New-Build Financing Sinks 35pc in Market Slowdown

Housing new loan commitments are down 14.1 per cent on last year while the rate of refinancing continues to climb, new Australian Bureau of Statistics data reveals.

And in more dire news, loans for the construction of new houses dropped 5.7 per cent on last month and are down more than 35 per cent on the previous year.

It’s indicative of the broader downturn in housing.

Following more than a year of interest rate rises, borrowers are now chasing better deals on existing properties, while building approvals were also down 8.1 per cent on the previous month.

Urban Taskforce chief executive Tom Forrest said the ABS housing approval figures showed a “huge chasm between current approvals and what is required under the revised National Housing Accord”.

“While the rhetoric is all positive on housing supply and reform, the performance is going in the opposite direction,” Forrest said.

“Now is the time for bold reform with a clear focus on housing supply. It’s time to match the welcome political rhetoric on housing supply and higher targets with action.

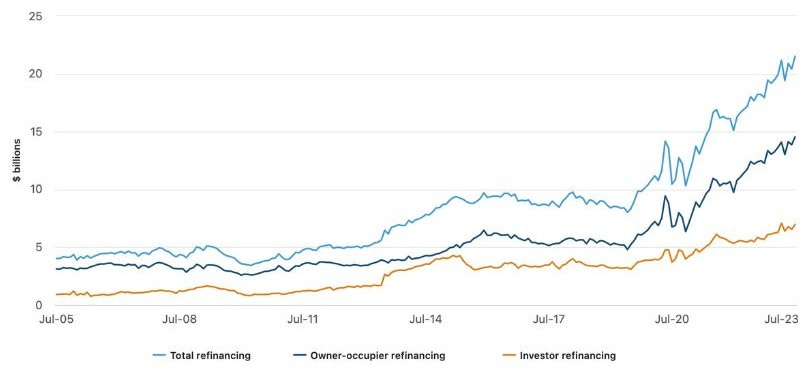

External refinancing (seasonally adjusted), values, Australia

“The numbers don’t lie—we are going backwards, and the industry’s confidence is waning.”

According to the ABS lending indicators data, a record number of loans were switched to a new lender in July, up 5.4 per cent on the previous month and more than 20 per cent higher than this time last year.

Canstar finance expert Steve Mickenbecker said rate rises continued to flow through to mortgage repayments, despite a reprieve in April, July and August this year.

“Even though the Reserve Bank looks likely to pause the cash rate in September, there is still a huge population of borrowers who have yet to experience the bitter taste of a rate increase,” Mickenbecker said.

“Fixed-rate lending rocketed up two years ago when rates were around 2 per cent and every month for the next year or so a mass of borrowers will move to a variable rate with repayments lifting by around 60 per cent.

“Fixed-rate borrowers converting to variable over the next year will have to embrace refinancing as the key coping mechanism for the massive one-off repayment increase. This will ensure that refinancing activity will continue to boom from its $21.5 billion record in July, keeping the banks fully occupied as new lending volumes contract.

“Not only is demand for refinance on the rise but banks have demonstrated their appetite to take on borrowers from their competitors, thankfully suggesting that there is still a healthy population of borrowers in sound financial shape and able to refinance.”

New loan commitments fell across every state in the country, with the biggest falls noted in the smaller and more volatile markets of Tasmania and Northern Territory.

Investor home loans were more resilient with smaller declines across most states, while Queensland, Northern Territory and Tasmania recorded moderate increases.