Sydney House Prices Fall as National Growth Conditions Remain Flat

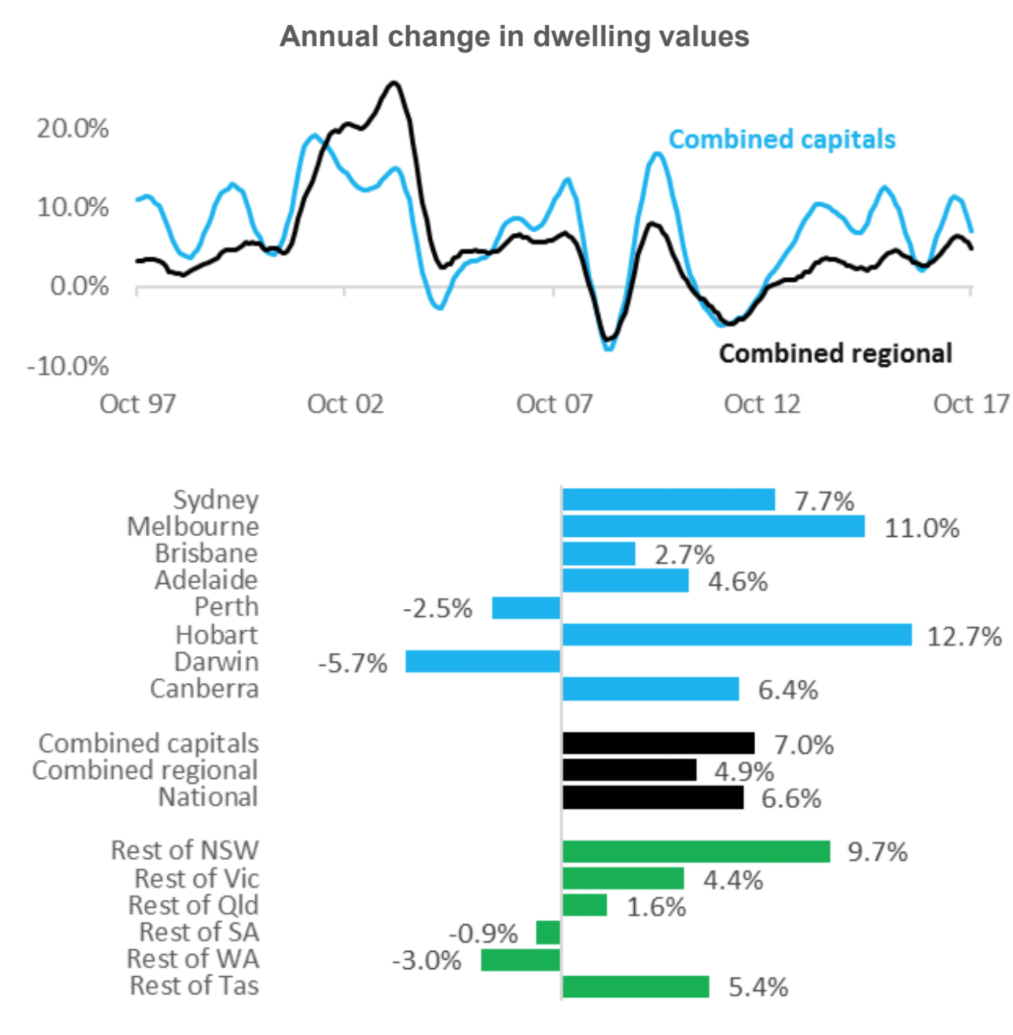

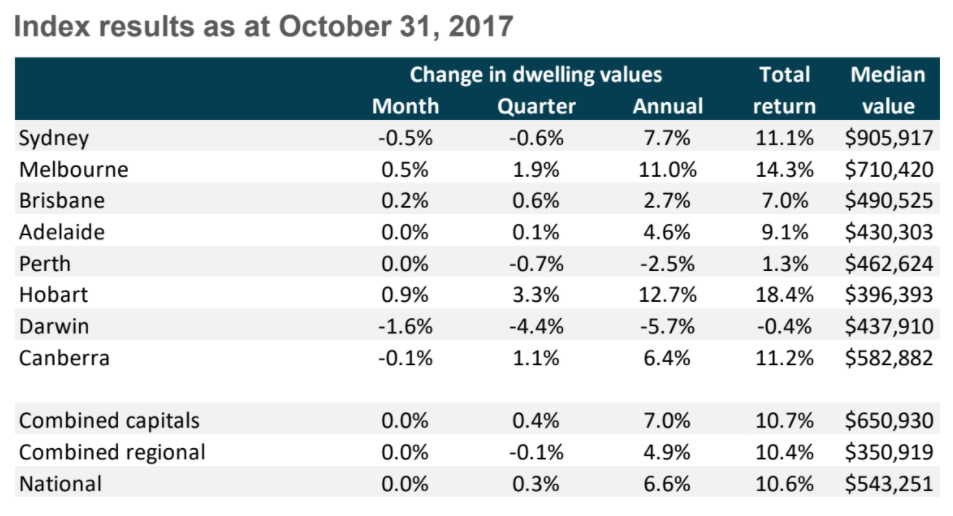

Since moving through a peak rate of growth in November 2016, capital gains across Australia’s housing market have been losing momentum, with national dwelling values unchanged over the month of October.

Sydney has joined Perth and Darwin as the only capital cities to experience a drop in housing prices -- with growth conditions remaining flat across both the combined capital cities and the combined regional areas of Australia.

CoreLogic head of research Tim Lawless said the slowdown in the pace of capital gains can be attributed primarily to tighter credit policies which have fundamentally changed the landscape for borrowers.

[Related reading: Slowing Housing Market More Pronounced In Sydney Than Melbourne]“In fact, the peak rate of growth in dwelling values lines up closely with the peak growth rate for investment lending in late 2016. We saw the housing market respond in a similar fashion through 2015, and the first half of 2016 as investors faced tighter credit conditions following the announcement from APRA that lenders couldn’t surpass a 10 per cent speed limit on investment lending.

“Of course, housing market conditions rebounded swiftly through the second half of 2016 once the investment related credit limits were achieved and the cash rate was adjusted lower in May and August last year,” Lawless said.

Despite the recent downshift in values, Sydney dwelling values are up 74 per cent since the growth cycle commenced in early 2012.

