Business Conditions Fall in March

Business activity took a hit in March recording falls in production and orders, and falls in employment and selling prices, reveals the Australian Industry Group’s latest business index.

The index dropped 6.4 points to 39.8 for March, reflecting a deterioration in business conditions as a result of increasing restrictions amid the coronavirus pandemic.

Ai Group chief executive Innes Willox said it is the lowest level since 2013.

“The immediate outlook is for further deterioration with an acceleration of cancelled and reduced orders over the month,” Willox said.

“The most severe impacts to date have been in industries that were already weakened by underlying contraction such as metal product manufacturing, apartment building, commercial construction and among retail trade and hospitality businesses.”

The Australian Bureau of Statistics reveals two-thirds, or 66 per cent, of Australian businesses reported turnover or cash flow has reduced due to the coronavirus.

The ABS survey on business impacts of Covid-19, released Tuesday, shows that almost half, or 47 per cent, of businesses made changes to their working arrangements, including temporarily reducing staff or the introduction of remote working.

While two in five businesses, 38 per cent, have changed how they deliver products or services, including the transition to online services.

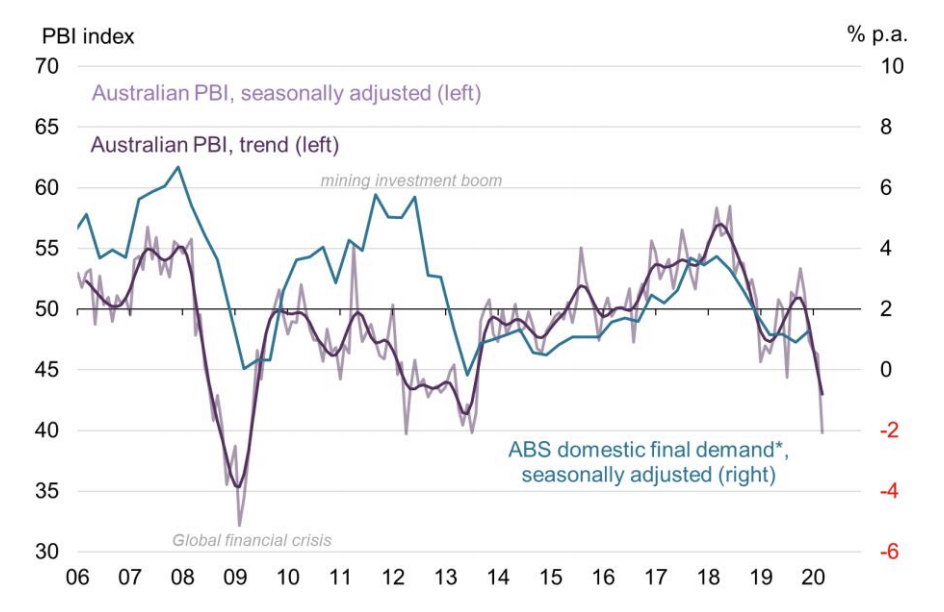

Ai Group's Performance of Business Index

Includes ABS domestic final demand, seasonally adjusted and inflation adjusted to Q4 2019. ABS National Accounts.

The Australian index is a weighted composite of Ai Group’s manufacturing index, services index, and construction index.

A result above 50 points indicates business activity is generally expanding in that month compared to the previous month; while below 50 indicates it is contracting.

The distance from 50 shows the strength of the expansion or decline.

Willox said all four activity indexes indicated large contractions in March.

“The March fall in business conditions is the largest single-month drop in the Australian PBI since the GFC and we are all hoping the strong stimulus measures announced by the Federal government, the Reserve Bank and the states and territories ensure further falls are limited,” Willox said.

| Australian PBI seasonally adjusted | Index this month | Change from last month |

|---|---|---|

| Australian PBI | 39.8 | -6.4 |

| Australian PMI | 53.7 | 9.4 |

| Australian PSI | 38.7 | -8.3 |

| PBI activity indices | ||

| Production / activity | 39.8 | -6.4 |

| Employment | 45.3 | 2 |

| New Orders | 37.2 | -13.5 |

| Supplier deliveries | 41.6 | -2.6 |

| Capacity Utilisation (%) | 77.8 | -1.4 |

The index results are based on responses from 500 private-sector businesses per month, from industries making up 72 per cent of Australia’s total industry output, 62 per cent of total gross domestic product and 89 per cent of all filled jobs.

The new orders index fell by 13.5 points to its lowest level since 2013, at 37.2 points due to cancelled and reduced orders becoming widespread through mid to late March.

“This indicates deep reductions in business activity are likely to occur in coming months,” the index notes.

“History suggests this index ‘leads’ business sales by about three months, but the ‘sudden nature of this pandemic means the usual time lag between reduced orders and reduced production is likely to be shorter.”

The input prices index jumped a further 8.5 points to 72.4 points in March, indicating rising input pricing pressures, with survey respondents reporting sharp increases in local and global freight costs in March. The average sat around 61.9 points last year.

While the average wages index fell by 1.8 points to 59.5 points for the month, after recording a recent high in January.

Willox says this reflects the first wave of employment responses to Covid-19.

“Which have primarily involved reductions in work hours and employment numbers, rather than reductions in salaries or wage rates per hour.”

The employment index recovered 2 points to 45.3 points in March, but the timing of the Ai Group business performance surveys means it may not reflect the job losses in the final week of March, with retail, hospitality and other consumer services businesses cutting back due to Covid-19 measures.