CBD Retail Vacancies Down On Post GFC high

Melbourne’s CBD retail core has continued its overall downward trend recording a vacancy rate of just 3.3 per cent in 2016, according to Savills latest research.

This trend is a moderate rise of 0.7 per cent on the previous year’s figure but well below the 5.2 per cent, five year average.

The survey of CBD Core & Swanston Street Precinct found there were just 39 vacancies among the 1181 shops which are dominated by Clothing, Footwear & Personal Accessories stores (492) and Cafes, Restaurants & Takeaway Food Services (281).

The number of shops grew from 1132 to 1181 over the 12 months, largely due to the opening of St Collins Lane.

The data which paints a relatively positive picture of CBD retailing reflects growing CBD and worker populations, which have driven a significant rise in service and hospitality based retail in recent years, as well as recent ABS data indicating growth in Victorian retail trade and a household move away from saving to spending.

ABS retail trade (seasonally adjusted) data revealed Victorian retail trade grew by 4.12 per cent in 2016, above the national average growth of 3.45 per cent, while the household savings ratio has been in +6 per cent territory over the past year - its lowest level since the GFC - indicating household budgets have begun a shift away from saving to spending.

Survey author, Savills Associate Director Research & Consultancy Monica Mondkar said Melbourne’s CBD core retail had weathered an apparent downturn in retailing surprisingly well given static wages growth and moderate levels of consumer confidence.

"Melbourne’s CBD has undoubtedly been a good performer in recent times with vacancy characteristic of periods of stronger economic growth and certainty, but what may seem outwardly as anomalous growth has some key underpinnings that more than adequately explain its status.

"There has been an apartment boom in Melbourne over several years which has significantly increased CBD and environs residential populations, while latterly a stronger office leasing market has also increased white collar employment and hence worker population, and of course a resurgence in student numbers has also been important.

"When you consider that the dominant CBD retail sectors are hospitality, food, and service sector related, it’s clear that population growth factors have been the key driver of CBD retail,’’ Ms Mondkar said.

Ms Mondkar said the continued influx of high profile global fashion brands and the attraction of modern retail hubs was also attractive to both tourists and Melbourne’s suburban population.

"The number of new and refurbished retail precincts and the continuation of the influx of high profile global brands has no doubt accounted for a significant part of the increase in spending, attracting thousands of new shoppers to the CBD.

"With the resident population alone expected to grow by 14 per cent by 2020 we are going to see the vacancy rate remain low over the medium term,’’ Ms Mondkar said.

Ms Mondkar said the demographic change - which reflected a cultural shift with Melburnians, once wedded firmly to the suburban quarter acre block - now showing a definite penchant for inner-city apartments, fashion, education sector growth and tourism would continue to bolster the coffers of CBD retailers.

"Apartment living is a development which is here to stay and that will continue to be a key driver in the make-up of CBD retail. At the same time Melbourne remains the fashion capital and is also firmly on the radar with tourist shoppers and students and those factors will continue to drive the CBD market for the foreseeable future,’’ she said.

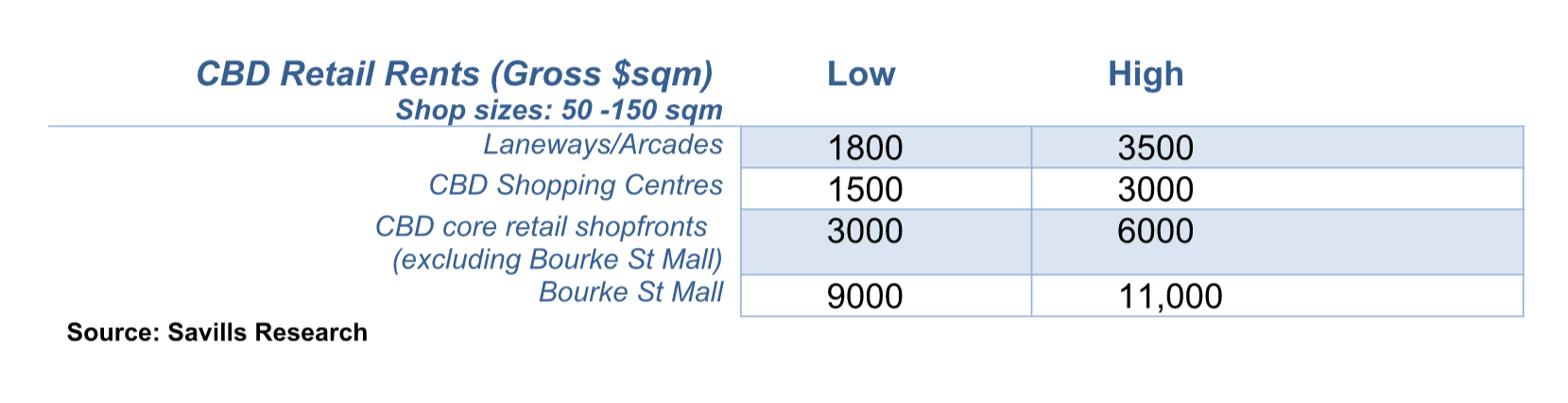

The survey found little movement in rents which now range between $1500 a square metre, for CBD shopping centre space, to circa $11,000 a square metre for prime space on Bourke Street Mall.