Eastern Seaboard Vacancy Rate to Remain as Supply Falls

Australia has experienced solid occupier demand for industrial space in recent years, particularly across the eastern seaboard with the average vacancy rate sitting around 3.8 per cent.

Demand for space in Queensland’s south-east industrial precinct remains strong, with vacancy rates 28 per cent lower than this time last year according to Stockland Logistics general manager Tony D’Addona.

The ASX-listed developer Stockland has recently completed stage two of its 9.6 hectare $70 million logistics development in Yatala, located between Brisbane and the Gold Coast.

The group secured three new 10 year leases at its Yatala distribution centre, securing more than 18,993sq m of the new facilities to Simtech Creations, Crimsafe Security Systems and OzWide Group.

In nearby Logan City, south of Brisbane, work has kicked off on a new $70 million industrial development, the M6 Connect, which will be developed on the final 10 hectares of a 100 hectare industrial land holding in Meadowbrook.

The site is owned by the Brisbane-based Hoare family, who has joined forces with advisory Development Directive on the Meadowbrook project.

Related: Adelaide Commercial Transactions Hit $2bn

In Melbourne's Truganina Stockland recently completed the a $44 million Key West distribution centre.

While Melbourne-based fund manager Quintessential Equity offloaded its industrial property in Noble Park for more than $14 million, selling on a 5.74 per cent yield.

The industrial and logistics sector also saw Singapore fund manager ARA Asset Management swipe a majority stake in the billion dollar Logos group this month.

Founded in 2010, Logos has a completed value of $8.9 billion across 17 projects, and operates across eight countries in the Asia Pacific region.

Strong occupier demand amid low vacancy

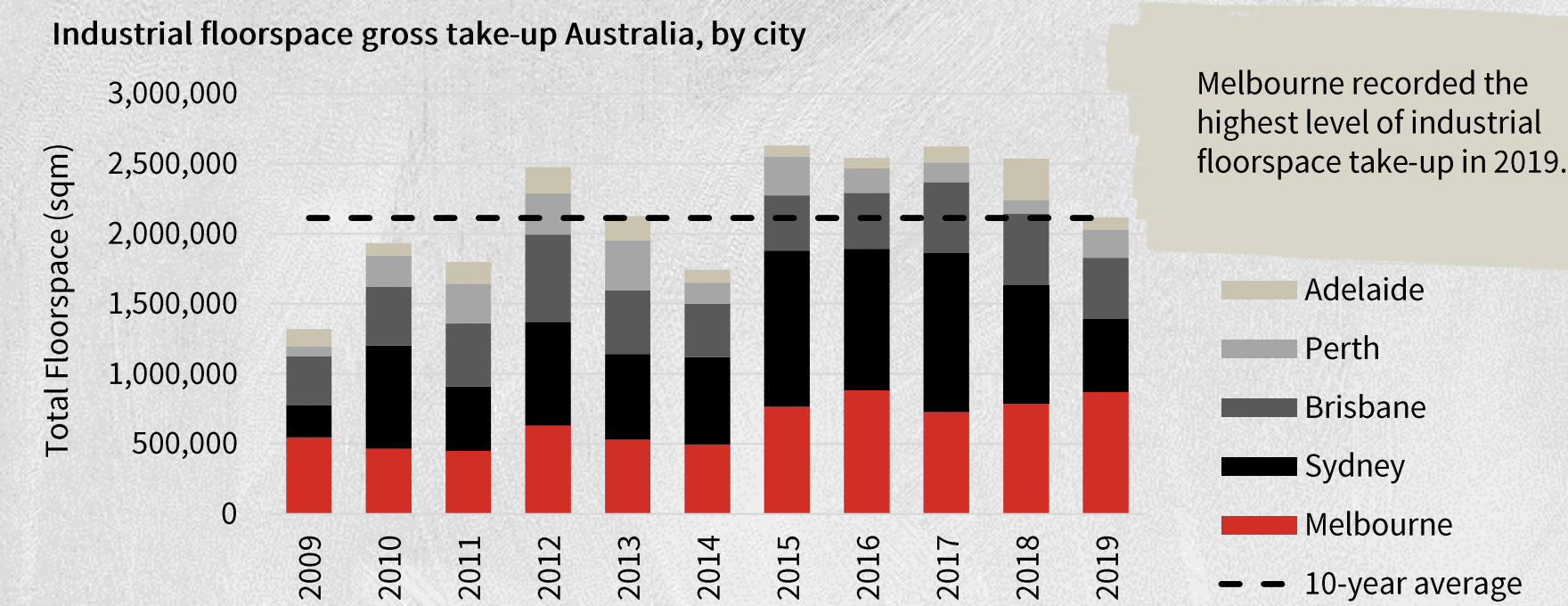

Australia’s industrial markets recorded solid levels of leasing activity last year, comparable to the 10-year annual average of 2.1 million square metres, according to the latest JLL findings.

“Over the year there was a notable increase in take-up levels within the Melbourne market,” JLL’s director of research Sass J-Baleh said.

“This represented the highest share of national take-up in 2019, at 40 per cent.”

The JLL report expects demand in the sector to continue - supported by domestic growth factors, such as population and non-discretionary retail growth, along with demographic changes, “mainly within the world’s emerging markets”, J-Baleh said.

“Although the 2020 development pipeline is comparatively high, around 50 per cent of this pipeline has already secured pre-commitment.”

“The eastern seaboard vacancy rate is expected to remain, if not further decline, over the short to medium run, as the supply pipeline begins to fall post-2020.”

Speaking on Western Australia’s market, J-Baleh says if the economy begins to rebound over the next year, Perth vacancy levels may also begin to decline.

“Which would in turn see Australia’s average vacancy rate fall below 5.9 per cent by the end of 2020, early 2021.”