Retail Vacancy Falls Show Signs of Bottoming Out

CBD retail vacancies rose in the first half of the year, but it appears to have turned the corner and the rest of the year should be rosier.

According to CBRE’s H1 CBD Retail Vacancy report, current enquiry levels suggest the market has bottomed out, particularly in Sydney where a relatively quick recovery is anticipated.

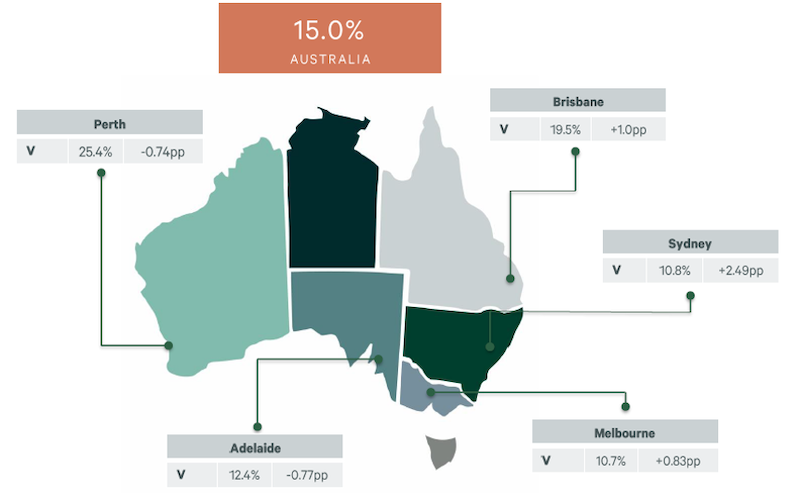

The report said that the national vacancy rate softened from 13.9 per cent in the second half of 2022 to 15 per cent in the first half of this year.

It was a mixed bag, with vacancy declines in Perth and Adelaide while increases were clocked in Sydney, Brisbane and Melbourne.

CBRE research analyst Darcy Badgery said that overall vacancy had softened nationally, coming off seasonal highs in 2022’s second half and lower spending, however, rising office occupancy rates and the return of international tourists and students had increased visitation.

“We’re also seeing a national flight to quality trend, with our latest Live, Work, Shop survey highlighting that 61 per cent of retailers want to increase the quality of their store locations.”

Retail vacancies, first half 2023

The biggest 2023 first half vacancy decline of 0.77 per cent was recorded in Adelaide, with a 0.74 per cent tightening in Perth.

While Melbourne’s vacancy increased by 0.8 per cent, the city now has the lowest vacancy in the country at 10.7 per cent.

This followed a 2.49 per cent increase in Sydney’s vacancy rate to 10.8 per cent. A vacancy increase was also recorded in Brisbane—1 per cent to 19.5 per cent.

CBRE Australian Head of Retail Leasing Leif Olson said that although the overall national vacancy rate had increased, based on current enquiry levels “we expect to see vacancies contract across all markets over the next six months”.

“This is particularly the case in Sydney, with deals pending several large arcade vacancies and strong enquiry from food and beverage, and luxury fashion retailers who are seeking new opportunities.”

Sydney

Despite overall vacancy softening, strip retail vacancy tightened significantly, dropping 3.19 per cent to 6.9 per cent.

This followed a surge in leasing deals in prime locations to brands including Adidas, NBA and JD Sports and continued activity by luxury retailers seeking to open flagship stores to remain competitive.

The overall CBD increase was attributable to a 406-basis points vacancy rise in arcade retail space and a 320bps rises in centre vacancies, largely due to tenancies becoming available following the refurbishment of the General Post Office coupled with difficulties in leasing upper-level retail centre tenancies.

CBRE’s report forecasts that increases in international visitor numbers, returning international students and a growing number of CBD events are expected to continue to boost city visitation and overall retail spending.

Melbourne

Melbourne’s 2023 first half vacancy softened slightly after the traditional trend of tightening vacancy leading up to the Christmas and holiday period.

