No Magic Wand for Sydney, Melbourne Office Occupancies

Wellness rooms, business lounges, showers and change rooms, coffee giveaways, yoga and pilates classes, lease incentives, business grants, even laundry facilities—there seems no end to the lengths landlords and employers will go to get workers back to the office.

Despite their best efforts, two sets of figures released this week show the return to pre-Covid work practices remains slow, particularly in Australia’s two biggest cities.

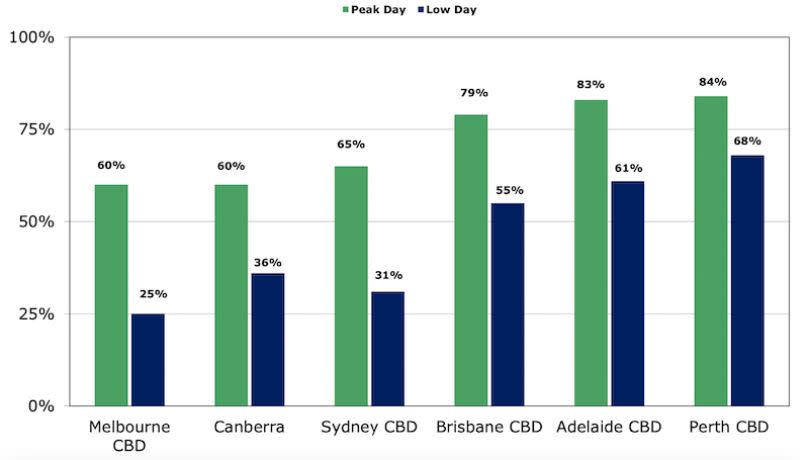

The Property Council of Australia’s latest office occupancy survey showed the number of workers returning to the office in the past month was up in most capital cities. Brisbane led the way with occupancy jumping from 57 to 70 per cent.

Adelaide increased from 71 to 78 per cent and Perth from 69 to 76 per cent.

The council’s chief executive Ken Morrison was pleased, saying they had expected to see office occupancy lift after the winter Covid wave subsided, “and that’s what we have witnessed in most capital cities around Australia.”

But Morrison acknowledged the results were “a lot lower in Melbourne and Sydney which has more lockdown disruption through the pandemic”.

Occupancy in Melbourne did rise, but from just 39 to 41 per cent while Sydney remained steady at 52 per cent. Canberra fell by 10 per cent to 54 per cent.

And all that in a week when research by global real estate giant JLL showed the national CBD vacancy rate in the September quarter remained unchanged at 14.1 per cent.

Peaks, low day occupancy levels

“It's what we would term a tenants’ market,” JLL director for office leasing Richard Norman said.

“The vacancy rate across the Melbourne CBD is broadly speaking around 15 per cent.

“And if you go back to March, 2020, when we were all living a normal life, the vacancy rate was a touch under 4 per cent.

“So there’s an ample stock out there for occupiers to consider.”

That view was echoed by the Reserve Bank of Australia last week in its latest financial stability review, which said the underlying tenant demand for CBD office property remains weak.

Norman said the corporate business community had generally returned to the office, which meant the eastern end of the Melbourne CBD was busy and felt like pre-pandemic days.

“But state government, major banks, major financial institutions, they've still more or less got a work from home order in place,” he said, and that meant areas like Docklands—with much bigger campus-style floorplates—were quieter.

In its own research, global commercial real estate brokers Cushman and Wakefield showed 550,000sq m of new and refurbished stock was added the Melbourne CBD over 2020 and 2021 combined, and another 60,000sq m in the first half of 2022.

Most of the stock expected in the market this year is refurbishment, and fitted-out speculative suites are providing the most activity according to Cushman’s office leasing team.

“We’re seeing a lot of landlords undertaking speculative fit-outs,” JLL’s Norman said.

“And that’s a bit of a risk, because you're going deliver a fit-out that you think the market will find appealing and want.

“The majority of building owners, particularly the savvy institutional-grade building owners know all-too-well they must continually invest in their buildings.

“Upgrading end-of-trip facilities, creating business lounges, bookable meeting spaces, introducing wellness rooms that every second day you might have a pilates or a yoga class, they might have coffee giveaways on particular day.”

Matthew Pollak, a director with Asia-Pacific-based tenant advisory service Tenant CS, agrees the practice is risky.

“I think eventually you'll be trying to fit square pegs into round holes,” he warned.

“I’m advising my clients when it comes to these speculative fit-outs to wait six months until those big suites are still sitting there vacant.

“And there’ll be new incentives on offer, over and above.”

Elsewhere, big corporations facing a staff reluctant to return to offices, have begun sub-letting space.

“Take Docklands,” Norman said. “Typically, you need to pre-commit to a Docklands building, and most of those are the major big banks, financial institutions, government, what have you.

“We’ve found a lot of those big corporate groups have rationalised space through sub-letting opportunities.”