Australian retail sales volumes have declined for the second quarter in a row, down 0.6 per cent for the March quarter.

According to the latest data from the Australian Bureau of Statistics, the fall follows a 0.3 per cent drop in the December, 2022 quarter.

This was despite Australian retail turnover rising 0.4 per cent for March and 0.2 per cent in February.

ABS head of retail statistics Ben Dorber said the second decline comes as mounting cost of living pressures continue to weigh on household spending.

“Outside of the pandemic period, this is the largest fall in retail sales volumes since the September quarter of 2009,” Dorber said.

As with the Consumer Price Index for the March quarter, retail prices remain high but price growth has slowed to 0.6 per cent this quarter.

“Retail prices rose for the sixth straight quarter, but price growth this quarter is the smallest since September 2021,” Dorber said.

“The slowdown in price growth was mainly due to discounts on clothing and large household items such as furniture and electronic goods, while food retailing prices continue rising.”

Monthly turnover by industry March 2023

▲ Monthly turnover, current prices, by industry—percentage change from last month. Source: ABS

Retail sales volumes for household goods retailing fell 3.7 per cent, the fifth consecutive fall. Consumers continue to spend less on large discretionary purchases in this industry, which peaked in the December quarter 2021 with higher demand during Covid.

Other retailing sales volumes fell 0.8 per cent. Sales volumes increased for department stores (1.5 per cent), and clothing, footwear and personal accessory retailing (0.2 per cent) where promotional activity and heavy discounts throughout the quarter boosted sales volumes.

Cafes, restaurants and takeaway food services sales volumes rose 1.0 per cent driven by the continued return of large-scale cultural and sporting events.

“We saw this rise in sales volumes even though businesses are passing on their rising costs to consumers,” Dorber said.

Food retailing was unchanged and followed a 1.8 per cent rise last quarter. Food volumes through the year have only increased 0.1 per cent, compared to a 6.9 per cent rise in retail prices.

“This means the turnover growth in food retailing we’ve seen each month over the past year, which includes price effects, has been driven by food inflation alone,” Dorber said.

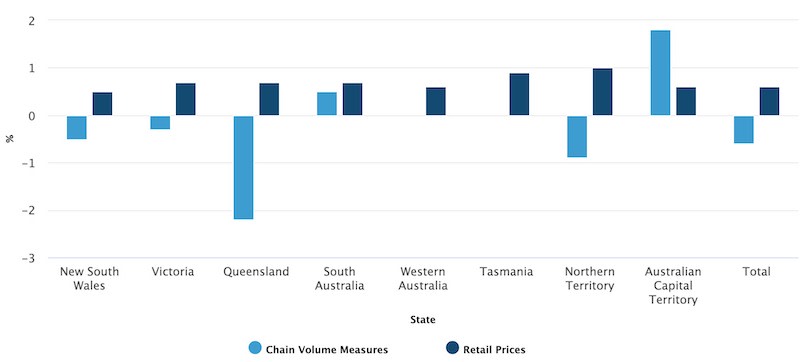

There were mixed results across the country, with four states and territories recording a fall in volumes: NSW down 0.5 per cent, Victoria 0.3 per cent, Queensland 2.2 per cent, and the NT 0.9 per cent.

Queensland’s largest dip in sales volumes was the third consecutive quarterly fall with retail volumes back to levels seen in late 2021.

The ACT and SA were up 1.8 per cent and 0.5 per cent respectively while WA and Tasmania were unchanged.