Australians Positive About House Price Growth

Australian house prices rose more in October than in any month in the past four years, after two years of downward trends.

Just 13 per cent of people now expect property prices to fall across Australia in the next 12 months, an improvement on the 17 per cent of those surveyed in July, according to ME Bank's latest property sentiment survey.

The results, based on a survey of 1,000 Australians, found that almost half of Australians in the property market expect prices to continue to rise and 30 per cent expecting them to stay the same.

On the ground, October saw a 1.2 per cent rise in prices, the fourth straight monthly increase and the largest since May 2015, according to Corelogic’s home value index monthly survey.

The strongest growth was in Melbourne and Sydney, where prices rose 2.3 per cent and 1.7 per cent, respectively, but prices were up across every capital city except Perth, where they dipped 0.4 per cent.

However, Darwin and Perth, meanwhile have seen dwelling prices decline 31 per cent and 22 per cent, respectively, since mid-2014.

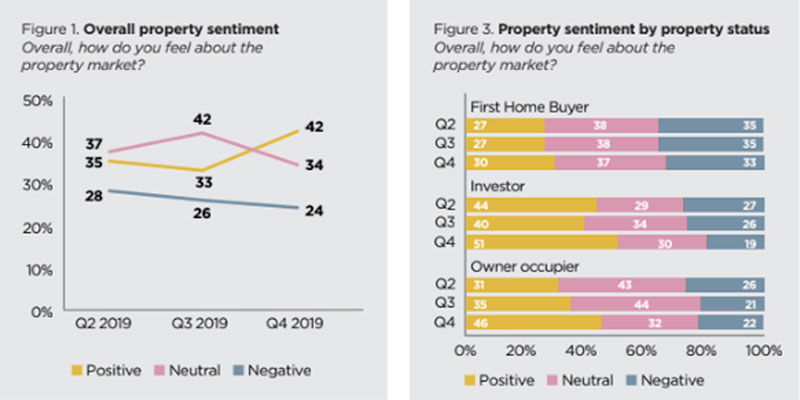

ME’s Quarterly Property Sentiment Report

Respondents across all major cities had a more positive outlook on prices with NSW, Victoria and Queensland seeing 57 per cent of those surveyed predicting prices to go up, jumping up by as much as 25 percentage points from last quarter’s predictions.

“With a relatively solid spring selling season and a number of months’ worth of house value growth under the belt—according to Corelogic data—there’s more confidence that the upward trajectory of prices will continue, albeit modest increases,” ME general manager home loans Andrew Bartolo said.

Australia’s four largest banks now all offer fixed mortgage rates below 3 per cent after cuts to the official cash rate—the rate the Reserve Bank of Australia charges banks on overnight loans—in June, July and October.

The industry super fund-owned bank reported sentiment among first home buyers didn’t surge as much as others, which suggests the recent house price movements may have marked the end of a unique opportunity to buy “at the bottom”.

“The recent uptick in first home buyer activity recorded by the ABS may represent the scramble to get in while they can due to renewed affordability pressures as prices rise,” Bartolo said.

More people between 18 and 24 are now feeling less positive about the state of the property market compared to the last survey, while 21 per cent of those 75 years old and above were pessimistic about the market compared to 10 per cent previously.

Millennials, investors and those who plan to buy in the next 12 months stood out as the most optimistic within their respective cohorts.

Those intending to sell were feeling more positive about the market respondents in the 25 to 39 age bracket identifying they are now as eager to buy – 51 per cent compared to 38 per cent in April.

Housing affordability remains the top worry with 89 per cent agreeing that “despite price falls in some areas, they still think housing affordability is a big issue in Australia”, down slightly from 93 per cent in July.

“Affordability is a much more complex issue than the price of houses and this enduring concern highlights that much more needs to be done to address the issue,” Bartolo said.