Rent or Buy, Affordability Slips Further Away

Home affordability in Australia is slipping further out of reach for most and those who can least afford rent increases are being hammered the hardest.

The latest ANZ CoreLogic Housing Affordability report, released on April 16, has underlined the dire state of the market, renting or buying, for more Australians.

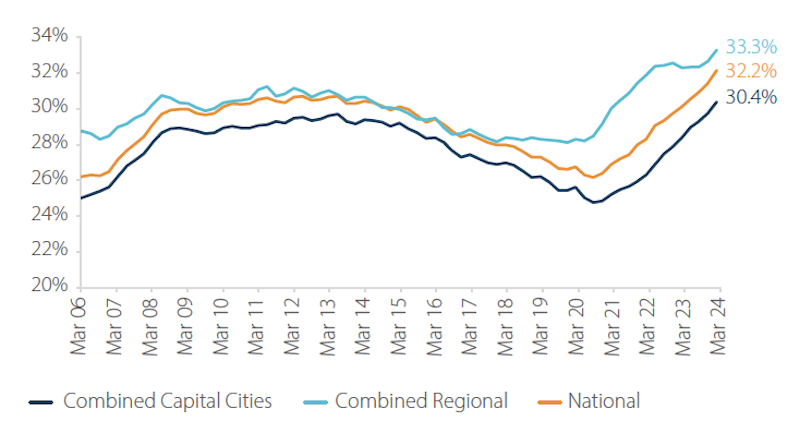

That could be seen clearly by the fact that the portion of income required to service rents has shifted from the 20 per cent range to more than 30 per cent range for median income earners, the report said.

The report found low-income earners were the most vulnerable in the face of a changing rental market, where 25th percentile rent values have increased faster than at the median (50th percentile) and high end of the market.

“In fact, the 25th percentile rent in Australia has lifted $53 per week in the past year, almost fully absorbing the $48 increase in minimum wages set by the Fair Work Commission,” the biannual report said.

Households in this percentile, earning an estimated $961 a week, would require a payment of 54.3 per cent of income to afford the $521 a week rent value of the percentile, according to CoreLogic.

Share of median income to service median rent

“This is the fifth consecutive quarter in which the median income to rent ratio was above 30 per cent after 7.5 years where median rent had been under that level,” the report said.

“Across the 15 greater capital city and rest of state markets, 11 were recording a median rent to income ratio of 30 per cent or more.”

The report said rent growth had once again gathered pace across the start of 2024.

Nationally, annual rent growth has lifted from a recent low of 8.1 per cent year-on-year in October 2023, to 8.6 per cent year-on-year in March, 2024.

The re-acceleration was particularly evident in house rents, where annual growth bottomed out at 6.8 per cent in the year to September, and rose to 8.4 per cent in the year to March, the report said.

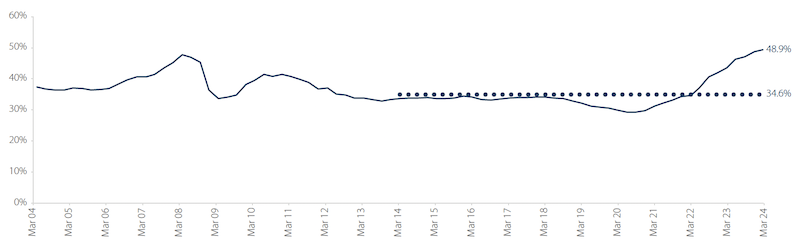

Mortgage serviceability has also deteriorated, as home values have continued to increase in a high-interest-rate environment.

Around 37 per cent of properties would be serviceable for buyers expending 40 per cent of Australia’s median income, compared to 17 per cent of properties using 30 per cent of median income.

Portion of income to service new loan

“First home buyers are arguably in the most challenging position,” the report said.

“They face an increase in the deposit hurdle as prices rise and are more likely to buy with a low deposit, increasing their interest costs.”

The report said that looking ahead, there was little prospect for the mortgage serviceability indicator to move back into the 30-per-cent range any time soon.

“This is because the cash rate is not expected to be cut until late 2024, and home values have continued to rise, even amid relatively high interest rate settings,” it said.

“Based on current levels of income and dwelling values across Australia, and assuming a 20 per cent home loan deposit, mortgage rates would need to fall to around 4.7 per cent to get serviceability just under 40 per cent of median income.”

Meanwhile, national vacancy rates held steady at 1 per cent for the 30 days to April 15, unchanged from February and down slightly from March, according to SQM Research.

The total number of rental vacancies Australia-wide now stands at 31,356 residential properties.

Perth and Adelaide continued to record the tightest rental markets across the capitals with each recording a rental vacancy rate of just 0.5 per cent.