Millennial Cohort May Cushion House Price Falls

The pathway out of the coronavirus-induced housing correction may be reliant on the emerging millennial cohort, analysts say.

Speaking at The Urban Developer’s housing demand dilemma webinar, Corelogic head of research Eliza Owen and Charter Keck Cramer research director Rob Burgess discussed the new drivers for housing amid shifts in demand and demographics.

Since the onset of the pandemic, national values have fallen by 2 per cent, in line with past recessionary-induced downturns.

Tight lender credit and low sales volumes has also meant a strong housing recovery remains unlikely in the medium-term, even as prices have stabilised and sales increased in recent weeks.

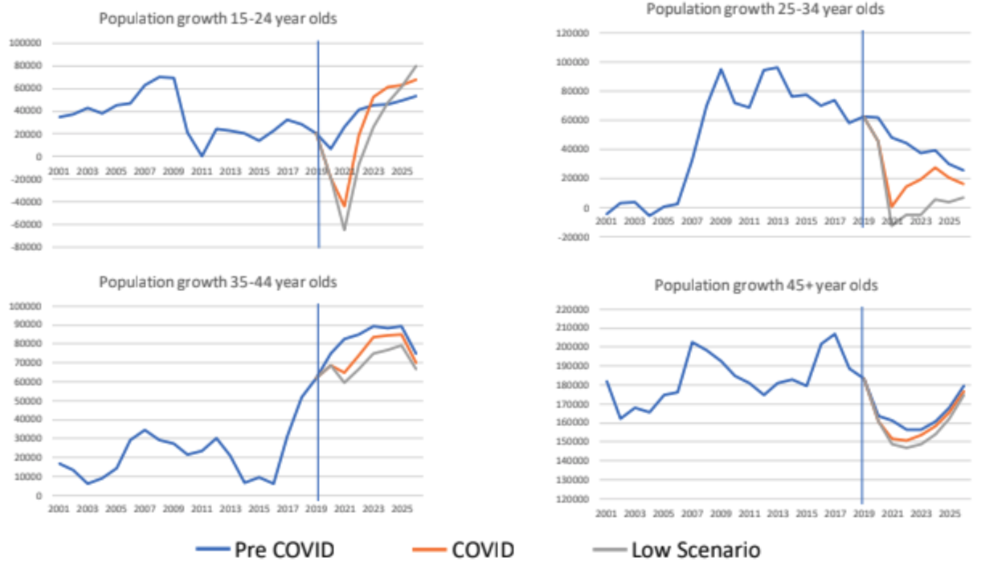

Population growth, traditionally a big driver of economic growth and housing construction, has contracted sharply as international travel restrictions remain in place.

“What we have right now are very significant ‘push and pull’ factors changing dynamics across the housing market,” Burgess said.

“In previous economic downturns immigration has fallen away, but what we are dealing with right now is an incredibly complicated scenario due to an uncertain global health issue weighing on the economy which has been overlaid by evolving political complexities.”

Soft economic conditions, limited regulator appetite for a credit rebound and nervous lenders have also contributed to a sluggish recovery.

Home ownership is also projected to fall despite the possibility of increased affordability brought on by the Covid-19 health and economic crises.

In July, official figures from the Australian Bureau of Statistics showed the average net worth, taking account of debt, for all households tipped over $1 million while the median wealth per household is almost half the headline figure at $625,000.

“The millennial cohort, who have traditionally been ‘couples with children’ looking for single detached dwellings at a median price point of $800,000 could be very important over the next few years,” Burgess said.

By 2025, Burgess expects 130,000 additional households to be absorbed by millennials—people born between 1981 and 1998, entering the market, with 40,000 in Sydney, just under 30,000 in Brisbane and over 60,000 bolstering Melbourne’s market.

“Unlike NSW or Sydney, Melbourne’s historical high levels of interstate migration will place it in high demand for the millennial cohort looking to break into the market,” Burgess said.

“While it is hard to understand locational preferences and the dwelling types these millennial’s will be targeting over the new few years, it is important to note that there could be flight from high-density locations with regional areas seeing increased levels of enquiry.”

Demographic shifts across Australia’s housing market

^Source: Charter Keck Cramer, factoring the federal government's position on overseas migration

The property market in Australia’s state capital cities have diverged since the onset of the coronavirus crisis.

While some cities continue to reel amid the market volatility, some have picked up relatively quickly thanks to a combination of economic and demographic factors, as well as state and local policies.

Since the end of August, home values in Brisbane and Canberra—locations which have been insulated from the drop off in migration and have seen low Covid-19 cases, have all started to recover.

There is also evidence of a significant deceleration in losses in Sydney while dwelling prices in Perth have also started stabilising.

Owen pointed to Adelaide as an investor market to watch pointing to the city’s strong rent yields across its unit market and low-dwelling price points for the city’s recent growth.

“Adelaide is a slow and steady market in terms of the asset, it hasn't really had a boom so it hasn’t been subjected to a bust,” Owen said.

“The pure stability in that market as a passive income opportunity might be very appealing for investors in the near future.”

Regional property markets, which have significantly outperformed city markets on average over the past year, have seen a recent surge in popularity due to more relaxed management attitudes to working away from the office since the Covid-19 shutdown.

“The normalisation of remote-working has made the proximity to work centres less of a decision in housing market purchases which continues to be advantageous to regional areas,” Owen said.

“While that is a long-term trend, it is important to remember in the short-term that cyclically the recession and downturn we are seeing will be playing out in regional areas as well.”

Government stimulus initiatives are also propping up home loan demand across smaller dwelling markets.

Many construction projects which had stalled in outer-city markets and regional locations have since been offset by the federal government’s Home Builder grant, where low price points and emerging infrastructure have converged.

The federal government unveiled the Home Builder grant in June to help stimulate the residential construction industry.

Eligible applications can access $25,000 through the scheme to build a new home or substantially renovate an existing one.

“One mitigating factor that could hamper regional growth is the fact that cities are now becoming less expensive now due to the downturn,” Owen said.

“I would expect to see some of these regional lifestyle markets experience price declines potentially by the end of this year or early next year.”