Australia’s Richest Property Players Revealed

Property continues to be the main driver for wealth in this year's record-breaking Financial Review Rich List featuring 200 of Australia's wealthiest people, 91 of whom are in the billionaires club.

Property dominated this year's list contributing 63 members responsible for the biggest development projects around the country.

Manufacturing and recycling magnate Anthony Pratt continues to hold on to the top spot, with an estimated wealth of $15.57 billion, an increase of 20.7 per cent on last year's earnings.

Iron ore miner Gina Rinehart is second, with wealth of $13.81 billion, followed by Meriton chief Harry Triguboff who has defied the property slowdown to bolster his wealth by six per cent to $13.54 billion.

Hong Kong-based property developer Hui Wing Mau is in fourth spot, joining the elite "ten-digit club", those with wealth exceeding $10 billion.

Take a look at the ten highest ranking property moguls from this year's list.

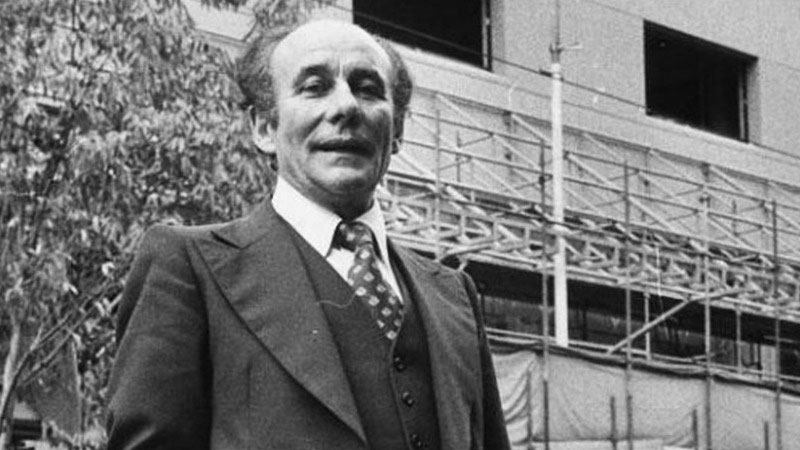

Harry Triguboff

$13.54bn

YoY wealth change +6.0%

Meriton chief Harry Triguboff increased his wealth by $770 million in the past year, but still slipped down a spot to be named Australia’s third richest person in 2019.

"High rise Harry" has become known for his bullish approach towards Sydney and south-east Queensland, building over 75,000 residential townhouses and apartments since Meriton was formed in 1963.

The company has gone on to become one of the biggest hotel and serviced apartment operators in the country. He sees the current market as an opportunity to grow his net asset base by acquiring development sites on the cheap, and renting out more of his units instead of on-selling them as he waits patiently for recovery.

Last month, Meriton purchased a 792sq m development site in Melbourne’s CBD, marking its first venture into the Melbourne market.

Hui Wing Mau

$10.39bn

YoY wealth change +14.2%

Chairman of Hong Kong Stock Exchange-listed Shimao Property Hui Wing Mau is known for residential, commercial and hotel projects throughout China.

His Australian assets include office towers in Sydney’s CBD, a majority stake in the NSW meat processor Bindaree Beef Group, and 45,000 head of cattle bought from fellow rich-lister Harold Mitchell last year for between $100 million and $150 million.

Australian citizen Mau joins the elite double-digit billionaire club after a higher share price for his Hong Kong-listed Shimao Property Holdings and slightly stronger Hong Kong dollar increased his valuation over last year's.

Late last year, Shimao moved to sell its half-share in Sydney’s landmark 175 Liverpool Street office tower.

Frank Lowy

$8.56bn

YoY wealth change +1.7%

Frank Lowy last year finalised a deal for the $33 billion takeover of Westfield by French giant Unibail-Rodamco.

Now retired, the former Westfield chairman has pocketed an estimated $1.3 billion in cash and shares from the deal after 60 years of operating Westfield. Lowy founded the company in 1958 alongside the late John Saunders in Sydney's Blacktown.

Shares in Westfield plummeted last year hitting Lowy's stock stake by $250 million. Nevertheless, Lowy's private investment vehicle, LFG Holdings continues to strengthen with a wide range of investments includes shareholdings in Australian and New Zealand shopping group Scentre, as well as the US-based home relocation service Updater.

