Counter-Cyclical Cities Lead House Price Gains

Australia has chalked up 17 straight months of home price growth to a new record in May of 2024.

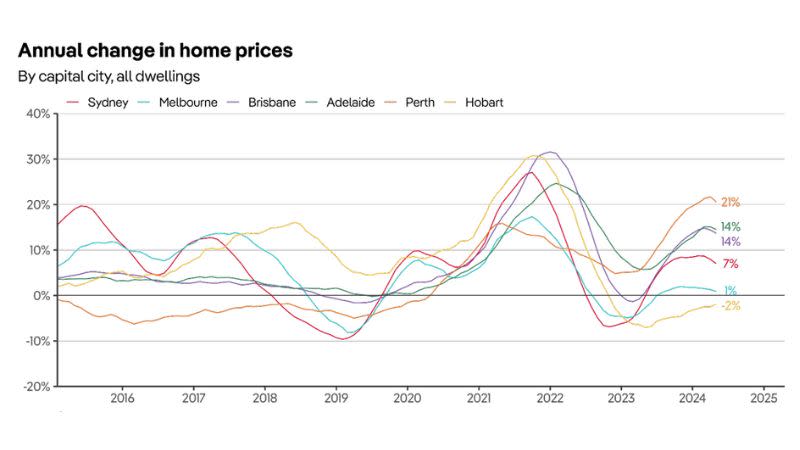

But it’s the nation’s counter-cyclical cities that are at the top of the leaderboard, with Perth outperforming all other capital cities to record a 0.73 per cent rise in May, and 20.58 per cent in the past 12 months.

Brisbane recorded a 0.67 per cent rise in May, while Adelaide experienced a 0.53 per cent uplift in prices.

PropTrack senior economist Eleanor Creagh said the housing supply challenges underpinned the 17 consecutive months of price growth nationally.

“Despite a rise in the number of homes for sale this year, strong population growth, tight rental markets and home equity gains continue to bolster strong demand,” Creagh said.

“Building activity remains challenged by capacity constraints and higher costs, with consequent tight housing supply pushing prices and rents higher.

“This mismatch between supply and demand is continuing to offset the higher interest rate environment.”

Creagh said the interest rate stability was encouraging buyer-seller confidence and consistent price rises were incentivising transactions.

“Despite some easing in the rate of population growth and more stock on market, home prices are expected to lift further in the months ahead,” Creagh said.

“Although, it is likely the pace of growth will continue slowing through the seasonally quieter winter period, particularly with interest rate cut expectations pushed out to late-2025.”

Perth

Perth’s golden streak continues as the strongest market in the country, recording annual home price growth of 20.58 per cent.

Tight supply and strong buyer demand is driving up prices, while the counter-cyclical market is recalibrating from a lower footing compared to the eastern states.

The relative affordability of the city’s homes, population growth, and very tight rental markets are also supporting home values.

Brisbane

Brisbane is now the second-most expensive capital following a period of consistently strong growth.

The River City has recorded an annual price growth of 13.69 per cent, putting values ahead of Melbourne and on par with Canberra.

Creagh said Brisbane remained one of the strongest performing markets over the past year, although the pace of monthly price growth has eased off from the breakneck speed of the first quarter of 2024.

Adelaide

Adelaide home prices rose 0.53 per cent in May to a new peak, and 14.49 per cent in the past 12 months.

Low stock levels and comparative affordability of the city’s homes has encouraged strong price growth despite interest rate increases.

Sydney

Sydney home prices lifted 0.42 per cent in May to a new peak and up 3.09 per cent for the year to date.

Prices were 7.01 per cent above May 2023 levels.

Creagh said the uplift in properties hitting the market this year has been matched by robust demand fuelling further price increases.

Melbourne

Melbourne home prices increased 0.23 per cent in May, making some gains on the small decrease of 0.05 per cent in April.

Prices are up just 0.87 per cent year-on-year while the city’s recovery continues to lag that of Sydney and Brisbane.