Lendlease Plots Morningside Flexi-Shed Development

Lendlease has filed plans with the Brisbane City Council for two large flexible sheds and nine smaller tenancies on a 3.4ha flood-prone site at Morningside.

The vacant site at 50-80 Manton Street backs on to Perrin Creek in the predominantly industrial precinct, which includes two Dexus assets.

The two larger Sparc-designed sheds are at the back of the irregular-shaped block, with the smaller offerings taking out the remainder of the block.

Place Design Group’s town planning report outlines the connectivity of the site within the Australia Trade Coast area.

“The land parcel is situated in proximity to Lytton Road, which provides convenient connection to the Gateway Motorway, Port of Brisbane and Brisbane Airport,” the report said.

“Surrounding land uses are characterised by wholesale, storage and industrial processing activities.”

The two flexibly designed large warehouses have a gross floor area of more than 5700sq m, while the smaller warehouse tenancies ranged from 341sq m to 863sq m of gross floor area.

According to RP Data, Lendlease acquired the site in May 2019 for about $25 million.

Lendlease’s Australian Prime Property Fund Industrial is a core, unlisted wholesale trust, which comprises assets in land-rich infill locations with last-mile logistics growth potential.

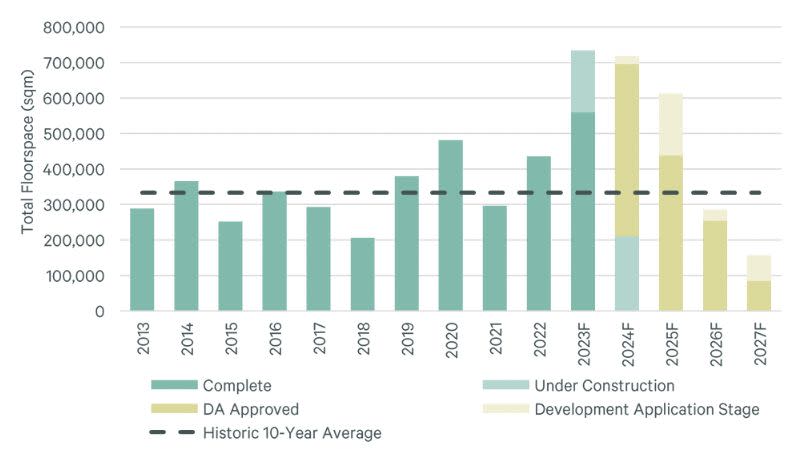

Brisbane industrial supply pipeline

The fund’s strategy is to provide well-located warehousing and logistics solutions to satisfy the growing demand for improved fulfilment and last-mile distribution facilities.

While the global developer signalled a move into an investment-led focus in its end of year results, the resilient industrial and logistics market continues to fire.

Brisbane’s industrial sector is experiencing high pre-leasing activity off the back of strong speculative development which is being rapidly absorbed, according to the latest CBRE data on the river city.

Gross take-up for the 12 months to September 2023 was 895,500sq m, well in excess of the 10-year average of 545,000 square metres.

Brisbane has an extremely low vacancy rate in industrial floor space of 0.6 per cent, and CBRE is forecasting strong pre-leasing deal for the remainder of 2023.

The town planning report said the proposed warehouse development featured articulated and low-maintenance building materials and sat within the 15m height limits.

“The proposed plans designed by Sparc Architects represent a high-quality industrial outcome in terms of built form, siting and massing,” the report said.

“The buildings incorporate small office components which provide openings to soften the scale of development.”