Property Market Passes $12 Trillion as Home Values Soar

Australia’s residential property market has surged past $12 trillion sooner than expected as the gap between house and unit values widens to a record high.

The premium for a detached house over an apartment in the combined capital cities has reached about $363,000, equal to nearly half the median capital city unit value, according to Cotality’s November Monthly Housing Chart Pack.

The gap has grown from just 20 per cent five years ago—the median house value is now $1.09 million compared to $728,000 for an apartment.

Houses rose 3.1 per cent in value over the three months to October, outpacing the 2.3 per cent lift for apartments.

Cotality economist Kaytlin Ezzy said the long-term outperformance of houses reflected the rising value of land.

“Houses have always seen stronger uplift than units in the long term because of the associated land value,” Ezzy said.

“That price sensitivity appears to have blown out through the strong growth cycle over the past five years.”

The house price premium varies from 31.6 per cent in Hobart to 77.8 per cent in Sydney.

“Due to affordability constraints, we may see more of a deflection towards units in cities such as Sydney in the short term but over the long term we still expect houses to outperform even if the premium on houses falls,” Ezzy said.

Cotality’s data shows lower to middle-value segments are leading price growth across most capital cities as affordability pressures push buyers to more accessible price points.

Government support schemes, including the expansion of the 5 per cent deposit program, may also be driving demand in these segments.

Ezzy said the trend was unexpected given this year’s monetary easing cycle.

“It is somewhat surprising to see such persistent outperformance of lower-value housing market segments given there were three rate cuts in 2025,” she said.

“Usually, the high end of the property market is more responsive to rate cuts. However, we have only seen 75 basis points of rate cuts delivered this year after a tightening cycle of 425 basis points, so perhaps this just wasn’t enough easing to push demand back into the high end of the market.”

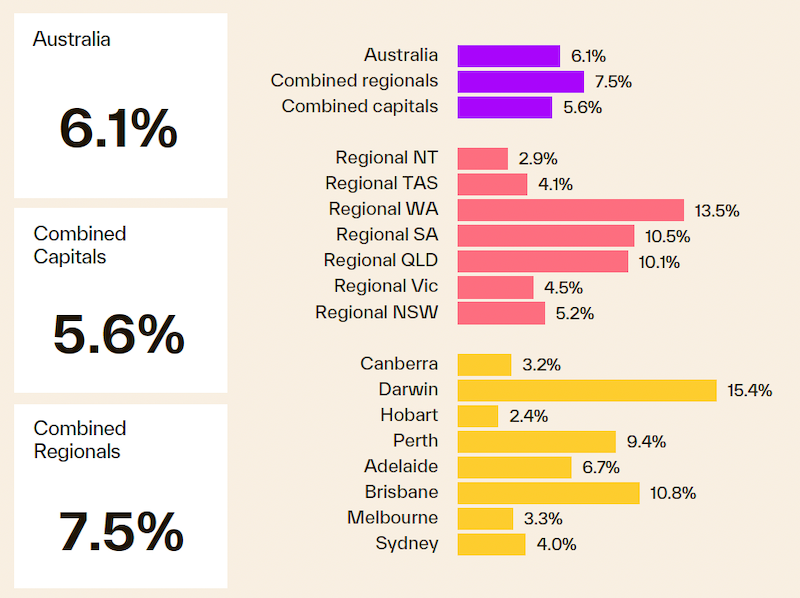

Australian home values, increases over 12 months

The total value of residential property nationwide now exceeds $12 trillion, more than double its size a decade ago.

Cotality said most of that growth had occurred in the past five years, with Queensland, South Australia and Western Australia gaining a larger share of total housing value as New South Wales and Victoria’s share declined.

“Victoria has had the biggest drop-off in housing market share in the past five years, from 29 per cent to less than a 25 per cent,” Ezzy said.

National home values climbed 2.8 per cent over the three months to October, the strongest quarterly growth since mid-2023.

Darwin and Perth led the quarterly gains at 5.4 per cent, followed by Brisbane at 4.9 per cent, while Hobart was the weakest capital at 0.5 per cent.

Cotality estimated about 48,764 sales were completed nationally through October, up 5.1 per cent on the same time last year.

Low stock levels and strong demand have tilted conditions further towards sellers, with the national median vendor discount rate falling to 3.1 per cent, its lowest in more than three years.

Brisbane and Perth sellers recorded the smallest discounts at 2.6 per cent, while regional Tasmania had the highest at 3.8 per cent.

Cotality recorded 127,833 properties advertised for sale in the four weeks to October 26, almost 20 per cent below the seasonal average.

The research group said total listings were down year-on-year in every capital and regional market except regional Victoria.