Chinese Buyers ‘Increasingly Sensitive to Upfront Costs’: UBS

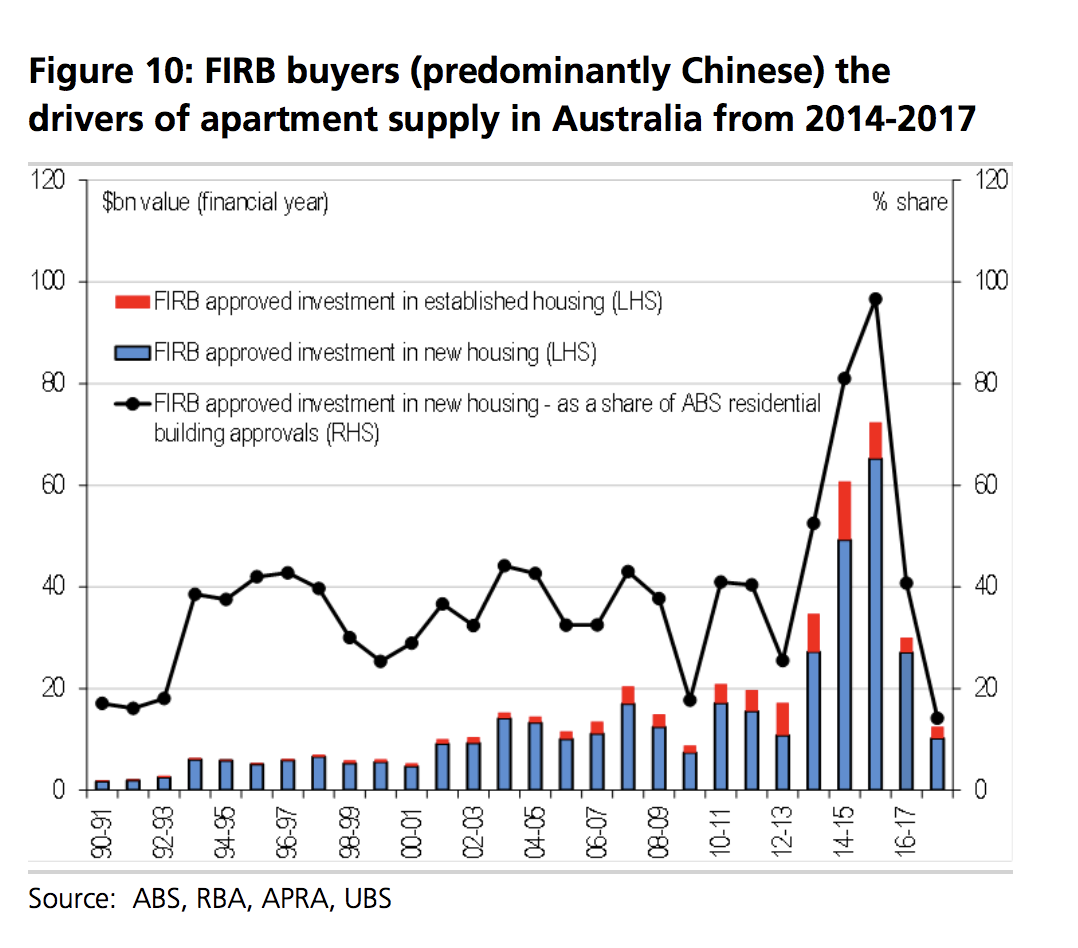

Over the past six years, Chinese buying of new build residential property in gateway cities has bolstered demand, construction activity and arguably house prices — particularly for apartments, UBS says.

A survey of 3,351 mainland Chinese, by UBS Evidence Lab, reveals they are still actively buying abroad.

Although good investment returns are no longer the key consideration, with lifestyle choices becoming increasingly important.

In Australia Chinese buying activity peaked in 2016, and further moderated in 2018.

“While buyers from the mainland are still active in Singapore, Canada, US and Japan for purchases, we are seeing growing interest in the Philippines,” the UBS report found.

“Expectations of Chinese buying to return to markets where flows have focused elsewhere remain low.”

Related: Chinese Developers Double Down on Australian Property

Upfront costs deterring investment

The survey shows that Chinese buyers are increasingly sensitive to upfront costs.

Western Australia announced an increase in the surcharge for foreign investors, implemented in January this year, increasing from 4 per cent to 7 per cent.

While Queensland increased its surcharge from 3 per cent to 7 per cent.

If stamp duty or upfront costs are kept low (i.e. 5 per cent or less) UBS found that mainland Chinese buyers are relatively insensitive to the upfront cost.

“However, as the rate moves higher, the proportion of consumers who would no longer buy abroad drops away.

“When upfront costs increases to 12 per cent and above, the current survey suggests a significant increase of potential purchasers (~20 per cent) would no longer buy the property.”

While Chinese buyers have “materially retreated” after driving the apartment supply wave the focus remains on the credit tightening environment post the Royal Commission into the Bank Sector.

“Over the past 12 months we have seen a material reduction in pre-sales which was largely driven by foreign purchasers (in particular Chinese) and domestic investors.

“Recent anecdotes from developers suggest Chinese buying has stabilised and potentially picked up from a very low base.”

UBS believe this reflects a combination of a period of stable stamp duty surcharges (with no further increases announced in the second half of last year) and depreciation in price (in particular AUD equivalent post FX depreciation).

“However, we do not anticipate a return of demand similar to 2016 levels.”