NOMINATIONS CLOSE SEPTEMBER 12 RECOGNISING THE INDIVIDUALS BEHIND THE PROJECTS

NOMINATIONS CLOSING SEPTEMBER 12 URBAN LEADER AWARDS

Resources

Newsletter

Stay up to date and with the latest news, projects, deals and features.

SubscribeWhile confidence in Sydney’s apartment market is improving, a new report forecasts a “stabilisation rather than a rebound” in demand for new apartments, which are unlikely to bounce back as strongly.

The next cycle in Sydney’s apartment market will likely see developer focus shift towards owner-occupiers, says the latest JLL Sydney apartment market report.

“This will change the current residential pipeline to more mid-density, boutique properties with larger apartments,” JLL’s head of residential research Leigh Warner said.

When it comes to site sales, the report notes that developers are eyeing residential sites suited to boutique developments in preparation for the next cycle.

“Record low interest rates have not only seen demand for apartments increase, but interest in residential development sites as developers capitalise on the cheaper cost of borrowing to prepare for the next cycle of development,” Warner said.

“With owner-occupiers now largely becoming the focus of developers, sites suited for boutique residential developments are in demand.”

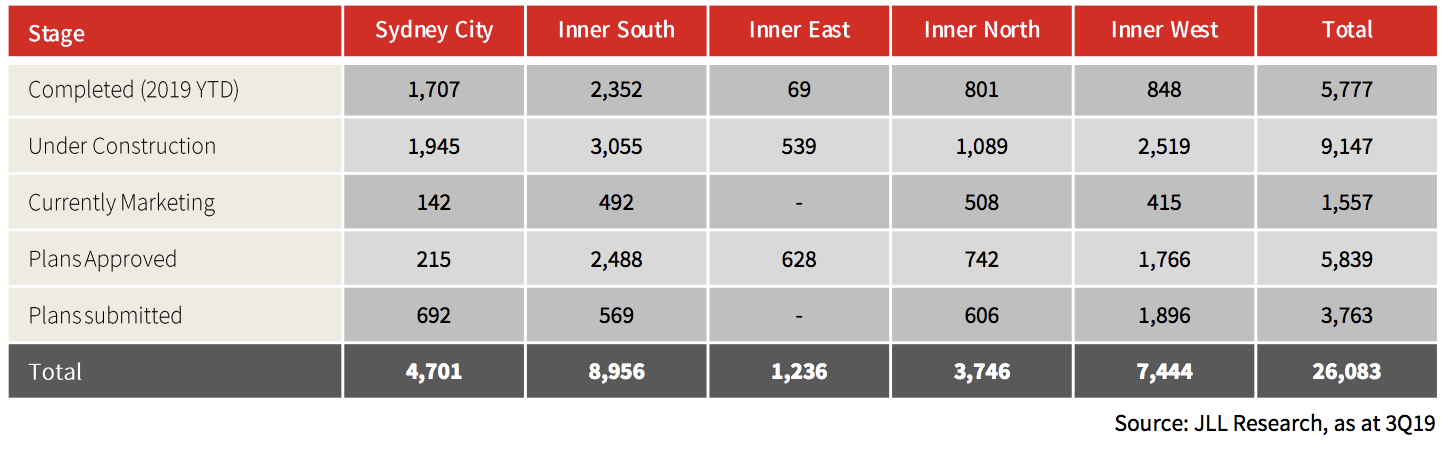

Supply Pipeline 2019 -2023 by stage and precinct

Sydney apartment completions this year are lower than 2018, while home financing commitments fell across the board over the year to August 2019.

The number of apartments under construction in the inner-city regions of Australia’s six major capital cities fell a further 5 per cent in the third quarter of 2019 to 37,500 apartments. This down 23 per cent over the past year and over 30 per cent from its peak, according to JLL data.

Related: Lendlease Wins Approval For Barangaroo Tower

In Melbourne, Warner expects strong population growth will help absorb new stock constructed predominantly concentrated in and around the CBD, as likely to be absorbed first.

“In comparison, Sydney’s construction cycle was much more decentralised and only reached a peak much more recently,” Warner said.

“As such, residual stock to be absorbed is more spread across the entire Greater Sydney area and will take a little longer to work through.

“The recent building defect issues have also affected buyer confidence in the market.”