Home Values Add $59,000 Over Financial Year

Investors and vendors in Perth, Adelaide and Brisbane had a happy end to the financial year but it was the other way around for potential buyers.

Severe housing shortages assisted the nation’s mid-range capital cities to record continued strong capital growth in June and across the 2023-24 financial year.

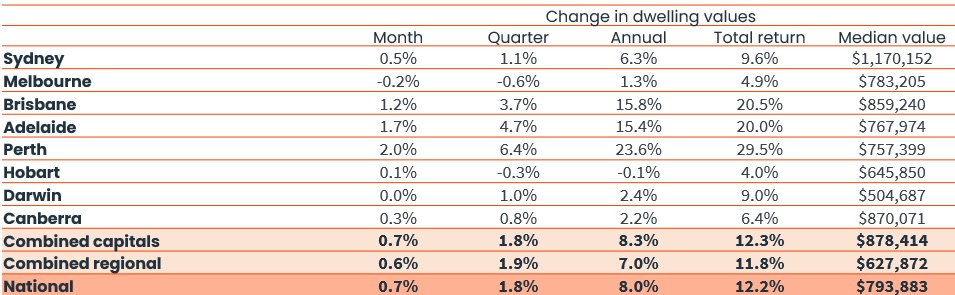

Nationally, home values rose 0.7 per cent in June, taking growth to 8 per cent for the 2023-24 financial year,

That is the equivalent of a $59,000 increase to the median home value in Australia, which is now $794,000, for the year.

Perth followed its 2 per cent performance growth in May with another 2 per cent increase in June, while Adelaide and Brisbane were the nation’s two other top performers, up 1.7 per cent and 1.2 per cent respectively, according to CoreLogic’s latest Home Value Index (HVI).

These three cities also experienced the highest median growth across the financial year with records of 23.6 per cent in Perth, 15.4 per cent in Adelaide and 15.8 per cent in Brisbane.

And the regional areas in those cities’ states were the top three in the country, for June and the financial year.

Melbourne however lost out badly to the mid-range capitals with another month of declines, down 0.2 per cent after the 0.1 per cent rise in May and a bare minimum of 1.3 per for the year.

However, the southern city’s listings rose to 14 per cent above their five-year average while Hobart’s listings are tracking 46 per cent above average.

But buyers in the winning median growth cities suffered with Perth, Adelaide and Brisbane recording severe housing shortages significantly below than that of their June averages.

CoreLogic research director Tim Lawless said these cities’ growth trends were reflected in above-average interstate migration rates and advertised stock levels.

Corlogic Home Value Index, June 2024

“Over the four weeks ending June, the number of homes advertised for sale in Perth were 23 per cent lower than at same time last year and 47 per cent lower than the previous five-year average,” Lawless said.

“Adelaide (-43 per cent) and Brisbane (-34 per cent) are also recording real estate listings that are significantly below average for this time of year.”

At the same time, investors in these three cities, as well as Sydney and Melbourne, pocketed strong returns for the financial year, even as rental growth eased.

Annual rental growth for houses in the five locations ranged between 7.8 per cent in Brisbane and 13.1 per cent in Perth. For units, annual rental growth began at 7.1 per cent in Sydney and lifted to 13.7 per cent in Perth.

Lawless said that a higher number of motivated sellers were giving more cities an increased number of listings—and this motivation could easily be due to pandemic savings finally lessening due mainly to cost-of-living pressures including “higher for longer” interest rates.

Yet while this listing increase is just what keen buyers need, Lawless warned that this stock was being snapped up as soon as it hit the market and that home values would continue to rise while a “material rise” in new home supply will not happen overnight.