NOMINATIONS CLOSE SEPTEMBER 12 RECOGNISING THE INDIVIDUALS BEHIND THE PROJECTS

NOMINATIONS CLOSING SEPTEMBER 12 URBAN LEADER AWARDS

Resources

Newsletter

Stay up to date and with the latest news, projects, deals and features.

SubscribeMelbourne's office leasing action has surpassed the five-year average in the 12 months to September 2017, with an approximate 31 per cent increase representing a total 400,053 square metres of leased floorspace.

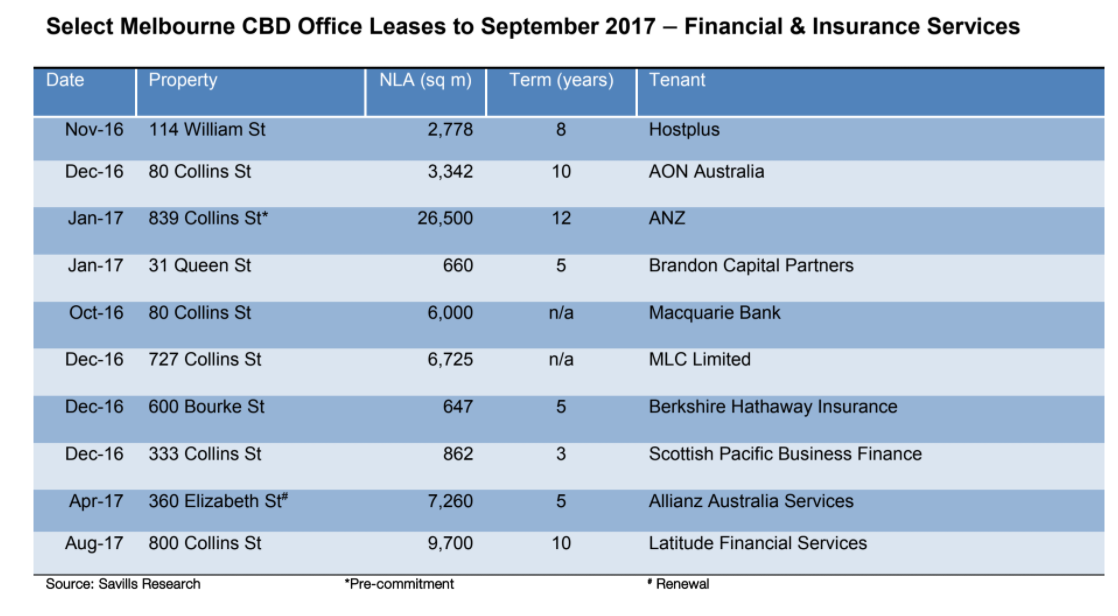

According to the latest Savills research, the finance and insurance services sector absorbed 76,631 square metres of the total space, 87 per cent of which was prime grade.

Finance and insurance leasing was in fact the highest it has been in five years -- up by 110 per cent over the past 12 months.

Associate director of research Monica Mondkar said another major triumph for the sector was securing a position amongst the top three occupier categories in the CBD after a five year period.

"Demand from the financial and insurance sector has finally turned a corner, which has previously been contracting since September 2010," she said.

"Australian Bureau of Statistics counted financial services at 9 per cent of GDP, the largest share by industry type in the national context, which is also a historical high for the sector.

"Financial services’ GDP contribution has even surpassed housing and the construction industry and now really is the leading economic driver, creating a lot of wealth, a lot of growth and a lot of jobs."Mondkar said there was pent-up demand from financial planners upgrading or expanding their footprint into the CBD, profiting from a rise in the number of investors favouring alternative investments over the risk-free government bonds.

Savills director of office leasing Phillip Cullity said there were a number of factors behind the massive surge in financial sector leasing, including jobs and population growth in Victoria, lease expiries, staff retention and recruitment, and efficiency gains.

