Build-to-Rent Climbing Up Lenders’ Wish Lists

Lenders interest in build-to-rent is ramping up as conditions swing towards favouring the development sector’s new poster child.

According to CBRE’s latest Lender Sentiment Survey, lenders are seeing population growth projections, an ever-tightening rental market and a more favourable taxation environment strengthen the sector’s growth prospects, and want to be a part of it.

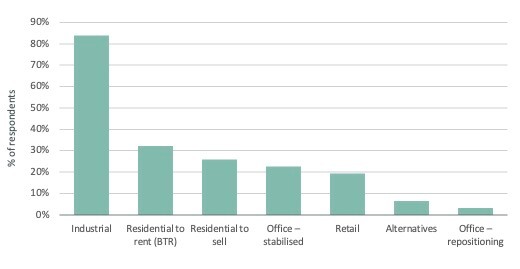

Australia’s industrial and logistics sector remains the clear top pick for lenders, with build-to-rent in at second place in the survey.

CBRE Research tapped 31 local and international banks and non-bank lenders for its 2023 first-half survey of Australian commercial real estate lenders.

The majority expect lending costs to increase while there was a moderate dip in the percentage of respondents expressing a desire to grow their commercial loan books—from 44 per cent in October last year to 32 per cent when this month’s results were calculated.

However, CBRE managing director of debt and structured finance Andrew McCasker said domestic banks, offshore banks and non-bank lenders were still participating with varying appetites across all the asset classes in Australia.

“The majority are willing participants in the industrial and build-to-rent sectors, and we see that continuing to build out over 2023, moving into 2024,” McCasker said.

“The underlying fundamentals of Australia’s housing economy is creating significant opportunities in the build-to-rent sector and the desire by domestic and offshore financiers to fund projects will see this sector continue to grow in the coming years.”

CBRE Pacific head of research Sameer Chopra said the top line results showed that industrial remained the favoured asset class, with more than 75 per cent of the survey respondents expressing a preference to lend into that sector.

“The overall reduction in lending appetite was most prominent among non-banks, although the results show they are still interested in growing their build-to-rent, residential-to-sell and industrial portfolios,” Chopra said.

“Tighter credit conditions are placing undue downward pressure on future supply, which could boost longer-term rent growth across all sectors.”

Preferred asset class for new investment

Credit margins could continue to experience upward pressure of about 20bps, with over 40 per cent of lenders indicating such a move over the next three months.

An Interest Coverage Ratio (ICR) requirement of 1.5x for new investment grade lending was preferred by more than 80 per cent of the institutions surveyed, with ICR also the main focus for new underwriting.

While Loan to Value (LVR) ratios have been stable around 40 per cent to 60 per cent, Chopra said “this might come under pressure as assets are revalued during the coming two quarters, with a slight uptick in hedging requirements since October last year.

“Lenders also indicated higher average credit spreads, LTV and ICR requirements for prime office assets compared to their industrial counterparts.”