Investment Opportunities to Come ‘Thick and Fast’ Mid-2021

Opportunities are opening up in the property sector for investors and funds quickly reacting to shifting trends and recognising key market drivers.

Real estate consulting and software heavyweight Altus Group, which has long championed the use of "big data" to understand fast-changing market trends, has remained one of industry's leading innovators, collating sentiment and market movements to better inform its 6,000 software and 50,000 services customers.

The Canadian-listed company, which is also known for providing quantity surveying, project management and asset management professional services, is better known for illuminating global factors driving the industry's next phases of change.

In its latest Global Property Development Trends Report, a survey of 400 development executives at tier one firms, Altus Group reveals that investors have been quick to recognise emerging opportunities in order to find long-term stability across portfolios.

“Looking at the global property market as a whole, we can see that unlike the GFC there is still a lot of liquidity and desire in the market,” Altus Group senior director Asia-Pacific Niall McSweeney said.

“However, nervousness remains intrinsically tied to decision making.

“The larger institutions are continuously looking for steady returns in mature markets, but what we have found is that a lot of investors are now trying to rebalance portfolios, if not cautiously.”

Significant challenges in real estate development firms

^Source: Altus Group Global Property Development Trends Report—Percentage of respondents who said the market force had a significant influence on development planning

When asked about strategic investments and decision-making during the downturn, a significant majority of respondents said they had continued to seek out new opportunities in acquisitions, asset repositioning and joint ventures.

The report underlined key challenges facing development firms, differed based on locality, but a consistent constraint and concern across all markets has been project cost escalation due to stalled or shut down projects.

The pandemic dramatically impacted cross-border trade, access to materials and scheduling early on, but workarounds are now appearing.

“People have to change how they think about escalation going forward,” McSweeney said.

“While people have zeroed in on supply chains, sourcing materials in new markets and the access to labour—there are spikes and unusual trends emerging as a result of the closed borders that are rapidly creating new opportunities for those who are aware.

“So far, critical material shortages have been alleviated and there is now a tendency for developers to push for local supply—despite being more expensive.”

While government has been integral to establishing a floor for economies, respondents highlighted ongoing concerns about the various stimulus measures in place and uncertainty regarding what may happen when these measures end.

“Interestingly, in Australia particularly, developers are watching the federal and state government's very closely for stimulus and public infrastructure investment, something that hasn't been a significant market factor on previous surveys,” McSweeney said.

Related: Property Players Using Big Data Are Playing ‘Moneyball’

Market forces impacting/influencing development planning

^Source: Altus Group Global Property Development Trends Report—Percentage of respondents who said the market force had a significant influence on development planning

“Government infrastructure projects could begin to hoover up resources as they attempt to support construction markets.

“However, uncertainty related to government action and inaction has amplified views both positively and negatively.”

One of the lower concerns for the Australian market has been the access to debt with many listed property groups tapping capital markets for fresh equity in order to shore up their balance sheets and insulate themselves against possible drops in property values.

Australian respondents highlighted that the lack of capital in the market was not an issue: instead, the biggest challenge in the down cycle was selecting new construction investments and investment partners.

The drop in migration, which has directly impacted residential property prices and urban renewal development pipelines, continues to weigh heavily on retail, hotels and tourism sectors.

However, Altus found activity from funds remained in steadfast within these markets, with many respondents taking a “wait and see” approach.

“From the report it is clear to see that the impacts surrounding the loss of migration in Australia is the key market influence and area of concern for those in the property sector,” McSweeney said.

“Compared to other global markets, the Australian construction sector is increasingly reliant on growing demographics, and there is anxiety in the market surrounding the cut back on population, that has flow-on effects for growth.

“From an international perspective there is a lot of desire to invest in Australia due to its assured governance, house prices holding up and relatively stable economy and debt levels.”

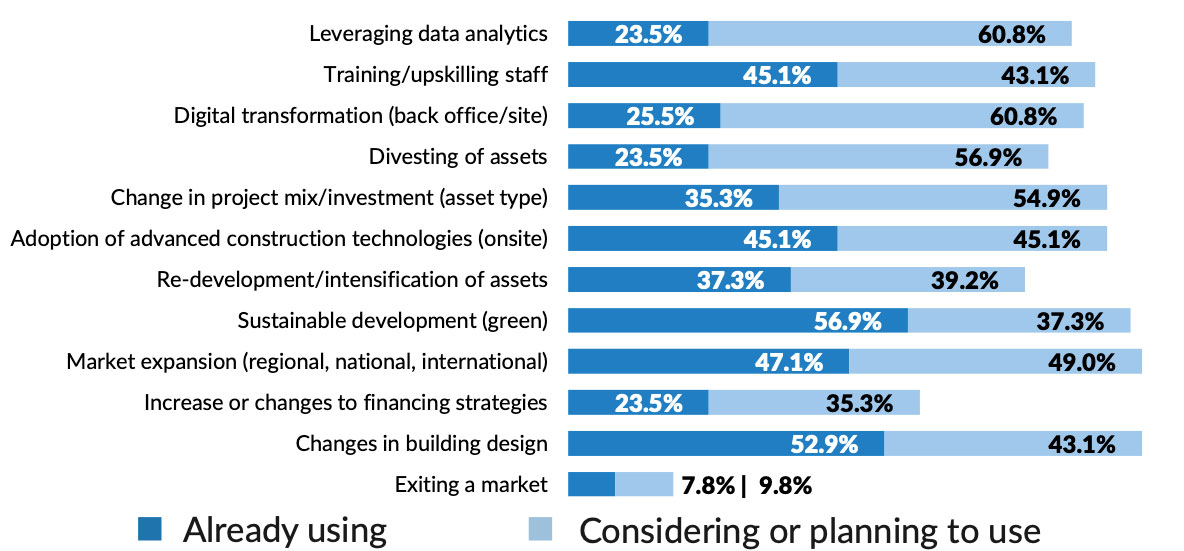

Strategies by Australian businesses to mitigate challenges

^Source: Altus Group Global Property Development Trends Report—Percentage of respondents who said the market force had a significant influence on development planning

The pandemic has also highlighted a renewed urgency for digital transformation and technology adoption across development firms with many leaning heavily on demographics and data.

“Having the knowledge and data available to you as a decision making tool is key—especially at a time like this,” McSweeney said.

“Firstly, having the right data and secondly, the right tools to interpret that information, provides increased security in decision making and strategic planning.

“What is evident is that businesses supported by leading technologies are understanding what is happening across their markets and are better prepared to weather the fluctuations in the rate of returns.”

While the pandemic hasn’t changed the type of information required, the report noted the growing dilemma seen across major firms has been the degree of inefficiency in gathering and manipulating information to make it useful.

McSweeney said the uptake in technology had remained imperative for funds looking to transform and interpret data quickly to manage project costs, build financial models and run frequent scenario analyses.

“Understanding the data, outgoings, expenditure, depreciation on allowances, are all key in regards to managing cash flow, but proactively using technologies will better inform users from moment to moment in order to alter financial strategies.

“When it comes to securing investment for development portfolios, it will now come down to businesses showing they are better than the rest by lifting metrics and demonstrating high-performance—and the more accurate the data and analytics underscoring your decisions, the more potent the results will be.”

The Urban Developer is proud to partner with Altus Group to deliver this article to you. In doing so, we can continue to publish our free daily news, information, insights and opinion to you, our valued readers.