“The Financial services sector, in particular, has been proactive in taking advantage of market conditions, locking in rents and incentives before rents begin to rise considerably.

“Tenants now realise that, as they are in competition for the best young talent, they must offer modern accommodation that includes the latest building and technology services, meeting and fitness facilities, access to transport, childcare and cafes,’’ Cullity said.

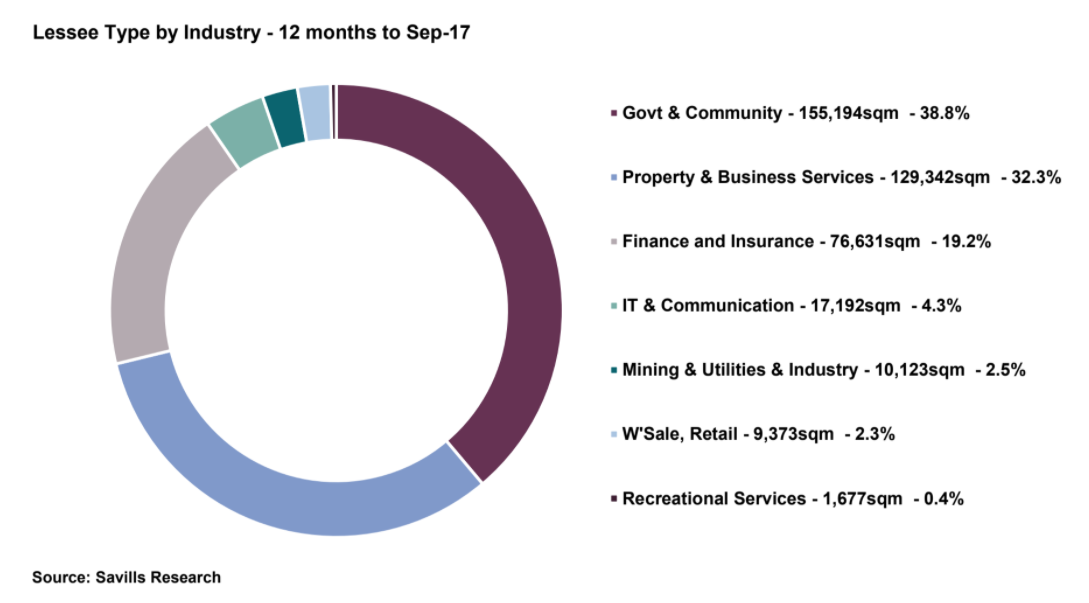

The make-up of Melbourne CBD’s occupiers is diverse with the government & community sector continuing its domination at 39 per cent, followed by property & business Services at 32 per cent and financial & insurance ranking the third largest sector by leasing 19 per cent.

“We can expect a number of significant leases to be concluded prior to the Christmas holiday period resulting from a strong pipeline of occupier requirements in the market," Cullity said.

Analysis revealed current tenant enquiries (above 500 square metres) measure about 250,000 square metres, all to be leased between the remainder of 2017 and 2018 in the CBD.

Mondkar said Melbourne's CBD’s net absorption in 2016 was 128,000 square metres which smashed the 10-year average at 76,000 square metres.

"With vacancy levels forecasted to fall further, outlook over the next 12–18 months is expected to be very positive," she said.

NAB’s monthly Business Conditions Index was at 14 points in September 2017 – almost three times the long-run average (+5). Victoria’s economy continues its drive with the strongest population growth in the nation and a major focus on jobs growth.

Growth in professional job advertisements in VIC (4.37 per cent) remained considerably higher than the 2.14 per cent national average. Professional job ads were consistently positive in Victoria over the last three years with job advertisements in August 2017 at their highest level since May 2012.

"This is clearly reflected in positive net absorption numbers in Melbourne CBD," Mondkar said.

"With growth in professional job ads still strong in the current quarter, it would be prudent to expect this to translate to continued CBD net absorption performance over the 2017-18 period."