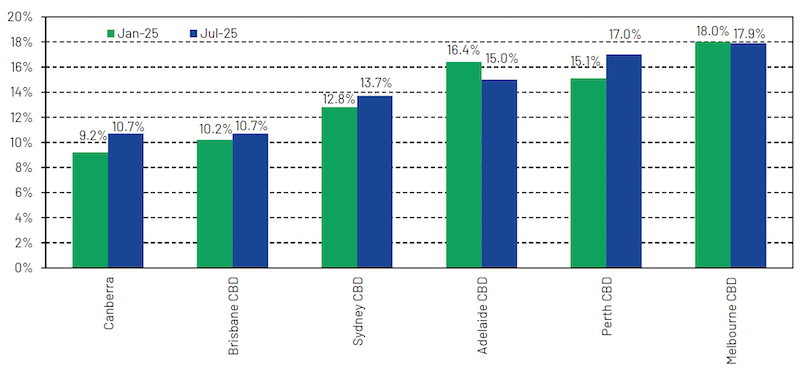

National CBD vacancies nudged up from 13.7 per cent to 14.3 per cent as rising levels of supply outpaced demand, according to the Property Council of Australia’s biannual report.

That was not expected to slow as 26,400sq m come online in the next six months as businesses increasingly moved towards premium office space, the report said.

The new stock is spread across Adelaide (23,170sq m), Canberra (16,000sq m), Melbourne (66,127sq m) and Sydney (26,400sq m).

“Australia’s CBDs have seen plenty of supply during the past five years, with 2.6 million sq m going live, totalling 13.7 per cent of the total office space in our cities,” the report said.

“In the past six months, the amount of occupied premium office stock increased by 2.7 per cent, a 7 per cent rise compared to the same time last year.

“This growth is much stronger than in other office grades. Grade A occupied stock rose by 0.1 per cent, while Grades B, C and D all saw declines—down 0.5 per cent, 0.3 per cent and 0.4 per cent, respectively.”

Property Council chief executive Mike Zorbas said the slew of new office supply during the past few years was part of a refresh of office spaces in our cities.

“We have seen a year-and-a-half of positive demand for office space, with more businesses taking up office space than leaving behind,” Zorbas said.

“Tenants are capitalising on opportunities to occupy premium buildings in prime CBD locations, with premium space continuing to see higher demand levels than lower-grade buildings.”

Low supply and slightly negative demand drove a slight vacancy increase in non-CBD markets from 17.2 to 17.3 per cent. The overall Australian office vacancy increased from 14.7 to 15.2 per cent.

CBD vacancy change, six months to July, 2025