How Much of the Market Can Your Income Buy?

Housing affordability is becoming an increasingly pressing concern through 2021, as dwelling values continue to rise and first home buyer activity has started to decline.

Through April, national dwelling values increased by 1.8 per cent, which is six times the average monthly movement in property prices for the past decade.

Adjusting the median dwelling value in Australia for this monthly uplift suggests the typical home price rose $11,240 in the space of a month.

With such rapid increases, just how much of the housing market is still attainable for buyers?

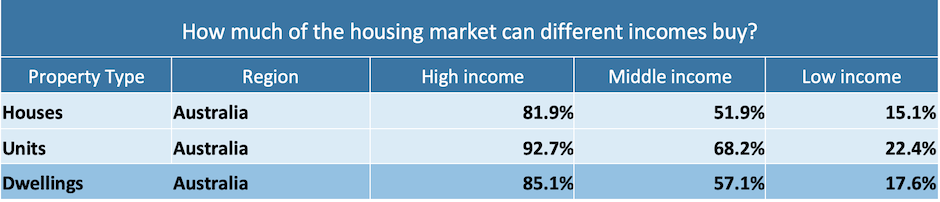

Unsurprisingly, high-income earners have the advantage in the buyer pool, with CoreLogic data suggesting high-level income earners could afford to purchase at least 85.1 per cent of Australian dwellings as of May 2021.

This includes almost 93 per cent of Australian unit stock, and 82 per cent of houses.

Middle-income households could attain 57.1 per cent of residential properties, and low-income earners could pay for up to 17.6 per cent of all Australian dwellings based on income.

To conduct this analysis, household incomes modelled by the Australian National University (ANU) Centre for Social Research and Methods were used. These included low (25th percentile) middle (50th percentile) and high (75th percentile) income estimates to September 2020, which amounted to weekly income estimates of $905, $1654 and $2,760 Australia-wide.

An estimate of borrowing capacity at these levels was made, based on a 30-year loan term with an interest rate of 2.44 per cent, and repayments based on a 30 per cent share of income.

A 20 per cent deposit was added to that borrowing capacity to determine an affordable purchase price at different income levels. These purchase prices amounted to $376,041, $685,723, and $1,144,715.

From here, CoreLogic valuation estimates were used to determine what proportion of properties fell under these purchase thresholds. No fees or additional transaction costs were factored into the analysis.

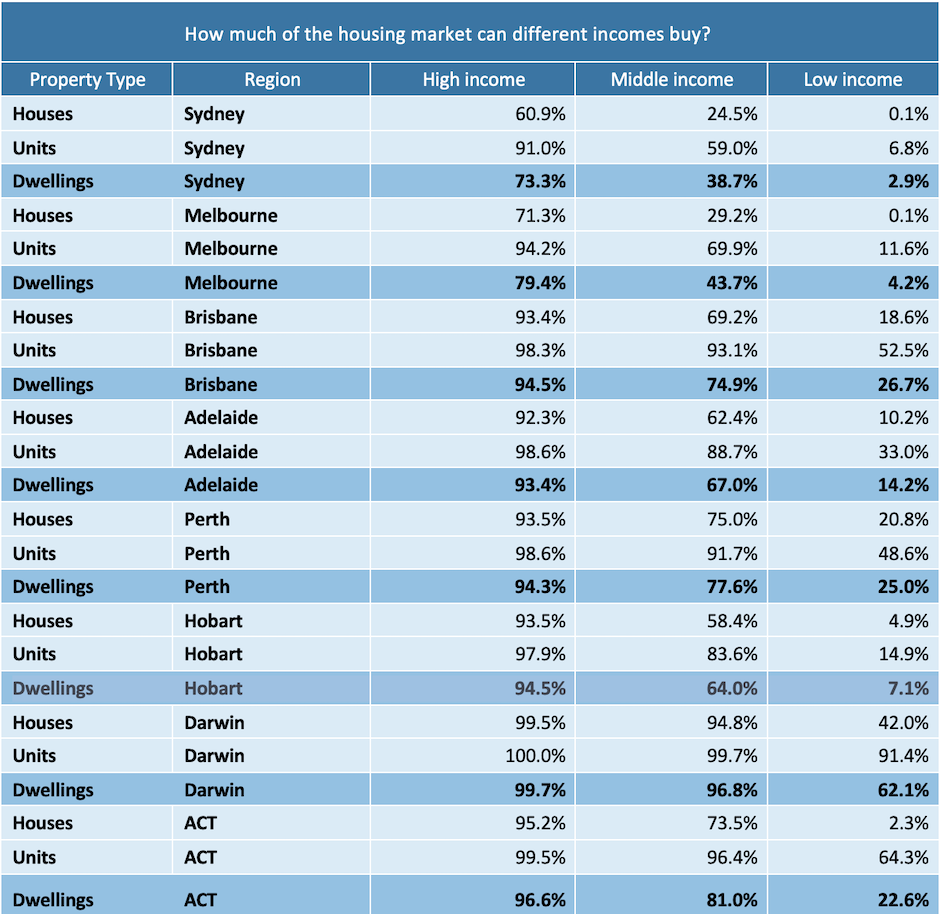

The table on page 2 lists the portion of properties that could be purchased at different income levels across the major capital cities.For the capital city data, income levels and purchasing capacities have been altered based on ANU estimates for these regions.

For example, the median household income across Sydney is estimated to have purchasing capacity for 24.5 per cent of houses, and 59.0 per cent of units in the Greater Sydney region.

Income alone is not enough

This dataset highlights pockets of strained affordability for Australian households, particularly at the lower end of the income spectrum and across larger cities like Sydney and Melbourne.

Yet through price surges in the past 12 months to April, sales volumes have risen an estimated 22.6 per cent.

The latest Survey on Housing and Income data suggests the majority of respondents own their home. Purchasing opportunities do not always dwindle when prices rise; it is just that income and savings alone is increasingly not enough to purchase property.

ABS lending data suggests the largest pool of buyers in the market now (at around 51.6 per cent of secured housing finance for purchases in March), are non-first home buyer owner-occupiers.

In other words, much of the buyer pool are those who are upsizing, downsizing or moving to another home.

For these buyers, it is not income alone that enabled purchasing, but the sale or equity of an existing home that creates greater purchasing power.

This is likely to be the case for most non-first home buyer owner occupiers, where the latest statement of monetary policy suggested around 98.7 per cent of existing home loans were in a position of positive equity.

This is one of the reasons first home buyers are far more sensitive to price changes, and the latest ABS lending data suggests financing for first home buyers has declined by 4.8 per cent during the past two months.

Another reason is that as prices increase faster than incomes, it is harder to accumulate a deposit, where our analysis assumes the buyer has a 20 per cent deposit

The past few housing booms in Australia have also given rise to terms like ‘rent-vesting’, ‘the bank of mum and dad’ and ‘fractional investing’, which highlight alternative methods first home buyers have turned to in order to access the housing market as prices rise.

Despite these alternative measures, 2021 is likely to see a decline in first home buyer numbers.