Melbourne conditions remained resilient relative to Sydney -- dwelling values were 0.5 per cent higher over the month to be up 1.9 per cent over the rolling quarter. Lawless attributed this resilience to Victoria’s record breaking migration rate, which is creating unprecedented housing demand.

“Despite the stronger growth profile, Melbourne dwelling values are now rising at their slowest quarterly pace since mid-2016,” Lawless said.

[Related reading: Melbourne’s Apartment Market Forecast Not So Bleak]Hobart continued to be the strongest capital city, with dwelling values pushing 0.9 per cent higher in October, to be up 12.7 per cent over the past twelve months.

The trend in Brisbane and Adelaide has remained relatively subdued, with Adelaide dwelling values unchanged in October, while Brisbane values were only 0.2 per cent higher. On an annual basis, dwelling values are only 2.7 per cent higher across Brisbane and 4.6 per cent higher in Adelaide.

Perth dwelling values moved sideways over the month, however the annual rate of decline has slowed from -4.9 per cent in August last year to -2.5 per cent over the twelve months ending October 2017.

The trend in Darwin hasn’t been as encouraging, with values slipping -4.4 per cent lower over the past three months to be down -5.3 per cent over the past twelve months. The correction across Darwin’s housing market surpassed 20 per cent since values peaked in May 2014.

Some cities, such as Brisbane, Adelaide, Darwin, Canberra and to a lesser extent Melbourne, showed a substantial performance gap between houses and units.

