From Doom to Boom: Make Opportunity from Adversity with Residential Investment Property

The residential investment property market is under stress. It has desperately needed a new product, and major revamp, for some time.

Out of this adversity the Property Collect team are preparing to snap up great buys in strategic areas for investors to profit.

Property Collect has their residential investment trust registered with ASIC and their responsible entity and other compliance structures in place. They are ready.

"I think Property Collect will revolutionise the residential investment property market," veteran property director and Property Collect founder Tim Wright said.

"Our BuyPower and BuildPower products are innovative, simple and the way of the future."

With the Banking Royal Commission putting pressure on residential housing prices and APRA's lending curbs stymying investor loans – the time is ripe for Property Collect.

When the right properties are uncovered, Property Collect wants to be "poised to strike".

"We are all about research and value for our investors," Wright said.

The Property Collect team has a mission to raise Australian investment property ownership from the current 1.9 million people today to 2.5 million people over a 5-year period.

"In this financial climate, residential property investors need to look at property in a whole new way.

"With record levels of personal debt and the financial burden now placed on property investors, it is becoming increasingly difficult for first time and repeat property investors to get into the market.”

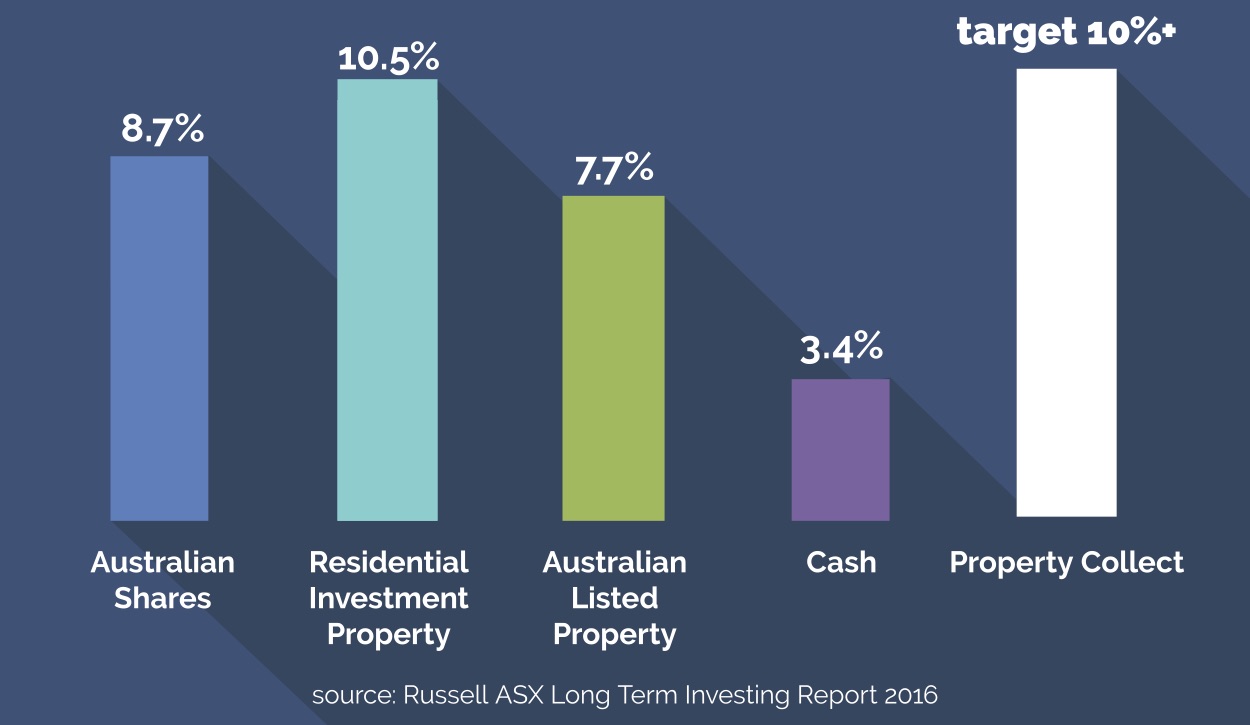

Wright says the new "collective investment" model has strategic advantages over traditional property syndicates.

"With lower barriers to entry, safer exit structures, improved investor liquidity and a refined investment formula for returns, the Property Collect syndication program will be the first of its kind in Australia."

"There is no longer any reason smaller investors should be left out of the property market."

Wright says that the pool of residential property investors in Australia with cash availability between $20,000 to $80,000 was far larger than those who had more than the $90,000-plus required to purchase their investment property, and hence an alternative "bricks and mortar" investment solution was necessary to allow people to experience the benefit of residential property investment.

Property Collect allows investors to buy into a Property Collect investment trust with as little as $20,000.

Property Collect’s vision is for all investors to experience the security and wealth generating potential of residential property investment without having all the hassles associated with outright residential investment property ownership.

12 key facts about Property Collect

1. Property Collect offers investment into a simple, diversified residential investment trust.

2. Property Collect pre-negotiates the purchase of brand new residential properties or develops brand new residential properties – to be held in its investment trusts – for collective residential property investment.

3. With Property Collect "Buypower" Syndicates – Property Collect purchases properties directly from property developers.

Property Collect cuts out the middle men, and is able to rebate 100 per cent of the agents commission back into their trust for the collective investors. The collective investors then own these properties at a "wholesale" price.

4. With a Property Collect "Buildpower" syndicate – Property Collect develops brand new residential properties and does not take any development margin.

The newly-built properties are then collectively owned by the investors at a "cost" price.

5. All properties that are purchased (Buypower) or developed (Buildpower) are collectively owned by the investors in the syndicate for residential property investment.

Owners receive potential rental income and capital growth of the properties in the syndicate over the life of the trust, proportionate to their financial share within the total value of the trust.

6. Property Collect aims to borrow 50 per cent of the total value of the properties they intend to purchase or develop, from a lender (bank), and raise the other 50 per cent through its comprehensive investor database.

7. Once funds are raised to allow Property Collect to buy the properties they have negotiated to purchase, or to develop the project they have proposed – the collective investors who invested into the trust will then collectively own these properties together once purchased (settled) or built.

8. These properties are rented out in an identical manner as any other residential investment property. These properties are not classified as affordable housing.

9. Importantly, Property Collect is not a build-to-rent model or fractional ownership investment model. It is a collective investment syndication program.

10. The Property Collect board are made up of individuals with extensive practical and relevant experience across the fields of residential, hotel and commercial property development, capital raising, construction finance, property law, sales & marketing, management rights & property research.

11. There is a clear exit structure for investors, which will be outlined in detail in the Product Disclosure Statement (PDS).

Property Collect are able to sell off properties from within the trust throughout the lifespan of the trust to payout early redeeming investors.

12. A typical Property Collect investment trust has a lifespan of up to 10 years, at which point in time, all remaining properties left within the trust will be sold.

All sales proceeds will be used to repay any existing debt facilities over the properties, and also payout collective investors capital and return.

Property Collect is aggressively building it investor database so that they can be ready to finalise a PDS (Product Disclosure Statement) to purchase their carefully selected property.

Property Collect use independent specialist researchers as well as their own extensive knowledge of the residential property investment market, so investors can rest assured knowing they are in safe and experienced hands.

If you would like to receive further information to learn more about how Property Collect works, or to register to receive the upcoming product disclosure statement – you are encouraged to contact development director Adam Carter at adam.carter@propertycollect.com.au or visit the website for further information.

The Urban Developer is proud to partner with Property Collect to deliver this article to you. In doing so, we can continue to publish our free daily news, information, insights and opinion to you, our valued readers.