Softer Rent Rises ‘More Than a Winter Lull’

There are signs the rapid rise in rents recorded during the first quarter of the year is easing.

According to Domain’s Rental Report for the June quarter, state capitals have experienced their weakest winter period since 2020 and 2021.

Nationally, rents declined by 3.2 per cent month-on-month and 11.1 per cent year-on-year.

While this kind of downturn is common for winter—and is especially noticeable after a busy rental start in the March quarter—the data reveals rental conditions are easing across the country.

In some capitals, rental prices have stalled while they have declined in others.

Across combined capital houses, the pace of quarterly rental growth was 1.5 times slower than during the March 2024 quarter.

The pace growth of house rentals halved in Melbourne and Brisbane; was seven times slower in Adelaide; stalled in Sydney and Perth; and declined in Hobart.

Meanwhile, unit rents in the combined capitals recorded a quarterly growth pace half that of the previous quarter.

Growth in Brisbane was three times quarter-on-quarter, while in Melbourne, Perth and Hobart growth stalled and it declined in Canberra and Darwin.

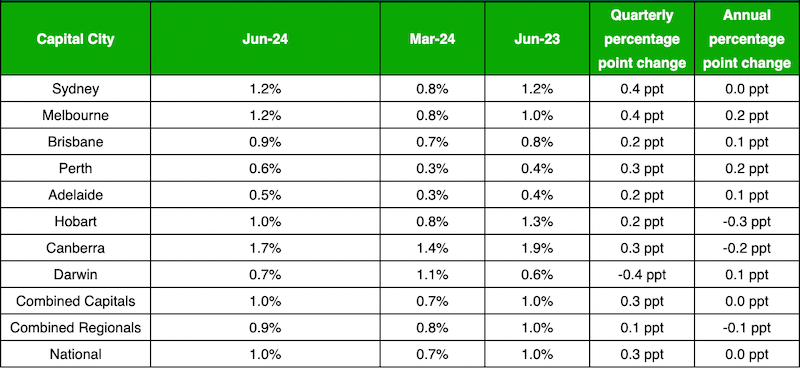

Slightly higher vacancy rates in the capitals helped this rent price easing, but they are still well below the ideal 2 to 3 per cent.

Nevertheless, the combined house and unit rates in Sydney (1.2 per cent), Melbourne (1.2 per cent), Brisbane (0.9 per cent) and Canberra (1.7 per cent) are a six-month high.

Perth (0.6 per cent) is experiencing a two-year high, Adelaide (0.5 per cent) recorded its highest point in two years and eight months, and Hobart is at a nine-month high with 1 per cent.

House and unit combined rental vacancy rates

Domain research and economics chief Dr Nicola Powell said the new quarterly figures were encouraging for tenants and she had hopes that the country’s rental market would continue to be more balanced in this financial year.

She said this was driven by several factors, including a rebalancing of supply and demand pressures, based on slowing rental growth, higher rental availability and a lessening of prospective tenants including those from overseas.

As well, Dr Powell said, investors were making a slow comeback into the market, accounting for nearly 36 per cent of new home loans—the highest level since 2018.

And increased first-home ownership was imminent, Dr Powell said, supported by government initiatives incluidng Queensland's doubled first-home buyer grant; the Federal Help to Buy shared equity scheme; and revised stamp duty concessions in the ACT, South Australia, Western Australia and Queensland.

“These measures aim to facilitate home ownership transitions and improve affordability, further alleviating rental conditions in Australia,” Dr Powell said.