Approvals Decline but Faith in Recovery Remains

Home approvals declined across November but we remain on track for a moderately paced recovery this year.

According to the Australian Bureau of Statistics, the total number of homes approved fell 3.6 per cent in November to 14,998.

This followed a 5.2 per cent rise in October, according to seasonally adjusted data from the ABS.

ABS head of construction statistics Daniel Rossi said the fall in November was across all residential building types—approvals for private sector houses were down 1.7 per cent, while private homes excluding houses slid 10.8 per cent.

“Despite the fall, approvals for total dwellings remain 3.2 per cent higher than November, 2023,” Rossi said.

The 1.7 per cent fall in private sector house approvals across Australia (to 9028 homes), followed a 4 per cent fall in October.

Despite this, approvals for private sector houses remain 3.8 per cent higher than one year ago.

HIA senior economist Matt King said the data revealed the ongoing strengthening in the new home building market and continued to point to a moderate-pace recovery in 2025.

“After a period of prolonged weakness, there are signs of life again in building approvals, which is pointing to a nascent recovery in new home building,” King said.

“November, 2024 marked exactly one year since the RBA last raised interest rates.

“Unchanged interest rate settings have provided a welcomed degree of certainty for consumers.

“Population growth rates have slowed across the country but remain elevated which is contributing to strong underlying demand for housing.

“Detached house approvals continue to rebound off a very low base, further confirming that the trough of the cycle is now in the rear-view mirror.”

Nothing meaningful until 2026

But the signs are that it be a modest improvement in 2025, with attached homes providing increased support, Oxford Economics Australia property and building forecasting head Timothy Hibbert said.

“We don’t expect a more meaningful double-digit recovery in total approvals until 2026, when mortgage rate cuts aid the release of pent-up housing demand, while traction on the supply policy front will become increasingly evident,” he said.

“Utility connection bottlenecks and trade labour shortages will inevitably apply a speed limit on the recovery.”

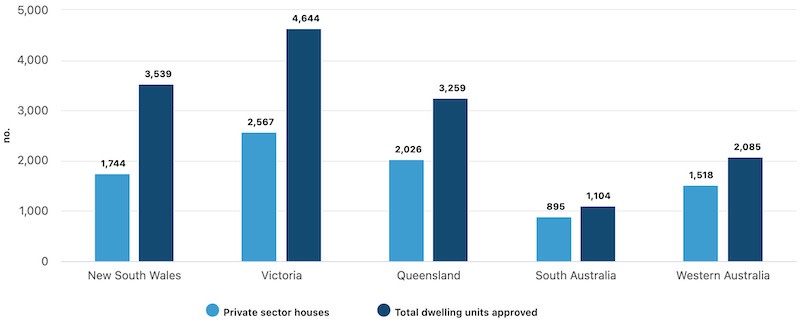

Approvals by state, November 2024

Queensland was the only state to experience growth in private sector house approvals in November, with a 4.3 per cent rise, according to the ABS data.

Private sector homes excluding houses fell 10.8 per cent (to 5285), which was 6.4 per cent lower than a year ago.

The drop in November was driven by a large fall in apartment approvals in New South Wales and Victoria, following a strong October result.

The value of total building approved rose 6.6 per cent (to $14.32 billion), after a 2.3 per cent fall in October.

The value of approved non-residential building rose 18.4 per cent (to $5.96 billion), following an 11.2 per cent fall the previous month.

Total residential building value fell 0.5 per cent (to $8.36 billion), comprising a 0.6 per cent fall in the value of new residential building approved ($7.21 billion) and a 0.3 per cent rise in alterations and additions ($1.15 billion), in seasonally adjusted terms.

King said at a national level, market confidence was returning as the majority of capital city and regional markets now appeared to have moved through the trough in new home building activity.

“A national recovery is in sight,” he said.

“Nevertheless, the size of the upswing in new home building activity will be heavily influenced by federal and state government housing policy settings.

“Policy makers must double-down on the pursuit of efficiencies and improvement in industry red tape, the excessive taxation of home build, the availability of land for residential development, and the supply of skilled labour.”