HIA Lays New Home Sales Slump at RBA’s Feet

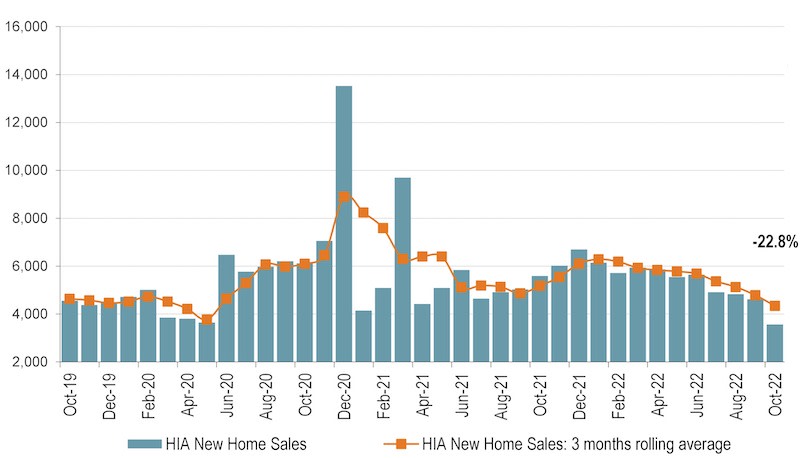

Sales of new homes fell by 22.8 per cent in October as the weight of increases in the cash rate slows building activity, according to the HIA.

The HIA New Home Sales report, a monthly survey of the largest volume home builders in the five largest states, showed that sales fell sharply in all regions for October, HIA chief economist Tim Reardon said.

“Sales of new homes had already fallen 15.8 per cent nationally in the three months to the end of September, due to the increases in the cash rate starting in May 2022,” he said.

“The increase in interest rates is compounding the rise in the cost of new home construction and further reducing the capacity of borrowers to finance the build of a new home.”

For the three months to October 2022, compared to the previous three months, new home sales in Queensland were down by 31.9 per cent, Victoria down by 22.8 per cent; NSW by 19.6 per cent; and WA by 9.1 per cent.

South Australia had the only increase, up by 13.9 per cent per cent.

Private new house sales, nationally (seasonably adjusted)

“Despite the fall in sales during the past four months, there remains a significant volume of home building under way, and many homes still to commence construction. This will ensure that work on the ground remains strong through 2023,” Reardon said.

“But it is very clear, even before the October and November increase in the cash rate start to impact on sales, that this building boom is coming to an end.”

The full effect of the November 2022 increase in the cash rate was not likely to flow through to new home sales fully until next June, Reardon said.

He said the consequence of the fastest increase in the cash rate in almost 30 years would cause detached home building activity slow to its lowest level in a decade by 2024.

“If the RBA doesn’t ease the cash rate in 2023, the Federal government’s goal of building a million homes in five years will be very difficult,” he said.