In line with Sydney, the softening was led by centres and arcades, particularly upper-level stores, as retailers gravitated towards prime strip locations.

CBRE associate director, retail leasing, Jason Orenbuch said that Melbourne’s strip vacancy tightened by 42bps to 10.5 per cent, with takeaway food outlets filling many of the vacancies to meet demand as office occupancy rates rise and international students return.

“Occupiers in the hospitality sector are also seeking out partially or fully fitted out space in hospitality hotspots such as Flinders Lane and Swanston Street,” Orenbuch said.

“There was also an uptick in the development of new stores in H1, which will draw new retail additions to the city and help lift CBD visitation.”

Brisbane

Brisbane’s overall CBD vacancy rose 1 per cent to 19.5 per cent primarily due to a rising number of empty shops in the CBD’s shopping centres and arcades.

Set against this, CBRE associate director, retail leasing, Tanaka Jabangwe said there was high demand from national and international retailers for super prime stores on the city’s retail strips.

“This was highlighted by Louis Vuitton’s move to a new mall location in the NAB Heritage Building, which is double the size of its previous store in Queens Plaza,” Jabangwe said.

“The demand for flagship outlets is being fueled by workers returning to the CBD and a resumption of international tourism, as retailers tap into the continued demand for experience-based, physical stores.”

Jabangwe said hospitality retailers were also driving demand for strip retail stores to cater to Brisbane’s growing number of inner-city residents. This resulted in a range of new lease commitments in the first half of the year, including Maru Grill at Mary Street, La Boca at Edward Street and Scugzini at Adelaide Street.

“The city’s vacancy issues are primarily associated with upper-level centre tenancies as retailers gravitate towards strip retail locations,” he said.

“An example involves Glue moving out of its store above JD Sports on Elizabeth Street to a new mall location early in 2023.”

Jabangwe said that centre tenancies with street exposure continued to attract demand.

Adelaide

Adelaide’s CBD retail vacancy contracted 77bps to 12.4 per cent in the first half of the year after a very significant drop of 371bps in the latter half of 2022.

CBRE retail leasing executive Scott Chow said activity in the CBD had been heightened by the reintroduction of major events including the Adelaide Festival in March 2023, in addition to a resurgence in travel-related retail expenditure.

“Demand for retail space on Rundle Mall continues to run high, particularly from luxury retailers, and with space being tightly held we’ve seen interest from high-profile tenants in space around the western end of the mall, which has historically seen high levels of vacancy,” Chow said.

“This comes off the back of major international brands like Uniqlo opening flagship stores in Adelaide and highlights the ‘flight to quality’ and ‘experiential’ retail trends being evidenced across the country.”

The vacancy in Adelaide Arcade remained at 0 per cent in 2023’s first half—the lowest rate in the country. A recovery in office worker lunch time spending has also been evident, lifting food retailing activity.

Perth

Perth’s CBD retail vacancy has continued to steadily decline, dropping by 74 basis points in H1 to 25.4 per cent—the lowest level in two years.

CBRE senior director and WA head of retail Fred Clohessy said retailer/tenant interest and enquiry was re-established in late 2022 when confidence returned in travelling to and from Perth following border closures.

“This has carried into 2023 and continued to break down the CBD’s high retail vacancy rate,” Clohessy said, noting that the strip retail vacancy rate dropped 31bps to 25.4 per cent.

“The addition of retailers such as Sunglass Hut and Peter Jackson on the Hay Street Mall have helped to reduce the city’s strip retail vacancy rate, with Murray Street Mall continuing to be tightly held.

“Demand for prime space from luxury brands is having a positive effect on rents and future vacancy levels. However, rents are still correcting on Hay Street Mall and in secondary locations where vacancy is concentrated, and higher incentives are being sought by retailers.”

CBRE’s report also highlighted that Perth’s high office occupancy levels post-Covid had increased demand for lunch and dinner venues in sections of the CBD.

Clohessy said the return of events, tourism international students and WA’s strong economic climate provided a continued base for further vacancy declines over the remainder 2023.