John Gandel

$6.6bn

YoY wealth change +2.3%

John Gandel built his wealth through the sale of a share in clothing group Sussan in the 1980s. He joined his parents company as a teenager and bought Melbourne's Chadstone Shopping Centre from Myer Emporium in 1983.

To this day Gandel retains a 50 per cent stake in the largest mall in the southern which last year reported a record $2 billion in sales from its 23 million visitors. Gandel is also a major shareholder in the ASX-listed Vicinity Centres, his co-partner in Chadstone.

Vicinity owns and operates 67 shopping centres across Australia, which generates approximately $18 billion in sales.

Lang Walker

$4.67bn

YoY wealth change +34.6%

Lang Walker started his career with an earthmoving business. He now commands more than $2 billion worth of investment properties.

Walker, who stepped away from residential apartment development in 2016, has turned his attention to commercial property with close to 10 office buildings currently under construction or in development phases.

Walker Corporation has close to 10 office buildings at some stage of construction or development, including approval for two towers in the $1.7bn Parramatta Square project in Sydney's west.

The two new office buildings, 6 and 8 Parramatta, will comprise 125,000sq m of space over 50-storeys. Property NSW last month agreed to lease 43,800sq m of office space. He's also developing 30,000 house-and-land blocks around Australia.

Betty Klimenko & Monica Weinberg-Saunders

$2.37bn

YoY wealth change -0%

Daughters of Westfield co-founder John Saunders, Betty Klimenko and Monica Saunders Weinberg, today manage Terrace Tower Group.

The group is heavily weighted toward the ownership of real estate assets in Australia and the US, including Sydney's Eastgardens shopping centre, half of which the group sold last year to ASX-listed retail giant Scentre Group for $720 million on a 4.25 per cent yield – representing one of the country’s largest ever single-asset retail deals.

Michael Hodgson

$2.34bn

YoY wealth change -0%

Michael Hodgson, not strictly a debutant to the Rich List, marks his return after a 30-year absence.

Hodgson made his initial fortune in 1989 having sold the family farm, including a 100,000-head livestock empire, for $100 million, as well as a listed wool-buying business.

Hodgson quietly shifted focus to Western Australian industrial property and is now one of the biggest landholders in Perth, with industrial tenants from Bunnings to Visy, and a 650-block residential subdivision at Midland among his assets.

Marc Besen

$2.34bn

YoY wealth change -2.5%

Marc Besen, husband of Eva Gandel, are considered Australian retail royalty. Along with Eva's brother John Gandel, the couple bought out her parents’ two lingerie shops and built the Sussan Group fashion chain, now owned by Besen's daughter Naomi Milgrom.

The Besen family fortune was boosted when they offloaded a quarter stake in one of Australia's largest malls, the Highpoint Shopping Centre in Melbourne's west, for $680 million.

Property development and shopping centre ownership also contributed to their wealth.

Maurice Alter

$2.33bn

YoY wealth change +3.1%

Maurice Alter's business, Pacific Group, owns a large portion of malls mostly in Melbourne and Adelaide and co-owns the Coles Group headquarters in Melbourne. Alter immigrated to Australia from Poland in the 1950s, and spent 20 years establishing his Pacific Shopping Centres.

The reclusive billionaire turned over control of Pacific Group operations over to his son Sam some years ago.

Pacific Group completed the sale of a 50 per cent stake in its flagship Werribee and Epping malls in Victoria to QIC Global Real Estate last June, netting $1 billion.

Ye Lipei

$2.05bn

YoY wealth change -3.3%

Shanghai-born Ye Lipei amassed most of his wealth through his 25 percent stake in Shanghai-listed property company Shanghai Tianchen.

Lipei migrated to Australia in 1979, working in the textiles sector before receiving Australian citizenship and returning to China.

Lipei turned his attention to property development and built the Zhongsheng Commercial Centre in 2003 which would go onto become one of Shanghai's largest shopping malls.

Part of his wealth is derived from his 25 per cent stake in Shanghai-listed property development company Shanghai Tianchen, run by his son Ye Mao Jing.