Cost Escalation Normalises, Building Approvals Down

While the cost of building a new house rose 0.8 per cent in the three months to December, building approvals data for November, 2023 show a marked decrease in volume.

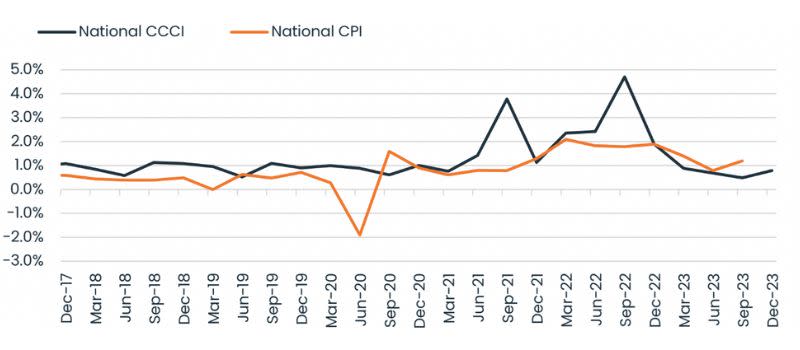

It’s a return to normal trends, according to CoreLogic’s Cordell Construction Cost Index (CCCI), following the easing of the previous four quarters.

The annual growth rate for the 2023 calendar year was 2.9 per cent but the latest growth rate remains 20 basis points below the pre-Covid decade average of 1 per cent, according to CoreLogic economist Kaytlin Ezzy.

“This suggests that reacceleration is more a return to trend rather than a new surge in construction costs,” Ezzy said.

“While up over the quarter, the annual change in residential construction costs continued to ease as larger quarterly increases fell out of the annual calculation.”

The 12-month increase of 2.9 per cent is the smallest annual rise in the index since March, 2007.

Quarterly Change CCCI vs National CPI

Ezzy said it suggested that construction cost growth has “normalised after recording a recent peak of 11.9 per cent over the 12 months to December 2022”.

But we’re not out of the woods yet.

Corelogic construction cost estimation manager John Bennett said pricing remained “unsettled” with no clear trend in most product types.

“Depending on the supplier, both increases and decreases were recorded in timber and metal prices, although we have seen rises in the price of hardware and chemical items,” Bennett said.

“This tells me suppliers are either bringing their product pricing back down to acceptable levels from the increases during the Covid period, or they are increasing to set up for the year ahead.”

While there may have been good news on construction cost escalation, the latest bureau of statistics data on building approvals revealed a decrease of 1.9 per cent in November, 2023.

HIA chief economist Tim Reardon said the lower building approvals levels forecast a slow down in construction for the year ahead.

“The fall in this month’s figures sees approvals in the three months to November lower by 8 per cent compared to the same period in the previous year,” Reardon said.

“The low volume of building approvals throughout 2023 will see the volume of homes commencing construction continue to slow this year.

“Other leading indicators of activity in the housing market, such as new home sales and housing finance data, are also consistent with their confirmation of this projected slowdown.”

Reardon said the rise in the cash rate was a leading cause of the slowdown in approvals.

New South Wales recorded the biggest drop in approvals at 16 per cent, followed by Victoria and South Australia.

Urban Taskforce chief executive Tom Forrest said NSW continued its “worst in a decade” performance for housing approvals.

“Over the past six months, the NSW planning system has delivered less than half the number of approvals needed to meet the National Housing Accord commitments,” Forrest said.

“The National Housing Accord target of 377,000 new home completions over 5 years from July 2024 will require around 90.000 approvals in NSW each year.”

“The rising cost of construction is now starting to settle – but costs are not going down. Fees taxes and charges continue to add to the cost of new homes, and the NSW planning system remains the slowest in the land, notwithstanding the recent policy announcements.”