Resources

Newsletter

Stay up to date and with the latest news, projects, deals and features.

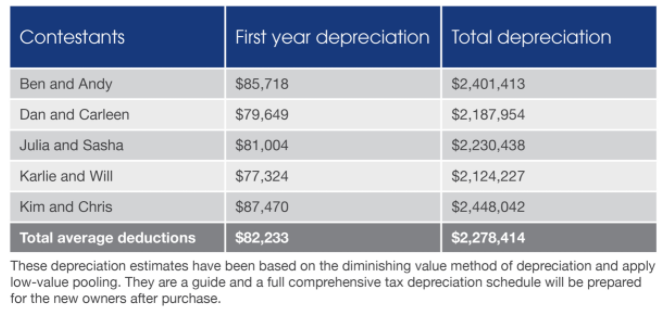

SubscribeAn analysis from Australia’s specialist depreciation schedule provider suggests that investors could claim an average of over $2.2 million in depreciation deductions for each apartment on Channel 9’s 2016 season of The Block.

Kim and Chris’s penthouse apartment has the highest amount of depreciation deductions available, with a first year deduction estimated to be at $87,470 and a total deduction estimated to be at $2,448,042 which can be claimed by the new owners, According to estimates provided by BMT Tax Depreciation.

Ben and Andy’s apartment at 4/164 Ingles Street, Port Melbourne, has the second highest depreciation deductions, with a total of $2,401,413 claimable over the lifetime of the property, according to BMT.

“As the property with the highest amount of total depreciation deductions available, Kim and Chris’s apartment may prove attractive to investors, particularly those who prefer their modern and contemporary styling” said Bradley Beer, Chief Executive Officer of BMT Tax Depreciation.

“While there are many factors that decide which apartment will achieve the highest price from buyers, the additional cash flow astute property investors receive from depreciation will assist them when crunching their numbers to make purchase decisions.

“While Kim and Chris appear to be the clear winners in terms of unlocked depreciation value - it’s a very close field,” said Mr Beer.

Following is a summary of the depreciation estimates BMT Tax Depreciation found for all five apartments:

The heritage art deco Port Melbourne property, formerly a Symex soap factory, was reportedly purchased by The Block’s production company for around $5 million. The building has undergone an extensive renovation on the show and when finished will be home to five luxury apartments.

Bradley Beer appeared on the show to share his expert knowledge with contestants regarding their properties' depreciation deductions.

Quantity surveyors are one of the few professionals recognised by the Australian Taxation Office as having the appropriate construction costing skills required to estimate building costs for depreciation.

Legislation allows the owners of any income producing property to claim depreciation deductions for the wear and tear of the building structure and the assets contained within.

“Despite the significant deductions investors are entitled to claim, research suggests that 80 per cent of property investors fail to take full advantage of property depreciation,” said Bradley Beer.

“Any property investor who doesn’t claim the maximum depreciation deductions available could be missing out on thousands of dollars in tax savings every year,” concluded Mr Beer.

The apartments will be auctioned Saturday November 12.