Clyde Town Centre Site Hits the Block for $60m

Burbank Group’s National Pacific Properties is selling a site slated for a town centre in Melbourne’s south-east growth corridor.

The group is reportedly seeking offers over $60 million for the 26.23ha site earmarked for the Clyde Town Centre in the Casey region.

It comes off the back of the group spending almost $50 million on a 500-lot parcel of land at Pakenham East last month.

National Pacific Properties general manager Tom Trevaskis said the group had secured planning approvals for the land and connected services to maximise its value.

“Very rarely do sites like this go on the market … even rarer with approvals in place,” Trevaskis said.

“With the strength of sales being experienced in the Clyde, Cranbourne [and] Berwick regions we feel now is the right time to capitalise on this demand.’’

Trevaskis said the 26.23ha site was the second largest retail centre planned for Melbourne, and had been identified as a major activity centre under the planning scheme, with up to 50,000sq m of retail floor space and 50,000sq m of commercial space.

The site is next to the future Clyde Train Station and near to NPP’s Eliston, Hartleigh and Bella projects.

Buyer confidence in the Melbourne market has rebounded, according to Westpac-Melbourne’s Institute Index of Consumer Sentiment.

The Casey corridor has made up about a third of all greenfield land sales during the past year.

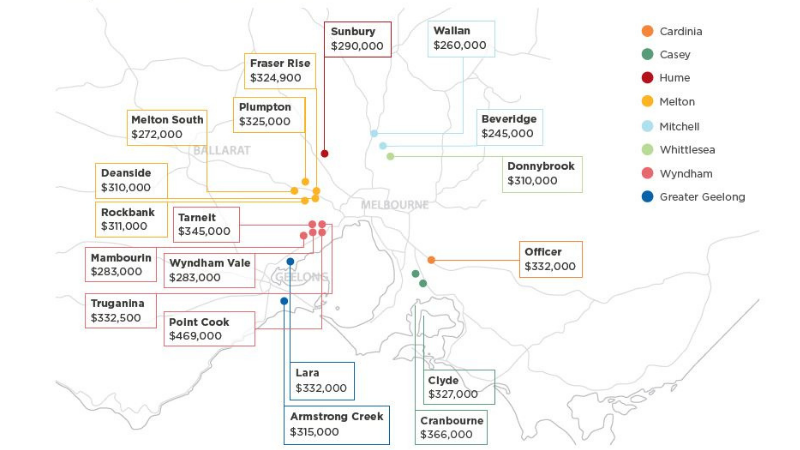

Red23 data showed land prices in Casey had fluctuated over the past three months based on land supply in the area, while Mitchell was the most affordable land in the growth corridors.

Land sizes have decreased 3 per cent in Metropolitan Melbourne, where the median land size is now 388sq m, and 400sq m in Greater Geelong. According to Red23, the traditional 400sq m block has now been superseded by a 350sq m lot.

A 350sq m block of land in Mitchell Shire starts at about $245,000, whereas in more established areas, such as Point Cook, it is $469,000 for the same sized block.

The median land price increased by 1 per cent in August to $332,400, which is 4 per cent up on 12 months ago.

Red23 data shows demand for land in Melbourne’s growth corridors was strong while land availability was drying up with limited land releases for the remainder of 2021.