Hotel Investors Hold On to Assets

Hotel investors are likely to hold onto their assets and wait for the market to settle after Covid-19 according to a new hotel sentiment survey.

New hotel listings in the near term were least likely in Melbourne and Adelaide while liquidity is on the rise in places like the Gold Coast, Darwin and Cairns.

This was in line with expectations for initial yield, which were the strongest in Darwin, Cairns, Gold Coast and Hobart above the Australian average at 6.79 per cent.

The three largest hotel markets, Sydney, Melbourne and Brisbane had the lowest expectations for yield.

According to the Colliers International survey the lost income from bookings will have an impact on hotel capital values and by the end of 2021 two-thirds of investors think values will fall by between 0 to 20 per cent.

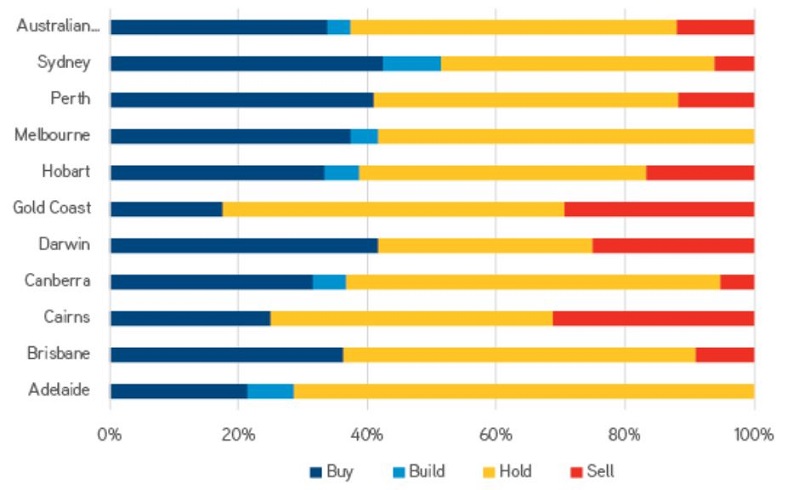

Short term investment intentions in the hotel sector

^Source: Colliers International Australian Hotel Investor Sentiment Survey

The report showed although sentiment had drastically improved, when compared to results in April, most investors would use a “wait and see” strategy in the next six months.

“More than one third say their primary investment activity will be to buy, indicating the Australian hotel transaction market is expected to head up towards the end of 2020,” the report said.

“Reflecting this, buy intentions are highest for Sydney (42.4pc), Darwin (41.7pc) and Perth (41.2pc).

“Sell sentiment recorded little change over the past couple of months at 12.0 per cent and is highest for Cairns and the Gold Coast.

“Build sentiment remains low at 3.6 per cent and is expected to remain so while uncertainty prevails.”

Related: Domestic Travel May ‘Fully Replace’ International Tourism

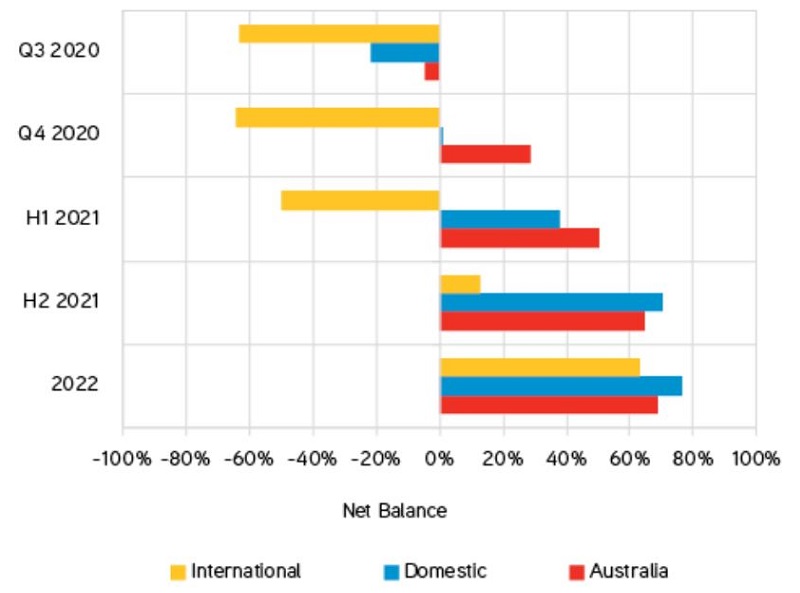

Investor trading performance expectations for hotel sector

^Source: Colliers International Australian Hotel Investor Sentiment Survey

Looking forward sentiment for trading averaged at -4.9 per cent in the third quarter before improving at the end of the year to 28.8 per cent.

The sentiment had improved markedly across all capital cities since the Covid-19 peak in April however Melbourne lagged behind.

Overall the hotel survey showed investors expected conditions would generally improve in the sector providing the country could contain the virus.

Improvements would continue into 2021 domestically before international tourists returned in the second half of the year.

However more domestic tourists were expected to drop booking in 2022 as there would be a “pent-up demand” international travel.