Housing Key Driver in 2024 Inflation High: ABS

Australia’s unrelenting house price growth is a leading cause of the nation’s inflation problem, according to the latest data from the Australian Bureau of Statistics, which could signpost a rate hike on August 6.

Inflation was recorded at 4 per cent in the 12 months to May, up from 3.6 per cent in April, and 20 basis points above economists forecasts for the month.

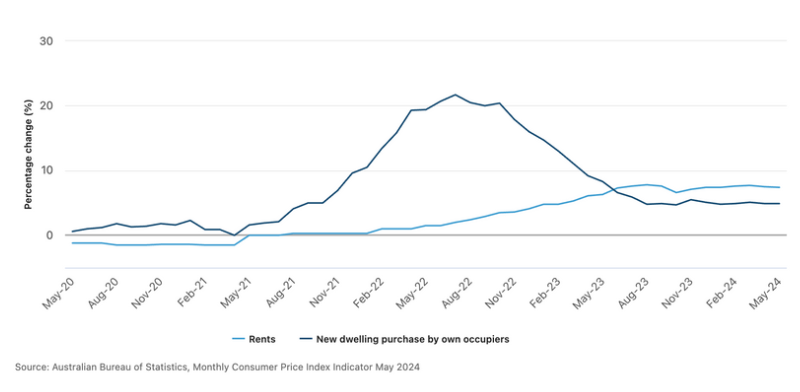

Housing rose 5.2 per cent in the 12 months to May, up from 4.9 per cent in April, while rent prices increased 7.4 per cent for the year.

ABS head of prices statistics Michelle Marquardt said the rise in new home prices had remained steady at 4.9 per cent, while builders were passing on the higher costs of labour and materials.

“CPI inflation is often impacted by items with volatile price changes like automotive fuel, fruit and vegetables, and holiday travel,” Marquardt said.

“It can be helpful to exclude these items from the headline CPI to provide a view of underlying inflation, which was 4 per cent in May, down from 4.1 per cent in April.”

New dwellings and rents, annual movement [%]

Speaking at the Australian Banking Association Conference in Melbourne today (June 26) Reserve Bank of Australia assistant government Christopher Kent said the central bank was “not ruling anything in or out” when it came to interest rates.

“The tightening in monetary policy over the past two years is underpinning restrictive financial conditions in Australia,” Kent said.

“This is contributing to slower growth of aggregate demand, thereby helping to bring the level of demand into better balance with supply and lower inflation.

“While recent economic data have been mixed, they have reinforced the need to remain vigilant to upside risks to inflation.”

Master Builders Australia chief executive Denita Wawn said the latest monthly inflation data demonstrated serious action was needed to bring down building costs and increase housing supply.

Wawn said the Australian Bureau of Statistics also released engineering construction data today that showed a decline in the volume of work, the first in two years.

“Inflation is a capacity killer, making investment more expensive and less attractive,” Wawn said.

“If we don’t get inflation under control and urgently start boosting housing supply we are in for a lengthy period of pain and depressed construction activity.”

Canstar financial services group executive Steve Mickenbecker said a cash rate hike could still be on the horizon in 2024.

“The increase in the CPI Indicator will have the Reserve Bank moving towards the starting blocks and readying to fire the interest rate increase gun, just as the men line up for the 100m final in Paris, presuming that June quarter inflation reflects the same trend,” Mickenbecker said.

“The Consumer Price Index (CPI) rose 1 per cent in the March 2024 quarter from 0.6 per cent in the December 2023 quarter and a further rise, or even a failure to fall, in the June quarter will test the Reserve Bank’s patience.

“With scant evidence that inflation is moving towards the target band, the Reserve Bank will feel uncomfortable waiting a further three months for the following release of quarterly CPI, and will surely lift rates in August. The risk of baked-in inflationary expectations is too high.”