Maturing Build-to-Rent Sector Readies 16,000 Units

The number of constructed build-to-rent units is set to double each year to 2025 as developers, backed by institutional investors, swoop on widening opportunities in the sector.

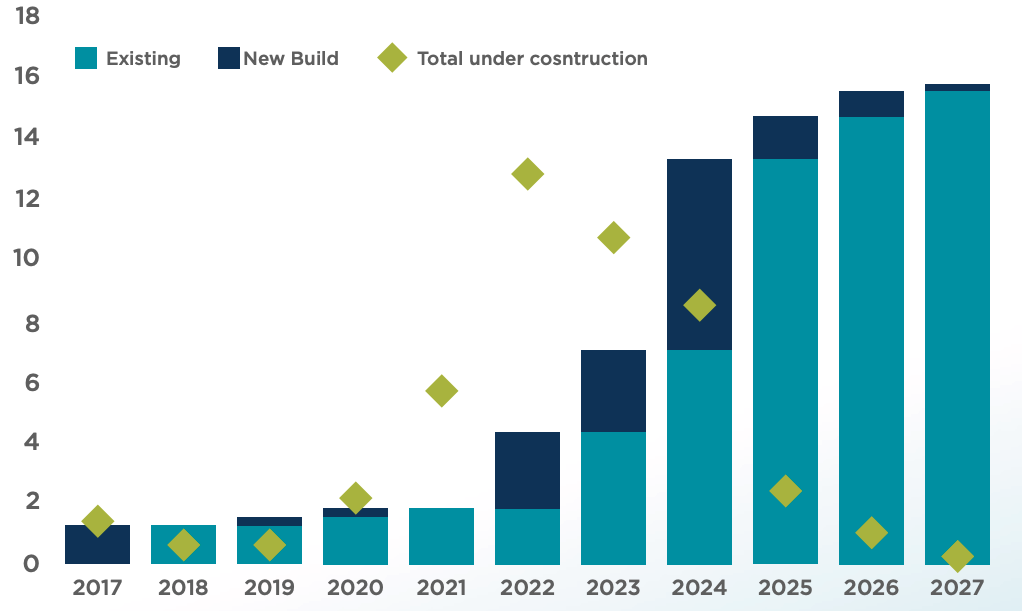

According to Cushman and Wakefield, the number of build-to-rent units will rise from 1800 in 2022 to nearly 16,000 by 2027, based on existing projects alone.

The now $9.6-billion sector was given a boost in 2020 by specifically targeted land tax reductions in NSW and Victoria.

Since then, 14 major institutional investors have rolled out plans for 40 build-to-rent projects across the country, representing 12,800 units and a combined value of $9.6 billion in projects under construction.

Cushman and Wakefield head of metropolitan markets Lukas Byrns said the nascent build-to-rent in Australia had reached a turning point and would likely play a key role in absorbing fundamental housing issues.

“We have witnessed a dramatic influx of investment into the build-to-rent sector since 2020 and a sharp increase in active groups,” Byrns said.

“They are typically backed by domestic and foreign capital and aiming to develop portfolios of up to 5000 units over the next five to seven years.”

“Population growth supporting tenant demand, higher rents increasing investor returns, and a significant amount of capital targeting Australian housing are all tailwinds for build-to-rent over the next decade.”

With the number of active groups in the build-to-rent market jumping from 12 to 35 since 2020, new developments are expected to add significantly to the construction pipeline as they are announced.

Less than 2000 units now exist across five projects in Queensland, Western Australia and New South Wales.

The most active area incorporates the CBD and inner portions of Docklands and Southbank, with seven advanced projects, comprising 2700 units, including those with plans approved, submitted or already under construction.

Melbourne currently has one completed project, Home Southbank at 256 City Road, which began operating at the beginning of May this year.

Number of BTR apartments built and under construction

^Source: Cushman and Wakefield

Major existing developments in Victoria include Assemble building nine projects encompassing 3600 units, LIV Mirvac’s three projects providing 1500 units and Home delivering 1600 units.

US powerhouse Greystar is also pressing ahead with the country’s largest build-to-rent project yet, a $500-million facility at upmarket South Yarra in Melbourne’s inner east, while Investa, alongside partner Oxford Properties, is targeting 5000 apartments.

Other players in the sector include US platforms Sentinel and Hines as well as Meriton, Gurner, Altis, Blackstone, Live Local, Samma Property Group, Novus and Alt Living.

Cushman and Wakefield metropolitan markets director Marcus Neill said Australia’s population growth will support demand for at least 300,000 rental units by 2029, which will positively impact the build-to-rent market.

“The number of constructed units is set grow nearly tenfold over the next five years,” Neill said.

“Victoria is currently the epicentre of build-to-rent and we expect it to play a key role in absorbing fundamental housing issues.”

Obstacles remain though for developers operating in the build-to-rent sector, including a lack of federal tax concessions, rising construction and land costs, and a lack of financing transactions occurring to date.

As it stands, a build-to-rent developer will still incur a 10 per cent GST on the development whereas build-to-sell developers can claim GST credits on land and construction costs.

Financing for build-to-rent development has also been scarce, likely a result of the infancy of the sector in Australia with the historical data banks use to price risk is essentially non-existent.