Australia’s Rental Growth Slows to Four-Year Low

Australia’s rental market has “well and truly passed the peak” of its recent boom, new data has revealed.

National rents recorded their slowest growth in four years, according to CoreLogic’s latest Quarterly Rental Review, with rents increasing by 4.8 per cent over 2024—a significant drop from the 8.1 per cent surge of 2023.

The December quarter notched a modest 0.4 per cent rise—the smallest fourth-quarter increase since 2018—as affordability pressures and shifts in supply and demand reshaped the market.

CoreLogic Australia economist Kaytlin Ezzy said rental affordability continued to weigh heavily on growth.

She said national rents had risen by 36.1 per cent since the onset of Covid, adding $171 a week or $8884 annually to the median rent.

Key rental and yield statistics, January 2025

At the median household income, renters were now spending 33 per cent of their annual pre-tax wages on rent—the highest proportion recorded since 2006.

“The net result has potentially seen some prospective renters delay their decision to leave the family home, while others have looked to form larger share households as a way of distributing the additional rental burden, unwinding the previous shrinking in the average household size that was apparent through the early stages of Covid,” Ezzy said.

This had potentially caused some would-be renters to delay moving out of the family home. Others were forming larger share households to spread rental costs, which was reversing the trend of smaller households triggered early in Covid, Ezzy said.

Houses outperformed units in 2024, with annual rent growth of 5 per cent compared to 4.2 per cent for units.

Over the December quarter, house rents rose by 0.6 per cent while unit rents fell by 0.2 per cent.

Ezzy said easing demand and improving supply also helped stabilise the market.

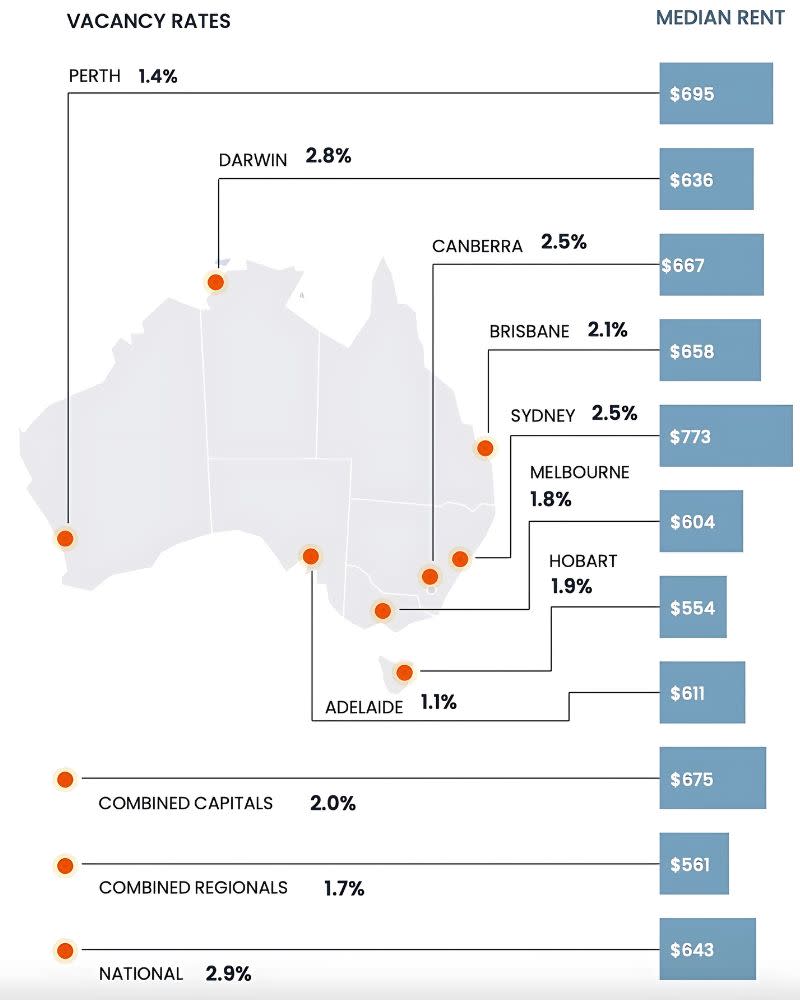

National vacancy rates and median rent

Vacancy rates rose from 1.4 per cent in November 2023 to 1.9 per cent by the end of 2024, while investor activity increased significantly, with the value of new investor lending up 26.3 per cent over the year to September.

“On the demand side, the easing in net overseas migration was also a factor contributing to softer rental demand, with net overseas migration levels expected to normalise around pre-Covid decade averages by the 26/27 financial year,” she said.

Regional areas continued to outperform the capitals, with annual rent growth of 6.2 per cent compared with 4.3 per cent for capital cities.

During the December quarter, regional rents rose by 1.2 per cent, while rents across the capitals increased by just 0.1 per cent.

Sydney and Melbourne led the slowdown, with annual growth rates easing to 3 per cent and 4.1 per cent respectively, down from 9.9 per cent and 11 per cent in 2023.

Hobart and Canberra were exceptions, with rents rising by 6 per cent and 2.6 per cent respectively.

National rents, fourth quarter, 2024

Despite the decline, Sydney remained the most expensive rental market, with a median weekly rent of $773, while Perth overtook Canberra for second place at $695 a week.

Hobart retained its position as the most affordable capital, with a median rent of $554 a week.

Gross rental yields held steady at 3.7 per cent nationally in 2024, balancing a 4.9 per cent rise in home values with a 4.8 per cent increase in rents.

However, trends varied across cities, with Melbourne seeing yields increase to 3.71 per cent as home values declined, while Brisbane and Adelaide recorded declines to 3.63 per cent and 3.66 per cent respectively due to strong property value growth.