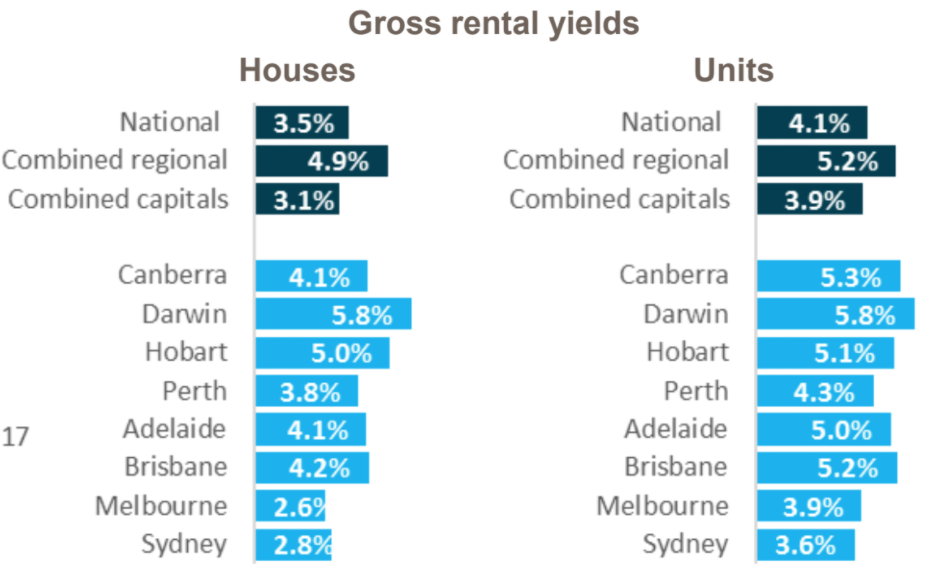

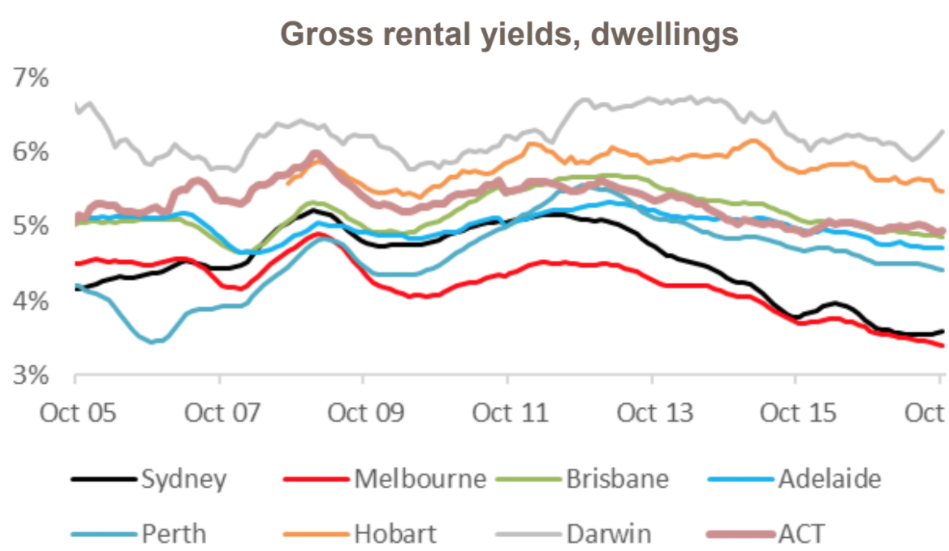

While the pace of capital gains has slowed across most regions, some momentum is gathering across rental markets, however, rental growth has not been high enough to reverse the downwards trend in yields. The national annual pace of rental growth has lifted from 0.9 per cent a year ago to 2.8 per cent over the most recent twelve month period.

Considering national dwelling values were 6.6 per cent higher over the past twelve months and rents rose by 2.8 per cent, yields have compressed further over the past year and generally remain at or close to record lows in most cities.

Gross rental yields across Melbourne remain the lowest of any capital city, with the typical dwelling attracting a gross yield of 2.89 per cent (record low) which is 20 basis points lower than a year ago. To provide some context about why rental yields have compressed so much, over the growth cycle to date, Melbourne dwelling values are up 58 per cent while weekly rents have only increased by 15.5 per cent over the same time frame.

Outside of the capital cities, the regional area of New South Wales is showing the strongest growth conditions. Dwelling values across regional New South Wales are now outperforming Sydney, with values up 9.7 per cent over the past twelve months. The strong regional growth is being led by the Newcastle and Lake Macquarie region. Regional Tasmania recorded the second highest annual capital gain at 5.4 per cent followed by Regional Victoria as 4.4 per cent.

Regional Western Australia (-3.0 per cent) and regional South Australia (-0.9%) were the only "rest-of-state" areas to record a fall in dwelling values over the past year, while regional Queensland dwelling values were up 1.6 per cent and regional Northern Territory saw values rise 1.3 per cent.

Financial markets have pushed expectations for a cash rate hike out to early 2019, which implies that mortgage rates aren’t likely to rise materially over the foreseeable future.

“With household debt at record highs, higher mortgage rates would test already stretched household balance sheets," Lawless said.