Retailers Fight for Life as Shops, Wallets Reopen

An already tumultuous year is set to become even more challenging for the retail sector as flagging consumer confidence, soaring job losses and fundamental changes in spending behaviour take their toll.

With real retail turnover growth expected to fall 1.4 per cent this year, 2020 is shaping up to be the sector’s worst year on record, according to Deloitte Access Economics’ retail forecast report.

After a surge in growth during the March quarter, retail spending is expected to contract by 4 per cent in the June quarter, with Covid-19 restrictions limiting spending—to an extent.

While the easing of Covid-19 restrictions and a number of fiscal stimulus programs are expected to provide something of a buffer, Deloitte’s analysts say retail is likely to face new headwinds on the road to recovery, with significant swings in consumer ability and willingness to spend set to continue as the year goes on.

Deloitte partner David Rumbens said a record-breaking fall in real retail sales was expected across the whole sector in the 2020 calendar year.

“But while the average is dire, there may not be many retailers performing at the average—many will fare much worse, while supermarkets, pharmacies and hardware, among others, have been experiencing a golden run.”

Consumer willingness to spend will likely be buffeted by a number of different factors, Rumben said, meaning that one month’s trading experience may be a “terrible” guide to how the year as a whole pans out.

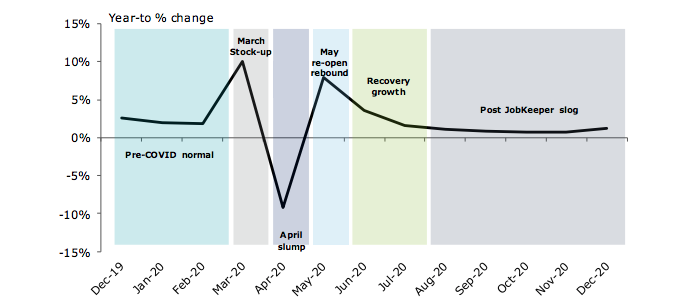

The year will be shaped by six phases of retail spending, Deloitte says, from a pre-Covid “normal” that was anything but, as the country dealt with the devastating bushfires at the beginning of the year, and some borders were starting to close.

Retail phases in 2020

^Source: Deloitte Access Economics

While for most retailers trading was in a familiar pattern with modest growth from month-to-month in the first, pre-pandemic, phase, the onset of widespread coronavirus restrictions in March led to big changes in shopping habits, the analysts said.

“Consumers entered a massive stocking-up cycle, with the extra spending on essentials masking a sharp decline in much discretionary spending—this culminated in the strongest monthly growth in retail sales on record.”

So began a wild ride that saw Australia’s two largest ASX-listed retail property managers, Scentre Group and Vicinity Centres —withdraw their earnings and distribution guidance.

The stockpiling phase gave way to the “April slump” that saw supermarket and related spending dip, while a downturn in discretionary spending—particularly calamitous for cafes, restaurants and apparel—resulted in the worst-ever fall in monthly Australian retail sales.

The May “re-open rebound” that occurred when consumers were given the green light to return to shopping centres as health concerns abated prompted a sharp pick-up in retail spending, aided by “pent-up demand, and a lot of government support, cushioning the blow which might otherwise have been seen on consumer incomes,” the analysts said.

Tempering the re-opening “frenzy”, Deloitte forecasts a “Covid-normal” recovery and growth period, with sales buoyed by an improving economy that continues to benefit from income support measures such as JobKeeper, deferral of mortgages and early access to superannuation.

A final post-JobKeeper phase is forecast to be a sombre one.

“September is already flashing red for many retailers as the month for the intended end to JobKeeper, and therefore the significant support many businesses—including retailers—have been receiving.”

Rumbens predicts a “precarious” road to recovery for retail spending.

“Short-term risks from rising unemployment and reduced willingness to spend will linger, especially as fiscal stimulus programs are unwound in September.

“More worrying is the longer-term risk from weak population growth. Migration has been an important support for retail spending over the past decade, but with borders closed there is potential for this tailwind for growth to turn into a headwind.”

Meanwhile, the so-called “golden run” continues for some, with online retail juggernaut Amazon expanding its empire by teaming up with industrial portfolio manager Goodman Group to build a new distribution centre in Queensland, set to open by Christmas.

And on the back of a strong sales rebound in May, Super Retail Group—comprised of Supercheap Auto, BCF, Rebel Sport and Macpac—announced a $203 million equity-raising, which chief executive Anthony Heraghty said would enable the group to “benefit from the changing consumer trends that are already providing tailwinds for our core four brands”.