House Prices Tipped to Fall 8pc in 2023

ANZ has revised its house price forecasts with the bank now expecting larger house price falls across the capitals during 2023 as rising mortgage rates start to bite.

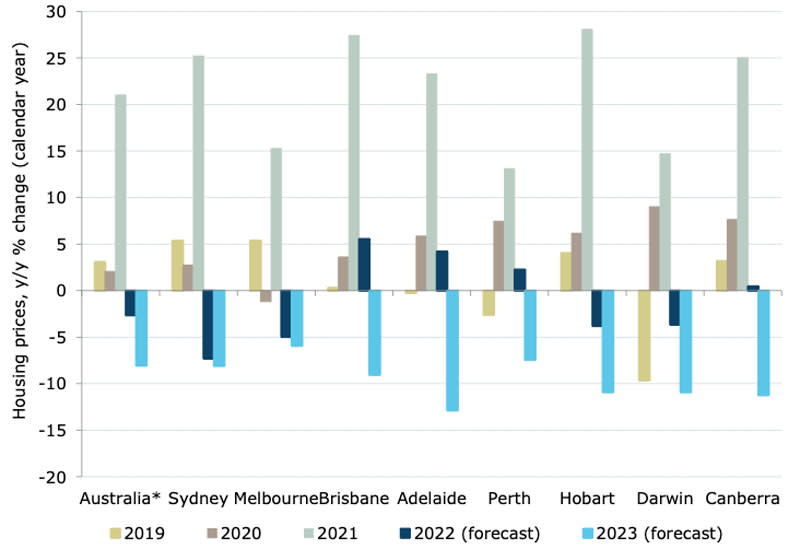

For the remainder of 2022, ANZ has forecast house price declines of 3 per cent, before falling a further 8 per cent in 2023.

Unlike the market consensus, which expects the cash rate to reach close to 3.25 per cent by mid-2023, ANZ is predicting the case rate will rise to 2.35 per cent by mid next year.

ANZ senior economists Felicity Emmett and Adelaide Timbrell said the bank’s predicted pricing of a cash rate would equate to a variable mortgage rate of 5.65 per cent and would be a bigger impost on the market.

“A steep increase in mortgage rates over the coming year will weigh heavily on house prices,” Emmet said.

“While fixed rates have already risen sharply, the steep increases in the cash rate will flow through to variable mortgage rates, lifting minimum repayments significantly and reducing borrowing power.”

ANZ has forecast Sydney’s house price growth will decline by 9 percentage points to 7 per cent, before dropping by 8 per cent in 2023.

Melbourne prices are set to drop by 5 per cent, a reverse the 5 per cent gain the bank forecast in February this year.

Brisbane and Adelaide, where prices are 8 per cent higher so far this year, are expected to make further gains this year before declines of 9 and 13 per cent respectively next year.

Housing price forecasts: Australian capital cities

“Rising fixed mortgage rates, macroprudential tightening, elevated supply and affordability constraints were weighing on the market before the cash rate began to rise earlier this month,” Timbrell said.

“Auction clearance rates are trending lower and are likely to continue to do so while housing finance for both investors and owner-occupiers is high, but growth has slowed sharply. Sentiment about house prices has also turned lower.

While a return to immigration in 2022 will be a plus, these negatives are likely to more than offset that positive, the economists say.

Alongside the strength in prices, and helped by fiscal support, housing approvals hit a record high earlier this year, and there’s still a substantial amount of work in the pipeline, but approvals are falling rapidly as the impact of the federal HomeBuilder program and other government support schemes unwinds.

AMP Capital chief economist Shane Oliver said more demand-side government support for first home buyers would increase prices in the long term, but not prevent a 10 to 15 per cent average price fall over the next 18 months due to higher interest rates.

Reserve Bank of Australia governor Philip Lowe said the outlook for dwelling and business investment had remained positive in recent weeks despite capacity constraints related to materials and skilled labour shortages becoming a growing challenge for firms.

“Dwelling investment had been curtailed by supply disruptions, including poor weather conditions on the east coast, but was expected to remain at a high level given the large pipeline of work,” Lowe said.

Globally, ongoing supply chain issues relating to the pandemic and subsequent lockdowns, particularly in Beijing and Shanghai, as well as the war in Ukraine have also added to the global impetus for inflation.

New loans issued where the debt was more than six times the borrower’s annual income increased to 24 per cent in the December quarter. The RBA said this category of borrower was at higher risk of mortgage default.

Headline inflation now at 5.1 per cent and the trimmed mean measure at 3.7 per cent.

Corelogic research director Eliza Owen said historical data had painted an inverse relationship between the home value index and the official cash rate.

“When interest rates start to rise, Corelogic expects growth in housing to come down,” Owen said.

“That will probably be the factor that ticks most of Australian housing markets into a downswing phase.”

Owen said modelling of an expected 200 basis point rise in the official case rate which the RBA thinks could create a 15 per cent decline in real property prices.

“For a lot of people who've been struggling to get into the housing market, that's a moment where maybe you… think all prices are going to come down.”

“What might be important to consider for first home buyers is… this is about an increase in interest costs as well.”