Australia’s Median Rent Cost Surges to Record High

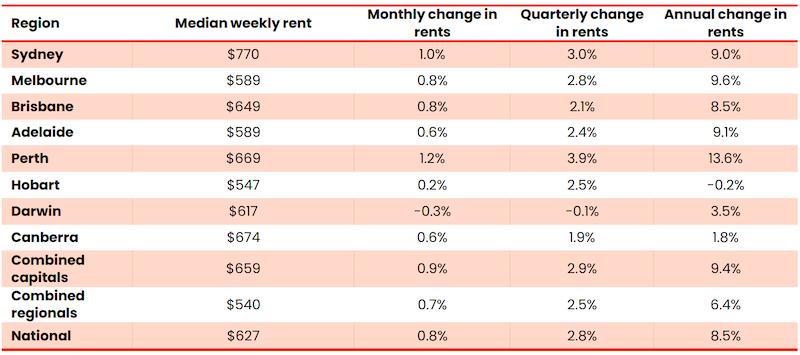

Australia’s median rent has reached a record high of $627 per week after a 0.8 per cent rise in April.

According to the latest data from CoreLogic, annual rent growth has re-accelerated through 2024, up from a recent low of 8.1 per cent growth in the year to October 2023, to 8.5 per cent in the year to April.

Perth home rents had the highest monthly, quarterly and annual gains across the capital cities, and has had the highest rent growth of the capital cities since Covid, up 57.6 per cent, followed by Adelaide at 41 per cent.

Melbourne’s median rent is now on par with Adelaide’s, at $589 per week, equal sixth, with only Hobart more affordable. Adelaide overtook Melbourne weekly rents in May 2022, and it’s been a tussle since, Corelogic said.

New analysis of rents by distance to CBDs shows markets within 30 to 40km of city centres had the strongest reacceleration in rent growth.

For example, in Sydney, Campbelltown’s annual growth went from 9.1 per cent in October to 13.4 per cent in the year to April.

In Brisbane, Jimboomba’s annual rent growth went from 3.8 per cent to 6.4 per cent, while Casey North in Melbourne, annual rent growth surged from 11.7 per cent to 13.1 per cent.

Just a fifth (21.3 per cent) of SA3 markets analysed have rents below their peak.

Median weekly rent and value change, April 2024

Around 9 per cent of SA3 rent markets were down from peaks in February or March this year, suggesting they were slipping from recent highs.

Other rent markets with more sustained declines from their peak were mostly remote, regional areas, however, some pockets of the Sydney rent market were also below peaks from 2023, such as Canterbury, Pennant Hills–Epping and Parramatta.

“Part of the reason for the re-acceleration in rents nationally could be due to renters being forced into more affordable, peripheral housing markets as they become priced out of more desirable and central metropolitan locations,” Corelogic head of research Australia Eliza Owen said.

“Areas where rents are slightly lower may offer more space for group households or have slightly less competitive rental conditions which are potentially being more targeted by prospective tenants.”

The latest ANZ CoreLogic Housing Affordability report, released on April 16, underlined the dire state of the market, renting or buying, for more Australians.

The report found low-income earners were the most vulnerable in the face of a changing rental market, where 25th percentile rent values have increased faster than at the median (50th percentile) and high end of the market.